Notwithstanding a delayed start to public life, the Li-S Energy Limited (ASX: LIS) share price has rocketed as much as 204% yesterday as investors scrambled to get in on the action.

The latest initial public offering

(IPO) to hit the ASX finished up 174% to $2.33 after initially raising $34 million at $0.85.

The rapid price appreciation values the business at $1.5 billion despite having zero revenue or production.

Batteries 101

Without getting too technical, let’s try to unpack what’s got investors buzzing around like electrons today.

Traditional batteries use Lithium-Ion (Li-I) battery chemistry given its reliability and relative safety.

Unfortunately, Li-I batteries have limitations and cannot be significantly improved moving forward. With demand for batteries only increasing with the emergence of electric vehicles, spacecraft and drones, the world needs a better option.

Luckily, we have known for some time that Lithium-Sulphur (Li-S) batteries are a superior option to Li-I.

Li-S is lighter, cheaper, charges faster and has 5x greater energy density.

However, charging issues has held back the adoption of Li-S due to the battery often failing within 100 charging cycles.

This is where Li-S Energy comes in.

We hit the jackpot

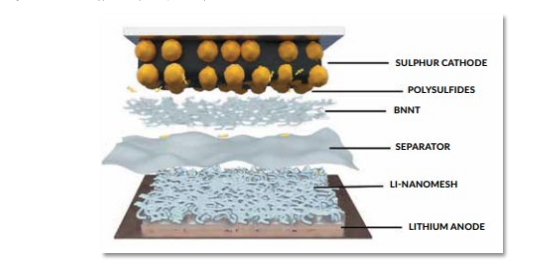

In conjunction with Deakin University, Li-S Energy has used boron nitride nanotubes (BNNTs) to stabilise the battery during charging and discharge.

Additionally, the business added Lithium-Nanomesh to improve loss of capacity and early failure.

If all of that flew over your head, don’t worry.

Basically, tests at Li-S Energy show it has worked out to reduce battery failure and therefore increase charging cycles.

This means Li-S may potentially be feasible for commercial use cases, providing a big opportunity for investors.

From Burwood to the big time

The business is now looking to bring its tech to market. It’s not focused on becoming a battery manufacturer, rather licensing its materials and intellectual property to existing producers.

Proceeds from the IPO will help further develop the battery through additional testing. Moreover, the business will build a pilot production facility to prove its benefits with commercial partners.

PPK sitting on a big unrealised gain

The largest shareholder of Li-S is innovative tech investor PPK Group Limited (ASX: PPK) with a 45.43% holding. On a look through-basis, PPK shareholding is now worth 41% of its market capitalisation.

Deakin University and BNNT Technologygy own 13.02% and 4.69% respectively.

My take

It’s awesome to read about such innovative technology.

But this is well outside of my circle of competence. At this stage, it remains a concept and not a proven business.

I’ll be tracking its progress in the future, but I won’t be rushing in to purchase shares anytime soon.

If you’re interested in small ASX shares, check out these three I’d buy today.