Shares in ASX retailer Temple & Webster Group Ltd (ASX: TPW) finished 2.76% in the red yesterday despite some strong numbers coming out of its recently hosted AGM.

Still, being one of the largest COVID beneficiaries, the longer-term share price chart is nothing short of impressive. Here’s a couple of ways I look at a company like Temple & Webster.

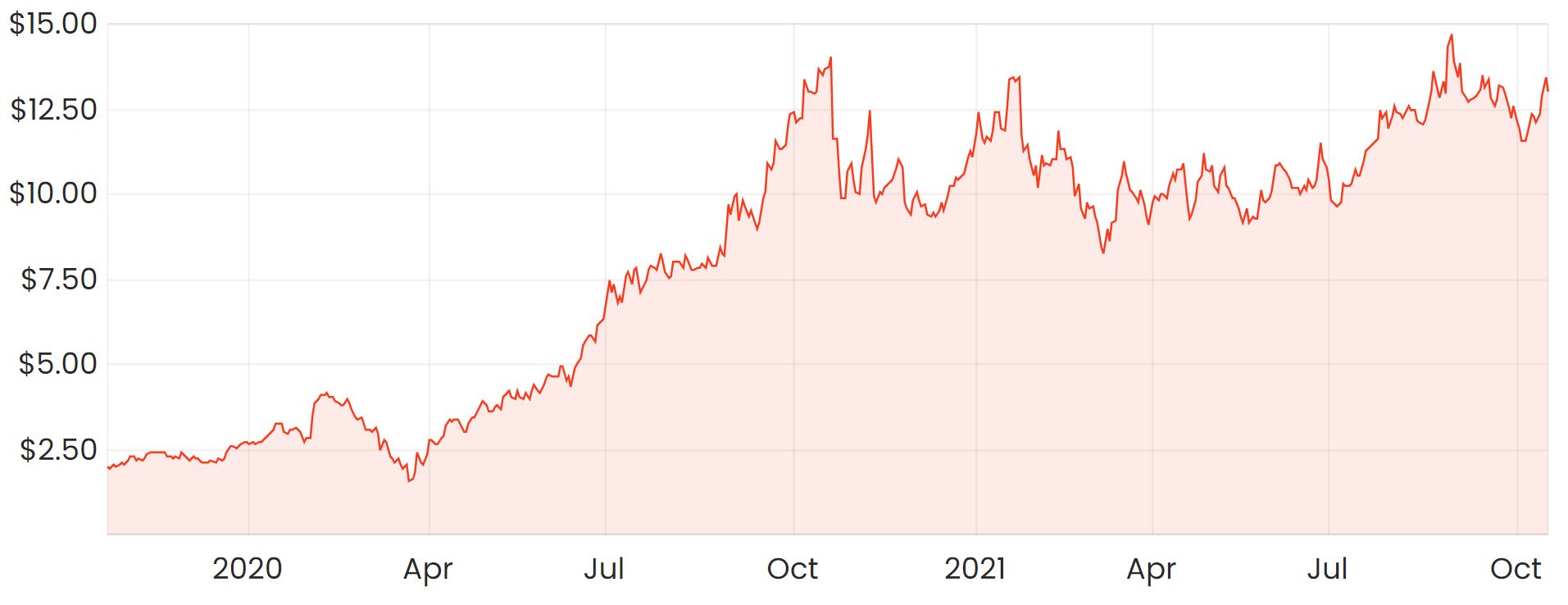

TPW share price chart

Positive structural trends

As per the Rask investment philosophy, we invest in areas that are structurally growing which provides a company with a much larger runway for growth.

TPW management reckons the furniture and homewares market is worth around $16 billion per year, but less than 10% mas migrated to eCommerce. This is in comparison to the US and other international markets that have much higher levels of online penetration of around 25%.

If you take the view that COVID has caused a permanent change in purchasing behaviour, it could mean that companies like TPW are well-positioned to take advantage of further online adoption.

In addition to its core market, it also operates in commercial furniture & homewares which takes its total addressable market (TAM) to over $30 billion.

A path to profitability

As it stands, Temple & Webster is bringing in around $25 million cash inflow from operations. Rather than borrowing outside capital, it’s using its own cash flows to deploy back into the business into things like marketing, better technology, product range and customer experience.

This is a strategy that we’ve seen from many other ASX retailers like Redbubble Limited (ASX: RBL) and Kogan.com (ASX: KGN).

Management will be targeting an EBITDA level of 2-4% in the short to mid-term. So while dividends are likely off the cards for the time being, those with a long-term focus would likely prefer the company to be heavily reinvesting at the moment.

As the company continues to scale, it will ideally be able to secure better supplier relationships on more attractive terms. These improvements in the unit economics will likely be reflected in the financials in future years.

Quality products with customer love

Assessing a company from the perspective of a customer is an often overlooked way of gaining some insight into how a business is run.

Customer and staff reviews can also be useful through app store reviews and websites like Seek, Glassdoor and Trustpilot.

TPW’s mobile app on iOS and Android are both rated above 4.8 stars with over 6.4k reviews on the iOS version alone.

On Trustpilot, TPW has over 7.5k reviews at an average of 4.4 stars. These are some good indications that its customers are genuinely satisfied with TPW’s products and customer service.

Summary

There are just a few ways I look at a company like Temple & Webster.

There is a convincing bull case to be made, but we should always try and weigh up both sides. An important next step could be to look at its valuation.

If this is something you’re looking to learn more about, take a look at Rask’s completely free share valuation course.