A lot of people profess to be long-term investors in ASX shares.

The strategy is best summarised by British fund manager Terry Smith’s three investing principles:

- Invest in good companies

- Try not to overpay

- Do nothing

However, in reality, few investors are truly long-term. For example, the average fund manager holds a company for around seven and a half months based on the BofA Global Fund Manager Survey.

The benefit of thinking and investing long-term is that it enables you to see the forest from the trees.

Will this business be materially bigger in ten years?

Here’s an introduction to two ASX shares I would buy and hold for the next decade.

1. NextDC (ASX: NXT)

NextDC Ltd is a relatively simple business model. The company designs, builds and manages data centres.

So what makes data centres so interesting?

It’s essentially the digital version of real estate.

Just like products – every tweet, post, story, article, video, photo and document on the internet needs to be stored somewhere.

Moreover, the amount of data being created is rising at an exponential rate. In 2018, there were 33 zettabytes (ZB) of global data. In 2020, this grew to 59ZB and is predicted to reach 175ZB by 2025.

NextDC is leveraged to this megatrend.

However, what makes NextDC unique is that it’s the only tier four network in Australia. Data centres are rated for uptime, availability and security across four tiers. One is the lowest, four is the highest.

As a result, the business targets premium customers with the highest data requirements enabling high returns on capital.

With the amount of data only increasing, I think the future is bright for NextDC.

2. Uniti Group Ltd (ASX: UGL)

I would make the argument that Uniti Group has the best business model of any ASX share.

The business develops and owns fibre networks.

Let’s say you’re a property developer building a 50-story building. You need to contract water, electricity and gas connections. Internet is no different.

The developer has two contractors to choose from. The large government owned-NBN, which is slower and more expensive. Or Uniti, the smaller, faster, cheaper private option.

I know which I’d choose. But here’s the kicker.

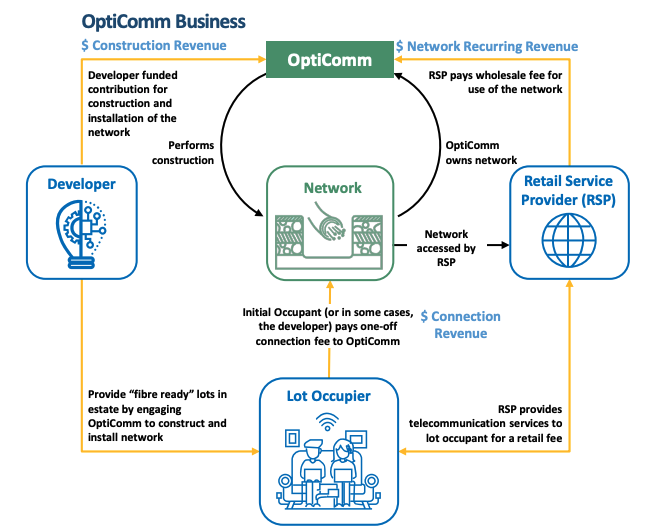

After Uniti installs the fibre, in most cases it will own the fibre infrastructure. Then it gets to charge retail service providers (RSPs) such as Telstra Corporation Ltd (ASX: TLS) and Optus to connect to each apartment for the life of the fibre asset (usually 20-25 years).

Effectively, Uniti is paid to build the fibre. Then it receives connection fees from RSPs. Little cash outflow for long-duration and high cash flow from monopoly assets.

With roughly 20% order book growth locked in for the next five years, I think Uniti will be far bigger by 2031.

Final thoughts

To leave you with a common investing adage:

“…in the short run, the market is like a voting machine – tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine -assessing the substance of a company” – Benjamin Graham

Rather than look for what’s popular, analyse the business fundamentals and what will drive value in the long-term.