The Bank of Queensland (ASX: BOQ) share price has been steadily rising but it’s suffering a bit of a blip of late. What’s going on with the Bank of Queensland share price?

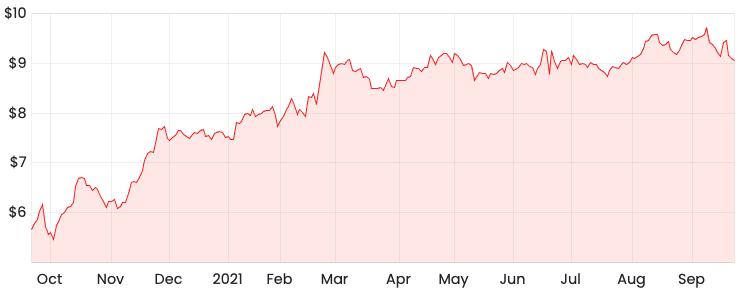

BOQ share price

A new captain for business banking

Bank of Queensland’s head of business banking, Fiammo Morton announced she will be pursuing other opportunities after a 15-month stint.

She replaced Peter Sarantzouklis in June 2020, who took over in August 2019 and exited the role only five months later in January 2020.

Prior to Sarantzouklis, Doug Snell held the role but only operated for eight months.

The position seems to be a hot seat.

The Chief Executive Officer of Bank of Queensland, George Frazis

has decided to replace Morton with the current Chief Product Officer, Chris Screen.

Screen has extensive experience in business banking supported by executive roles at National Australia Bank (ASX: NAB) and Westpac (ASX: WBC).

My thoughts

The head of business banking is integral to Bank of Queensland’s future given it generated around 65% of profits prior to the takeover of ME Bank.

Morton was starting to provide some stability, so I find this move to be a bit odd. It will be interesting to see how the business banking division performed once the full-year results get released on 23 October.

Having to restart again with a new head with fresh ideas and approaches will require staff to adapt once more, which takes time and effort.

It’s also disappointing to see only one female remaining on the executive committee.

Overall, I think there are more negatives than positives in this change. I’d much prefer to invest in businesses that have low staff turnover with leaders that have long tenures.

Why do I prefer this?

A low turnover of leaders and staff is one signal of a strong culture. Look at Xero Limited (ASX: XRO) where founder, Rod Drury has been with the business for 15 years and carved out an envious culture illustrated by the high employee ratings on both Glassdoor and Indeed.

I’m not saying Bank of Queensland doesn’t have a great culture, it just doesn’t meet my standards.

If you want to learn how to do your own ASX company valuations, take our free share valuation course.