Question: What do Butter Nuts, Juicy Plums, Black currants and Smashed Avo have in common?

Answer: They’re four of the colours from underwear disruptor Step One Clothing Limited (ASX: STP) product range.

The Step One initial public offering (IPO) is on track for November 1. The business is raising $81.5 million at $1.53 to supercharge growth.

Valued at about $241 million, that’s an expensive jocks business.

Let’s look at why it might be worth all the rage.

Not your standard briefs

Step One isn’t a typical retailer.

It’s a pure-play e-commerce company. No physical stores. 100% online.

It sells something we all need – underwear.

Specifically men’s underwear (for now).

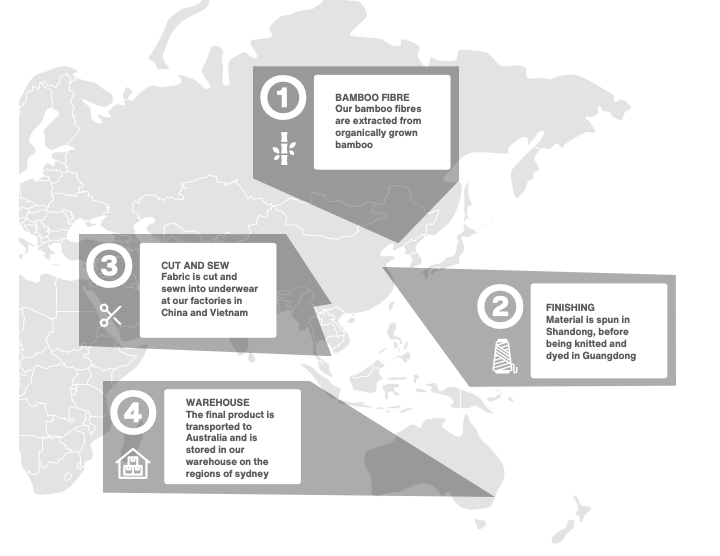

It’s made from organically sourced bamboo, which uses 65% less water and 38% less energy than traditional cotton.

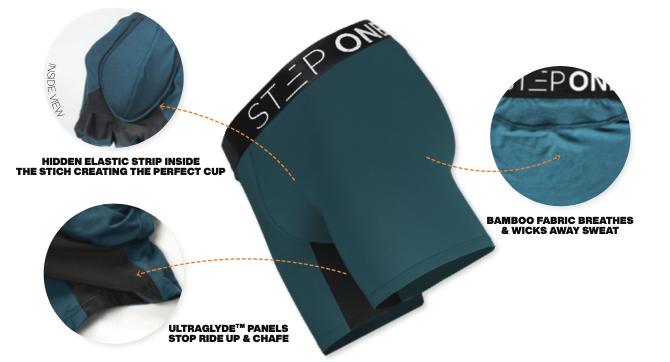

The underwear is lined with compression material, similar to that found in bike shorts, which radically reduces chaffing.

The bamboo fabric wicks away sweat. And a hidden elastic strap provides the perfect support for your gonads.

In summary, it makes briefs that are more comfortable and better for the planet.

Solving an uncomfortable problem

If there was an award for the best opening line to a prospectus, Step One would win by a country mile:

Step One was born whilst I was hiking in New Zealand and suffering from chafing.

In 2017, founder and Chief Executive Greg Taylor (65.4% shareholding) simply wanted a better pair of undies.

He jumped on a plane to China.

Designed and subsequently bought 5,000 pairs of jocks.

Fast forward four years and now he’s sold over 1.25 million.

Step One is named after what is generally the first piece of clothing in the morning – underwear.

If you’re thinking why would I trade in my BONDS for a pair of Step One? The reviews say it all.

Customers love the product. In fact, 45% of customers in FY21 were repeat customers.

Its target market is skewed towards younger demographics, with 24-34 year olds (33%) and 35-44 year olds (21%) making up the bulk of sales.

