CSL Limited (ASX: CSL) held its Annual General Meeting (AGM) today for shareholders.

Chairman Brian McNamee and Chief Executive Paul Perreault addressed shareholders virtually discussing the FY21 results and the future outlook for the business.

Here’s your 2-minute guide on the notable comments made at the AGM.

1. Is CSL the best ESG company in Australia?

CSL is lauded as one of the best companies – if not the best company on the Australian Stock Exchange

.

I’d make the argument it’s also the best environmental, social and governance (ESG) company as well.

The business identifies life-threatening conditions. Then it tries to solve them through scientific research and development. The result is safe and mission-critical products.

“This is where your company operates: the point at which the commercial imperative for our shareholders coincides with social license for broader society” – Dr McNamee

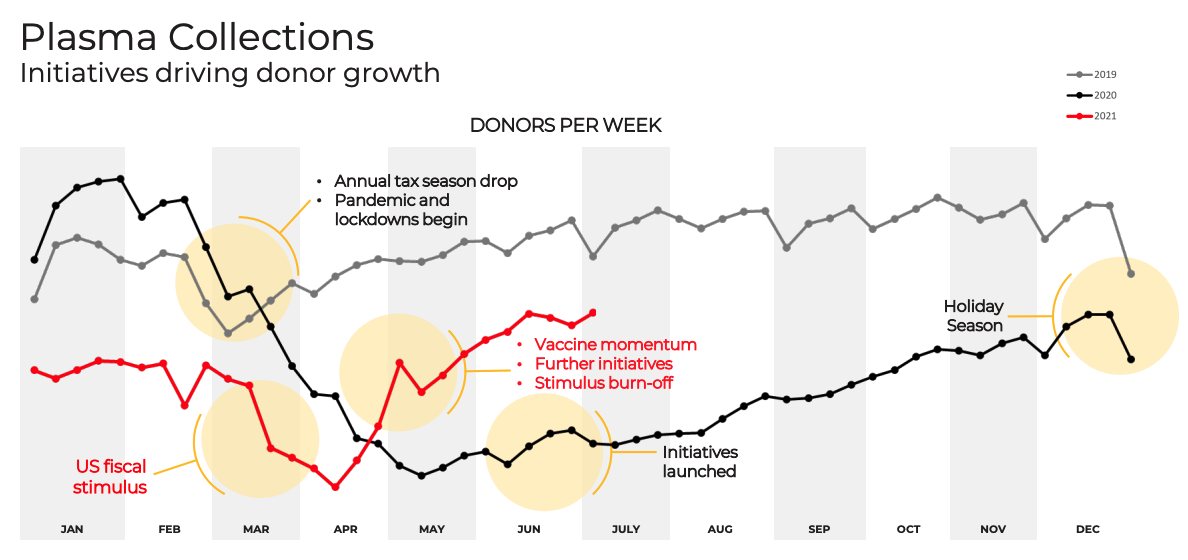

2. Plasma collections gain momentum

The unprecedented levels of government stimulus and movement restrictions meant plasma collections were down around 20% for the year.

However, recently donor numbers have been returning. This is a positive for CSL, given it relies on donors to collect plasma for its treatments.

3. 2030 Strategy

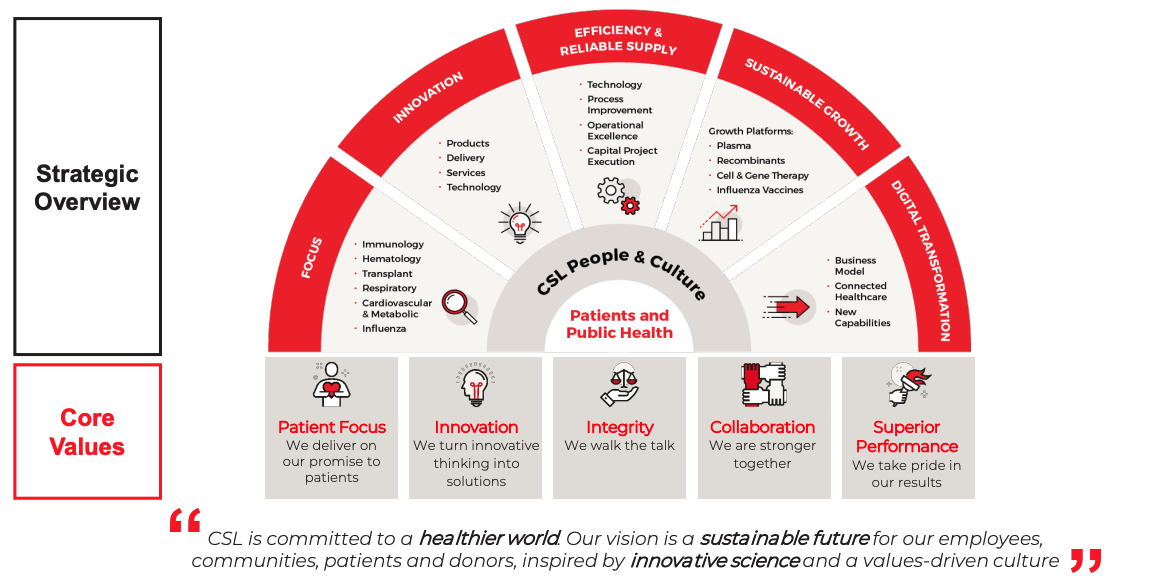

Throughout the AGM, Dr McNamee and Mr Perreault constantly referred back to CSL’s 2030 strategy.

The strategy is a 10-year plan to position the business for growth across new treatments, sustainability and shareholders.

There are not many companies that announce an explicit plan to shareholders. Let alone one that lasts 10 years.

However, when you consider the business has been around since 1916, ten years doesn’t seem so long.

This is a high-quality management team building a business for decades, not short-term gains.

4. Transition years

Despite the optimistic long-term outlook, the business flagged that the next year or two will be transitionary.

Management guided minimal growth over FY22 due to increased costs and margin compression. However, CSL expects to return to sustainable growth within 24 months.

5. Mission critical

Most investors would already be aware, but the AGM reinforced the defensive nature of CSL.

By defensive, we mean the business is more immune to changes in the economy relative to other businesses.

It doesn’t matter if house prices are soaring or interest rates are falling, patients need access to vaccines and treatments.

“The products that CSL produces are not discretionary. They are essential to keeping patients healthy, and in some instances, alive” – Mr Perreault

If you like CSL, you must be a long-term investor. Check two other ASX shares I’d buy and hold for the next decade.