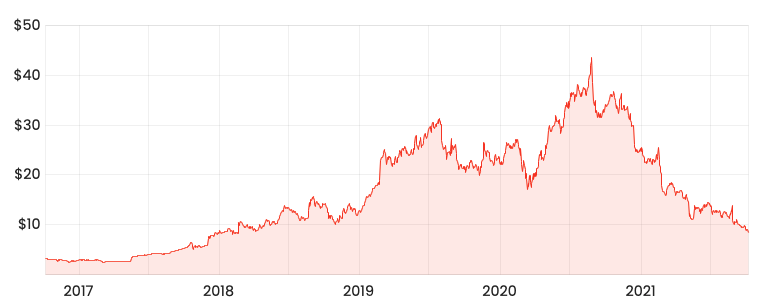

Formerly a tech darling, the Appen Ltd (ASX: APX) share price has tumbled 66% since the start of 2021.

Zooming out a bit further, the Appen share price is down 78% from its highs and at levels not seen since 2018.

Since the onset of the pandemic, the business has suffered from project delays, intense competition and changes in demand for artificial intelligence (AI) training data.

Despite the share price plummet, the acquisition of its largest competitor offers some hope for Appen investors.

APX share price

History doesn’t repeat itself, but it does rhyme

Appen’s biggest direct competitor is Lionbridge Technologies, which was acquired by Vancouver based Telus Corporation (T: TSX; NYSE: TU) for AU$1.31 billion (C$1.20 billion) in November 2020.

When announcing the acquisition, Telus provided the following financial data for Lionbridge:

- Lionbridge recorded AU$283 million (C$260 million) in revenue in FY19

- Revenue increased 29% on the prior year

- Lionbridge’s earnings before interest, tax, depreciation and amortisation (EBITDA explained) within a margin of 20% to 25%.

- Lionbridge has 750 employees across multiple countries

Despite the numbers being a couple of years old, Lionbridge has a similar financial profile to Appen.

Subsequently – by using the above information, we can reach a relative valuation for Appen based on the price paid for Lionbridge.

With an EBITDA margin of 20-25%, Lionbridge’s implied EBITDA was in the range of AU$56 million to AU$70 million.

This valued the business on a multiple of around 18 to 24x EBITDA.

Putting a number on Appen

Appen has guided for EBITDA of around AU$81 million to AU$88 million in FY21.

Based on the EBITDA multiple paid for Lionbridge, Appen could be worth between AU$1.4 billion to AU$2.1 billion depending on where EBITDA lands and the multiple applied.

With a current market capitalisation of around AU$1 billion, Appen looks undervalued.

Final thoughts

It’s worth noting that just because a similar business was sold for a particular price, does not mean Appen is necessarily valued on the same multiple.

Lionbridge will have different customers, growth prospects, intellectual property – so on and so forth.

However, most businesses are worth something to someone. It wouldn’t surprise me if Telus or another AI-focused company ran the ruler over Appen.

I’m not jumping in straight away. But I’ll be keeping an eye on the business in its upcoming full-year result to see if any takeover suitors appear.