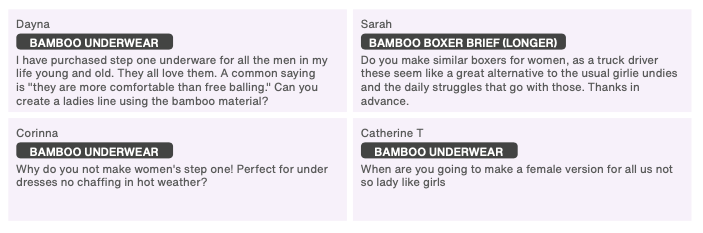

Interestingly, 37% of its customers are female, often purchasing for friends or family.

Service at its core

To compensate for the inability to see and feel the products before purchasing, Step One offers a 30-day satisfaction guarantee.

Customers can return the goods and receive a full refund.

It also offers a 12-month warranty in addition to 24/7 customer support.

Give me the numbers

Cool. The business makes comfortable jocks out of bamboo. What makes you think it’s worth $240 million?

Step One has grown rapidly since 2017. The business achieved revenue of $22.2 million in FY20. The next year – FY21, sales almost tripled to $61.7 million.

Its gross margin is about 82%. Essentially this means after paying for the cost of underwear it has $82 leftover for every $100 in sales.

Its biggest expense is advertising, mainly spent on online search through Google and Facebook. About $43 for every $100 in sales goes towards marketing at this stage.

That’s an enormous sum to be spending on advertising. More work would need to be done to find out the potential return on that investment.

Overall, the business made $10.8 million in earnings before interest, tax, depreciation and amortisation (EBITDA explained).

It’s profitable on an EBITDA basis, but it certainly needs to grow to justify its current valuation.

The business is forecasting revenue of $73.9 million in FY22 and EBITDA of $15.0 million. However, more than $6 million of revenue is from the United States, which is yet to be launched. This implies marginal growth in Australia and the United Kingdom.

ESG you say?

Environment, social and governance (ESG) factors are all the rage at the moment. Step One capitalises on it in a big way.

All its manufacturing facilities are Business Social Compliance Initiative (BSCI) or SA8000 accredited. This means the company ensures:

- Fair wages

- Fair working conditions

- No child labour

- No forced labour

The business also uses compostable packaging to send its orders.

Finally – as mentioned earlier, bamboo produces fewer emissions, uses less water and reduces electricity than standard cotton.

Multiple ways to win

The business is raising capital to expand into the United States. Moving abroad is typically fraught with danger for Australian businesses.

However, Step One has shown an ability to execute. In its first new geography, the United Kingdom, the business grew revenue from $1 million in FY20 to $21 million in FY21.

Step One is looking to spend on womenswear given the apparent demand from women customers buying for men.

It can also expand its product range. Currently, it only has 3 styles and 7 colours.

Things to be wary of

As mentioned in finances, Step One is not expecting a big step in sales in Australia and the United Kingdom. It’s likely been a big pandemic beneficiary. Will it be able to maintain its growth momentum when borders reopen?

Step One only has $43 million in net assets. The vast majority is in cash. It doesn’t own any factories or equipment.

Capital light companies are great because they can scale quickly. But if it falls apart, there’s not many tangible assets leftover.

The business only has 22 employees and outsources its distribution and until recently finances. Is it scalable to become a $500 million and then $1 billion company?

At some stage, it will likely need to invest in its own website infrastructure, which is currently run off Shopify.

Finally, logistics is a concern. Especially companies that don’t control their own supply chain.

90% of production is sourced from two sources. If something at the factory or in transit goes wrong, Step One will have a big backlog.

Final thoughts on the Step One IPO

The best way to analyse Step One IPO might be to splash $29 and try a pair.

If you like the product, the service and the overall shopping experience – there’s a fair chance others do.

The business reminds me a lot of Aussie Broadband Ltd (ASX: ABB). A small player in a competitive industry but customers absolutely love them.

However, at 16x forecasted FY22 EBITDA, it’s richly priced for modest forecasted growth in FY22.

As a result, I’ll be waiting to see how the business trades before deciding to invest.