In the past year, the share price of several market darlings has sunk.

The Appen Ltd (ASX: APX) share price is down 70%. A2 Milk Company Ltd (ASX: A2M) declined 67%. Meanwhile, Kogan.com Ltd (ASX: KGN) has fallen 50%.

Perennial outperformer Magellan Financial Group Ltd (ASX: MFG) is now on that list. The Magellan share price is down 32% over the past year to around $40.

Let’s unpack Magellan’s decline and explore why today may be a buying opportunity.

Is Magellan losing its Midas touch?

Much of the falling Magellan share price can be attributed to the underperformance of its flagship global fund.

Rockstar fund manager Hamish Douglass and his Magellan team retained healthy levels of cash throughout 2020, believing a second market slump was on the horizon.

Unfortunately, the anticipated market pullback never eventuated and the fund significantly underperformed its benchmark. This underperformance has also dragged down the performance in other time periods as shown below.

While the underperformance is stark, it’s worth noting three points.

Magellan has always stated the performance objective of the global fund is 9% per annum after fees. It’s overwhelmingly achieved this benchmark in every time period.

Secondly, the fund is defensive in nature to minimise the risk of a permanent capital loss. In March 2020 when the index tanked 8.6%, the fund only fell 4.0%. Furthermore, over the March 2020 quarter, the fund only fell 1.2%, compared to 9.3% for the index.

Finally, the crackdown on Chinese monopolies such as Tencent and Alibaba, which have been core holdings for the fund has hit performance. This is outside the firm’s control and only amplified the underwhelming returns.

Ugly headline numbers

While revenue increased 9% for the year, performance fees sunk 63% in FY21 and dividends reversed marginally.

Another aspect of the FY21 result the market didn’t like was the 33% fall in net profit after tax.

It’s worth noting that the fall in profit was mainly the result of private equity investments (discussed below).

It’s easy to get caught up on the headline numbers. But I’d look through them as a one-off rather than the norm.

Still some juice left in this orange

A common bear case against Magellan is that the business is ex-growth. Its funds have reached capacity and there is no more juice to squeeze from the orange.

While it’s true that its reaching capacity (the global fund is closed to new institutional investors), the business will still benefit from rising markets and existing client inflow.

Magellan grew average funds under management (FUM) by 9% over FY21.

The increase in FUM was driven by the market movement of $13.2 billion and net inflows of $4.5 billion less distributions of $1.0 billion.

Both retail and institutional FUM recorded positive net inflows albeit growth is slowing:

- Institutional net inflows of $2.6 billion compared to $2.8 billion in FY20

- Retail net inflows of $1.9 billion compared to $2.9 billion in FY20

Fine, but where’s the next leg of growth?

With net inflows slowing, the business has undertaken a number of growth initiatives.

Magellan recently launched several new investment options:

- FuturePay which focuses on providing a steady monthly income stream for retirees

- The Core Series, which enables investors to gain access to the Magellan universe for only a 50 basis points fee – similar to an ETF

- Sustainable fund for ethical investors

Not all of these will be winners, but it provides the business with optionality.

Apart from new products, Magellan made three private equity investments throughout the year.

The biggest was investment bank disruptor Barrenjoey. Much has been said in the media about the business and its mounting losses.

I’d make the argument it’s a short-term hit for a long-term gain.

When you poach a bunch of investment bankers and capital market operators from rival firms, give them equity and then a license to make money – that’s pretty good alignment.

As Charlie Munger once said, “show me the incentive and I’ll show you the outcome”.

Magellan also made investments in market technology FinClear and quick service restaurant Guzman y Gomez.

I’d back management to make smart capital allocation decisions. While its best growth may be behind it, I don’t see it going backwards anytime soon.

Putting a number on Magellan

Valuing fund management businesses can be a fickle task.

Personally, I think it’s best to value them using the management fee income and disregard performance revenue for the time being.

Given Magellan pays 95% of its profits via dividends, it’s a decent proxy for free cash flow. FY21 total dividends without performance fees were $1.997 with 75% franking.

With the current share price hovering around $40, this values the business on a free cash flow yield of pretty much bang on 5% or 20x earnings.

This is before franking, potential performance fees or any growth in FUM in future years.

Thesis killers

I’ve been bullish so far on Magellan. However, investing is a dangerous game if you only accept the good and not the bad. Or vice versa.

First and foremost, the underperformance needs to be rectified. The investment committee made an unforced error in 2020, which now needs to be countered with some winners.

The second big red flag would be if any of the key management team left the business. Obviously Douglass, but also any of the investing team including but not limited to Deputy CIO Domenico Giuliano, Infrastructure head Gerald Stack or Head of Research Vihari Ross.

If the economics of the business changed, I would also evaluate the thesis. Magellan has a revenue margin (how much it receives for managing money) of 61 basis points currently. This has been trending down over time and may continue to fall.

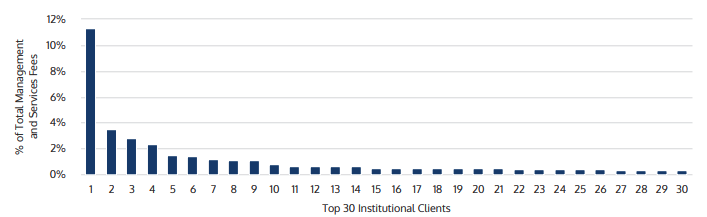

Notably, one client accounts for over 11% of management fees, with four over 2%. These clients could request better rates or move elsewhere, which would either affect margins or FUM.

Moreover, if net inflows became negative or institutional clients pulled money I would certainly reevaluate the investment case.

Not so much thesis killers, but there are two other points worth mentioning.

Magellan will lose its offshore banking unit tax concession in FY23. This will increase its effective tax rate from 21.4% up to 30%, thus reducing margins.

Secondly, Magellan is a cyclical business. It’s linked to the market cycle and should be treated with caution.

Final thoughts

The business has obviously fallen out of favour with the market.

Could this potentially be Magellan’s Perpetual moment?

I doubt it.

Magellan is still meeting all of its stated fund targets, recording net inflows and retains growth optionality.

Management is high quality and I expect the investment team to turn around the global fund’s recent subpar performance.

I’d be a buyer of shares today, especially if you’re looking for a decent dividend yield.

Want to learn how to do your own ASX company valuations? Take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.