The most simple method for valuing ASX shares is the price to earnings ratio (P/E).

The thinking goes that the lower the P/E ratio, the better value a company is. However, this analysis often does not hold true.

Usually, a stock is cheap for a reason – earnings are in decline, competitors are eroding margins, and so forth. This is known as a value trap.

“A value trap is when something looks cheap on a near-term basis. However is likely in a structural decline and hence today’s cheap price is a reflection of the company’s future prospects, or lack of”.

Below we’ll discuss three ASX shares that have the hallmarks of a value trap.

1. AGL Energy Limited (ASX: AGL)

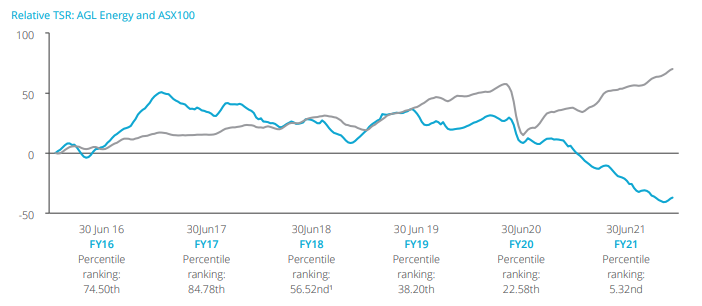

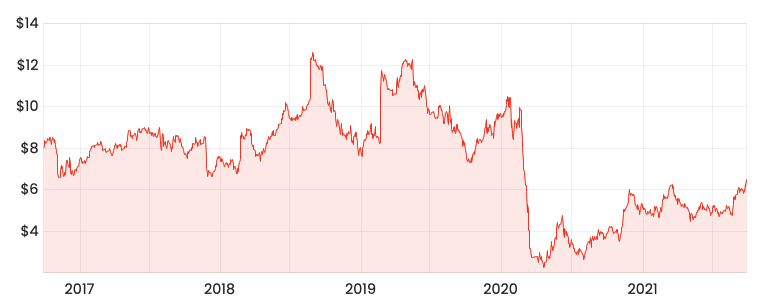

Australia’s oldest energy business, AGL, has had a turbulent four years falling 79% from its highs in 2017.

Its balance sheet looks to be carrying too much debt and its legacy coal assets are no longer as profitable.

It’s not all management’s fault though. Outside factors including falling wholesale energy prices and policy uncertainty have only amplified losses.

The company delivered 86.2 cents per share in underlying earnings for FY21. At today’s current AGL share price of $5.66, this implies a price to earnings ratio of around 6.5x. What a steal!

However, AGL is a classic value trap. The retail business is highly competitive, and the energy assets are a drain on resources. Time to look elsewhere for returns.

2. AMP Ltd (ASX: AMP)

It’s hard to find something positive to say about AMP. The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services in 2017 shined a light on some very sketchy practices.

Subsequently, financial advisors left in droves, investors redeemed funds and major leadership changes have hampered any progress.

AMP achieved earnings per share of 8.6 cents in FY20. With a current share price of $1.02, this values the company on 11.8 P/E.

Relative to AGL, I think AMP could possibly turn itself around. But I’m yet to be convinced.

As Warren Buffet once said, “turnarounds seldom turn”.

3. Webjet Limited (ASX: WEB)

Webjet isn’t cheap in the traditional sense like AMP and AGL.

But if you look at a price chart of Webjet shares you’ll see the current $6.40 share price is well below the $10 pre-pandemic levels.

So, Webjet shares are still 36% below previous levels right? Wrong.

Because the business had to raise equity to survive the pandemic, meaning future profits are now shared among more shareholders.

On an enterprise value calculation, the business is actually more expensive than it was pre-pandemic.

Overall, I think Webjet is a high-quality business. But the fact it had to raise so much capital means I don’t think shares are cheap at current prices.

Instead of looking for cheap shares, I’d suggest having a look at 2 ASX shares I’d buy and hold for the next decade

.