Tuesday was another tough day for the information technology sector on the ASX.

The tech-heavy Nasdaq fell 2.1% on Monday despite a promising new COVID-19 treatment. Investors instead shifted their focus towards the 10-year US bond yield, which recently spiked to 1.525% on the back of inflation fears.

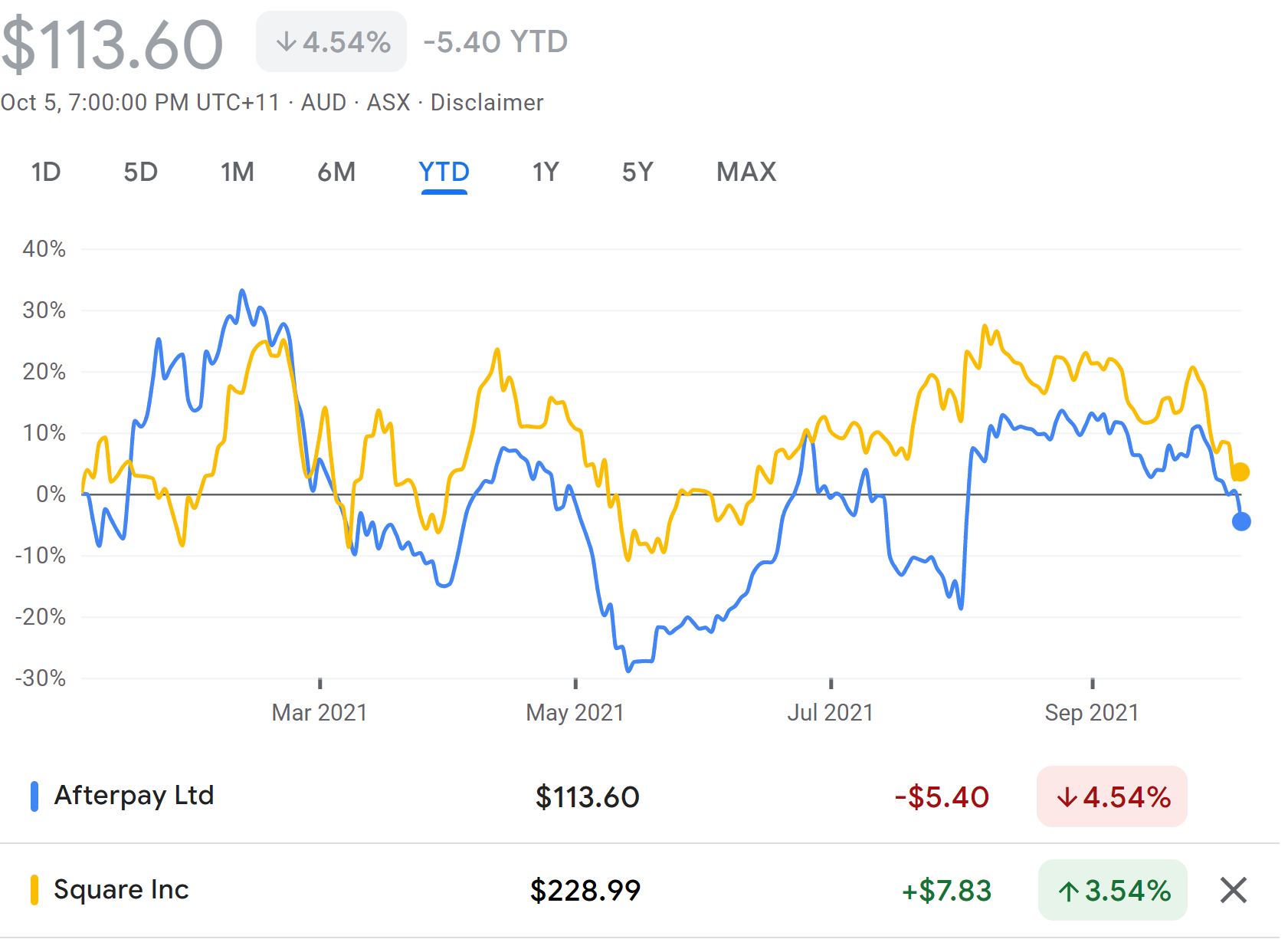

Since the news that US payments giant Square Inc (NASDAQ: SQ) would acquire Afterpay Limited (ASX: APT), you can see that their share prices have more or less followed each other.

The deal valued Afterpay at $39 billion, or roughly $126 per share. Based on the current share price of $113, that’s around a 10% discount to Square’s offer.

Why the volatility?

If you’re a long-term believer in either Square or Afterpay, I wouldn’t get caught up in the short-term price movements too much.

Remember that it’s general market forces at play rather than company-specific changes. Here on the ASX, we’ve seen losses from other quality tech names like Xero Limited (ASX: XRO), NextDC Limited (ASX: NXT) and Dicker Data Limited (ASX: DDR).

Where to from here?

For every 1 Afterpay share held, holders will receive 0.375 Square shares in return. Afterpay will be removed from the ASX, but holders will have the opportunity to have a stake in a much larger combined operation.

Square’s almost comical Price/Earnings (P/E) ratio of 185 might be enough to turn some investors away. But keep in mind how rapidly Square has been growing and how the Afterpay acquisition could complement its existing offering.

From Square’s point of sale (POS) systems, cash app, business services, and stock trading, it’s easy to see why something like Afterpay’s BNPL offering would be a good fit within its ecosystem.

Having such a broad range of financial services all under one umbrella could result in some sticky customers without a strong incentive to switch to an alternative.

If you’re after some other share ideas, click here to read: 2 ASX small cap shares I’d buy in October.