US stock markets continue to struggle, unable to climb the ‘wall of worry’ with the Dow Jones down 1.6%, the S&P 500 down 1.2% and the Nasdaq outperforming, falling just 0.4% as the quarter came to an end.

The end of the quarter usually sees rebalancing back into bonds, but this wasn’t the case in September following the weakest quarterly returns since March 2020.

The concern appears to be focused on global energy set to pressure most economies into the Northern winter. China for instance has ordered the state-owned energy companies to secure supplies for winter at all costs. This is pressuring everything from coal to oil and gas.

Sticking with China, proof of its slowdown was delivered on Thursday with the manufacturing PMI falling to 49.6 and into contraction as lockdowns and output curbs hit the economy.

Debt ceiling extended

On the positive side, the US Government passed a nine-week extension on their debt ceiling, averting another shutdown but kicking the can down the road with the Republican’s demanding spending cuts.

Monthly movers

The Dow was down 4.5% in September, with the S&P 500 and Nasdaq both falling over 5% as the ASX outperformed in a rare win.

Gaming on the up, Zoom and Five9 abandon acquisition

Both NVIDIA (NASDAQ: NVDA) and Electronic Arts (NASDAQ: EA) moved higher overnight with the former approving a number of new games for its cloud gaming platform.

Elsewhere, Zoom’s (NASDAQ: ZM) US$14.7 billion acquisition of Five9 (NASDAQ: FIVN) has reached the end of the road with the merger terminated “by mutual agreement”. This comes after Zoom failed to win sufficient approval from Five9 shareholders, who were told not to accept the offer because of Zoom’s stock volatility.

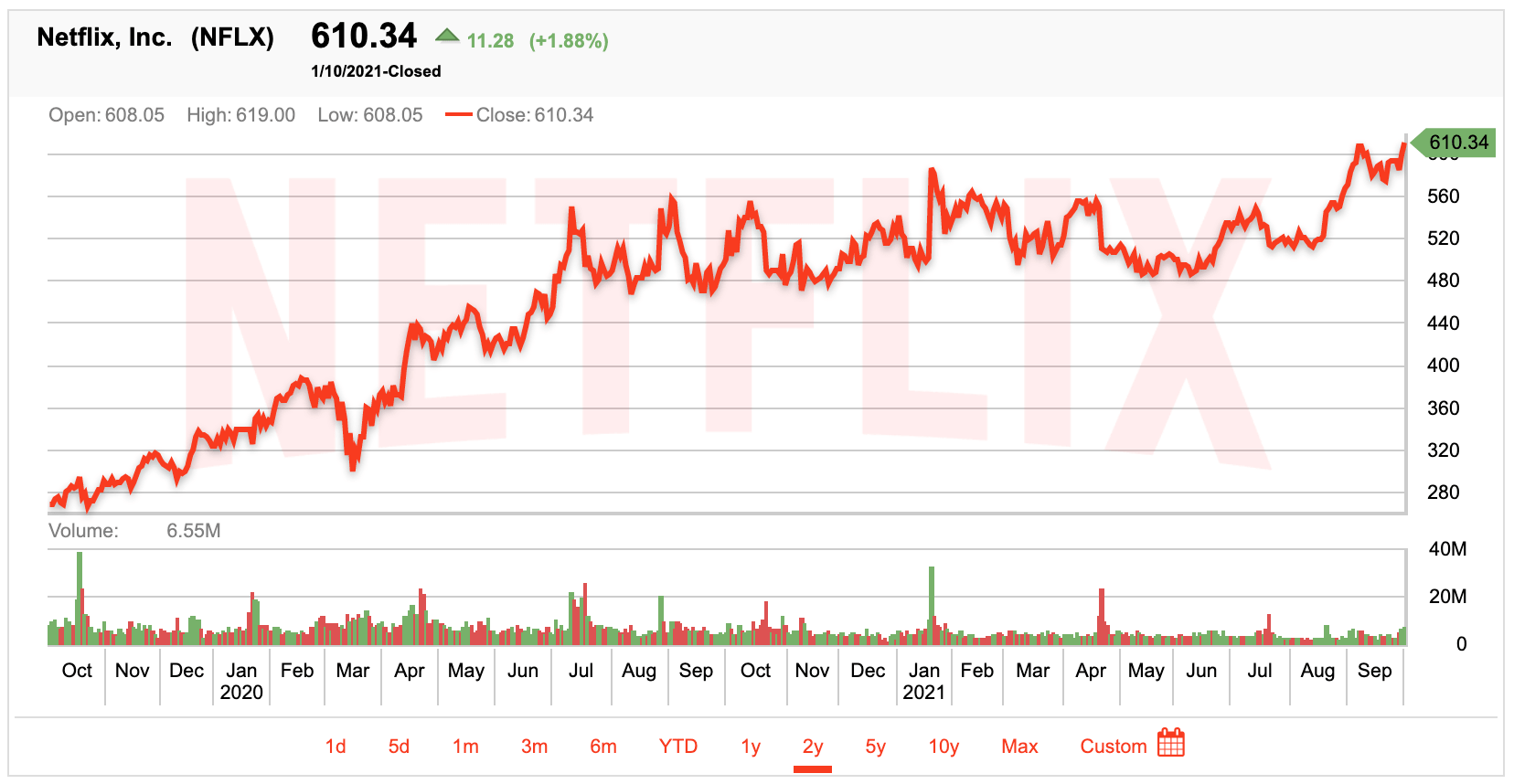

Meanwhile, Netflix (NASDAQ: NFLX) remains at all-time highs as investors return to the consistent cash flow pandemic winner.

US stock market movers

These US stocks were among the biggest movers on Thursday.

- Virgin Galactic (NYSE: SPCE) up 12.2%

- Affirm (NASDAQ: AFRM) up 5.6%

- Splunk (NASDAQ: SPLK) up 5.2%

- Bath & Body Works (NYSE: BBWI) down 6.6%

- Gap (NSYE: GPS) down 8.0%

- CarMax (NYSE: KMX) down 12.6%

The S&P/ASX 200 (ASX: XJO) is expected to follow this negative lead from US markets to open lower on Friday. For all the latest, check out my ASX 200 morning report.