The Hub24 Ltd (ASX: HUB) share price has jumped today after the business provided a first-quarter update.

Currently, the Hub share price is up 9% to $31.31.

It’s been a good day to be investing in wealth platforms, with Netwealth Group Ltd (ASX: NWL) up 15% after upgrading its FY22 guidance.

What did Hub report?

Key highlights from the first quarter of FY22 include:

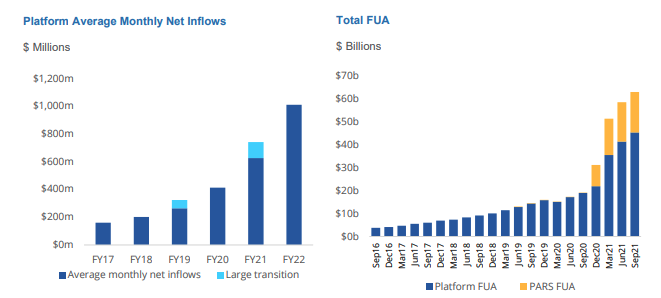

- Total funds under administration (FUA) of $63.2 billion

- Platform FUA of $45.4 billion, up 9.5% on the prior quarter

- Portfolio administration and reporting services (PARS) FUA of $17.8 billion, up 3% on the prior quarter

- 30 new licensee agreements signed and 158 advisers onboarded

Throughout Q1, the company onboarded 10 new distribution team members to spur further growth. It’s also expanding its executive and technology resources.

The Xplore acquisition integration remains on track. Hub is working with licensees to support advisers as they transition across.

How to interpret the Hub result?

Two key metrics to keep a track of for platform FUA is net inflows and market movement. The former is in the control of Hub whereas the latter is largely outside its control.

Platform FUA performed strongly, achieving net inflows of $3.0 billion and around $0.9 billion of market movement.

For PARS, the key metric to track is the number of accounts.

PARS increased FUA by $0.6 billion for the quarter as new accounts were onboarded.

“The record quarter comes on the back of a record FY21 net inflow result and is testament to HUB24’s market leadership position and continued focus on delivering innovative solutions and customer service excellence”.

How is Hub performing against its peers?

Hub has doubled its market share over the past year from 2.1% to 4.3% as of June 2021.

It is now the 7th biggest wealth platform and second only behind Netwealth for net inflows.

What next for the Hub share price?

Hub’s quarter has somewhat been overshadowed by its competitor Netwealth who upgraded its FUA estimate.

However, I think this is a great result for the business. It’s taking market share from incumbents and growth doesn’t look like it will slow down any time soon.

I struggle to predict short-term price movements. However in the longer term, if the company can keep attracting net inflows, I believe the Hub share price will follow a similar trajectory.

Looking for new share ideas? Check out two ASX shares I’d buy and hold for the next decade.