It’s been a rough month for equity markets around the world. Tech companies seem to have fared the worst.

Here in Australia, we’ve seen some big declines from popular tech companies like Xero Limited (ASX: XRO), Afterpay Limited (ASX: APT), Technology One Ltd (ASX: TNE), Appen Ltd (ASX: APX), Tyro Payments Ltd (ASX: TYR) and NextDC Ltd (ASX: NXT).

Here are two ASX shares I’d be happy to pick up in the month of October.

Smartpay

Smartpay Holdings Limited (ASX: SMP) is a New Zealand-based technology company that provides EFTPOS terminals to its merchants across New Zealand and Australia.

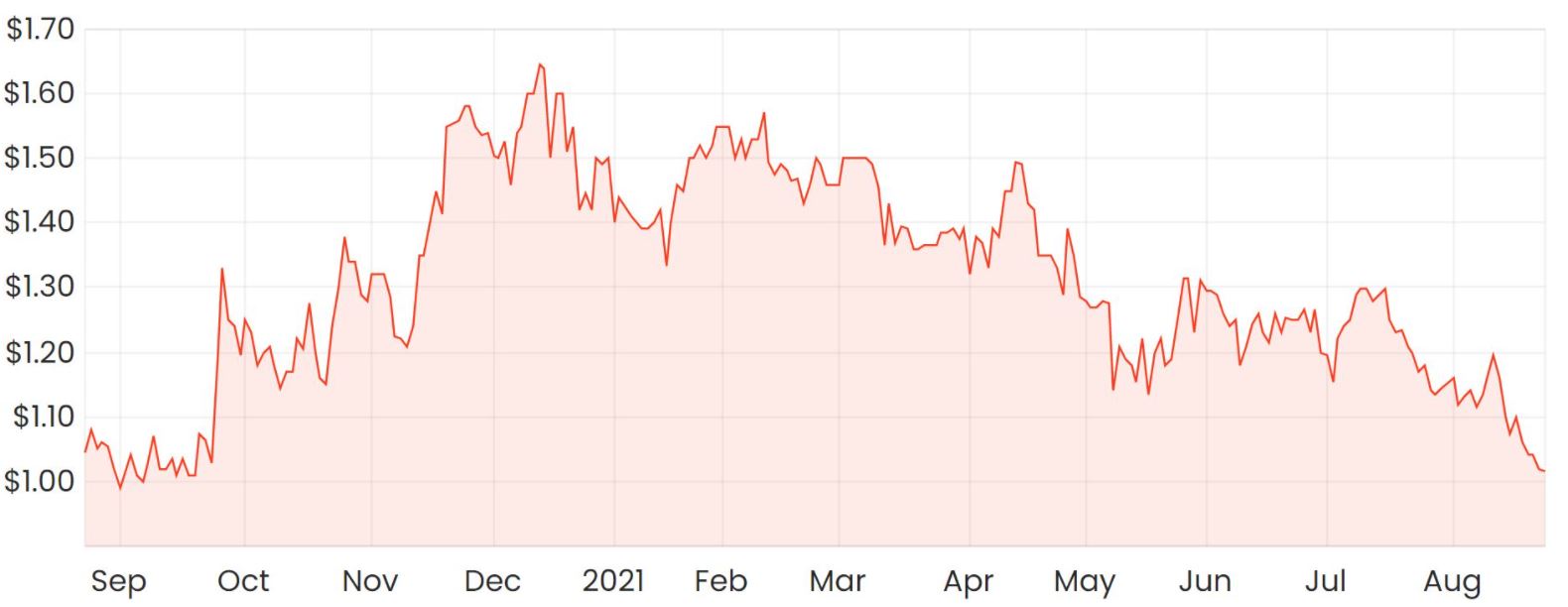

Its shares have lost around 25% of their value over the past six months. This is likely partly due to lockdowns which have seen transaction volumes decline.

Notwithstanding this, the Australian business is expanding rapidly in comparison to its more mature New Zealand business.

Its value proposition to its merchants surrounds its pricing. Businesses have to pay usually between 1-2% of the transaction value when a debit or credit card is used to pay for something.

Smartpay can automatically apply the appropriate surcharge, passing the charge onto the customer. This means merchants can often save thousands in fees every year.

To read more about Smartpay, check out my deep dive: My deep-dive into Smartpay Holdings (ASX:SMP) shares.

Kip McGrath

Another company that’s faced some challenges from Covid is Kip McGrath Education Centres (ASX:KME).

Kip McGrath has been tutoring primary and secondary school children throughout the world to improve or extend their learning, particularly in English and Maths. It operates primarily across Australia, New Zealand, and the UK.

Its shares have fallen out of favour recently, but there’s still a strong underlying business that I suspect will improve coming out of COVID due to more lessons being taught in person.

Kip McGrath has around 10 new corporate centres in its pipeline which are expected to double revenue corporate revenue across FY22.

For more reading, check out Kip McGrath’s latest results here: Kip McGrath (ASX:KME) share price on watch after FY21 result.