The takeover target Australian Pharmaceutical Industries Ltd (ASX: API) share price will be on watch today after it provided a positive trading update.

Currently, the API share price is trading up marginally to $1.51.

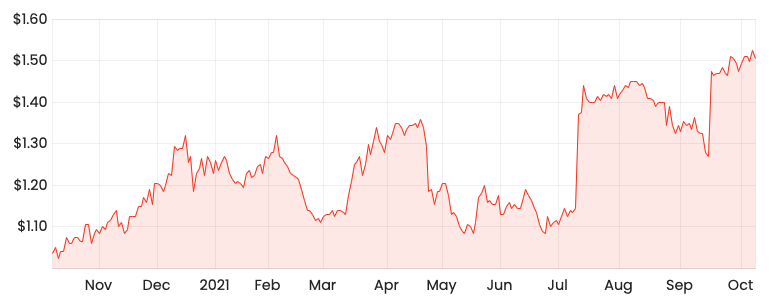

API share price

What was the positive news?

API provided an update on its profit guidance for FY21. The business anticipates the following for the year ending 31 August 2021:

- Underlying earnings before interest and tax (EBIT) of approximately $70 million

- Reported EBIT of approximately $28 million

Underlying EBIT is a more accurate reflection of the company’s annual performance as reported EBIT contains several non-cash items.

Chief Executive Officer and Managing Director Richard Vincent said:

“API recorded a stronger trading performance through our suburban and regional Priceline Pharmacies as well as online. We also experienced elevated volumes through our Pharmacy Distribution business that we were not anticipating”.

The upgraded underlying EBIT guidance is a 24% increase from the previous financial year. In FY20, API achieved an underlying EBIT of $56.3 million.

API will release its FY21 results on October 28.

What was the previous guidance?

In July, API cautioned that lockdown restrictions in NSW would curtail EBIT by around $1 million per week.

Subsequently, the business downgraded its initial guidance to:

- Underlying EBIT of $66 million to $68 million

- Reported EBIT in the range of $31 million to $33 million

Fortunately, the impact of lockdowns did not flow through as forecasted in July. Consequently, the business was able to increase its profit prediction.

Unhappy campers

Despite the news of positive profit, API announced it is facing a class action in the Victorian Supreme Court.

The business is accused by current and former franchisees of breaching state regulations and charging excessive fees.

“API denies the plaintiffs’ allegations and will vigorously defend the action”. – API

How does this impact the takeover battle?

Sigma Healthcare Ltd (ASX: SIG) and Wesfarmers Ltd

(ASX: WES) are currently locking horns for control over API.

The upgraded guidance will reaffirm both bidders interest in the business. Furthermore, it demonstrates the resiliency of pharmacies and that despite movement restrictions, people still need medication.

API’s management also deserves a tick. The company underpromised and overdelivered, which is a sign of a high-quality management team.

It will be interesting to see if the takeover battle is resolved prior to the full-year results being released in two weeks. I don’t expect either party to walk away quietly.