The Treasury Wine Estates Ltd (ASX: TWE) share price has gone into the red today after the business provided a first-quarter update.

The share price is currently down 5% to $11.67.

TWE share price

What was announced?

At its Annual General Meeting (AGM), Treasury Wine provided an update on the start to FY22.

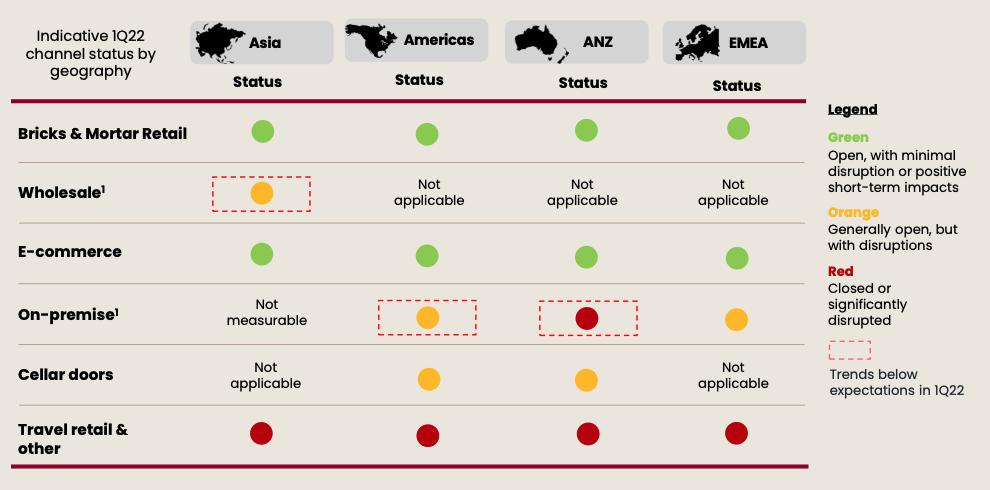

Despite economies beginning to reopen, it’s at a slower pace than the company had anticipated especially in the United States.

Moreover, lockdowns in Sydney and Melbourne have effectively closed on-premise consumption, which is a higher-margin sales channel.

Subsequently, the business has been unable to execute its plans outside of large retailers, particularly for Penfolds.

“As we exit the first quarter of fiscal 22, the recovery of key luxury channels impacted by the pandemic are slightly behind the expectations we had at the beginning of the year”.

Treasury also noted logistics and supply chain constraints due to reduced vessel availability and delays.

Management remains confident the vaccination programs will lead to the easing of restrictions across key premium and luxury wine sales channels.

On a positive note, retail and e-commerce continue to perform strongly albeit at moderate rates.

What next for the Treasury Wine share price?

The market hasn’t taken kindly to the Q1 update. However, I think it’s been a bit harsh given it’s out of Treasury Wine’s control.

Economies will eventually reopen. Customers will return to restaurants. It’s not a matter of if but rather when.

“…pandemic related factors will continue to have a bearing on our performance in the short term, both with respect to the timing and pace with which key sales channels re-open and recover across key markets”.

If you take a 1-year view, I think the overall sentiment around the Treasury Wine share price will be much higher.

My take

I look at Treasury Wines as two businesses under one company. It has Penfolds, which is the jewel in the crown. And then it has a portfolio of wines including Wolf Blass and 19 Crimes.

Given households have record-high savings, I suspect some of this extra cash will be splashed on premium experiences. Penfolds will directly benefit from this, as will the portfolio to some extent.

If you’re looking for other reopening plays, check out 2 ASX shares that will benefit from the reopening of borders.