The world’s energy systems are being disrupted by clean green renewables, and hydrogen has become the new hot topic. ETF Securities has launched the Hydrogen ETF (ASX: HGEN), up 15% in the two weeks since inception, but is it priced to be the next Hindenburg?

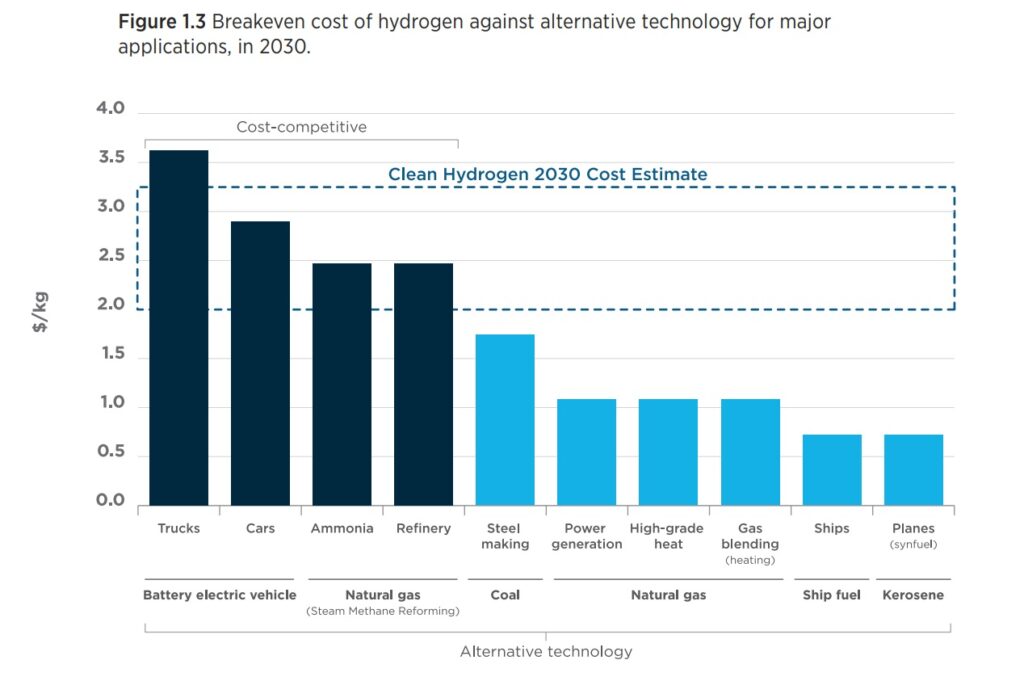

Driving down the price of hydrogen is a priority for the world

Clean, green, innovative, safe, hydrogen energy. That’s the vision of Australia’s National Hydrogen Strategy, developed by Australia’s Chief Scientist Alan Finkel. But it’s not just Australia that’s trying to position itself: Korea, Japan, Germany, the US, the UK, Canada, Norway and a raft of other countries are investing billions.

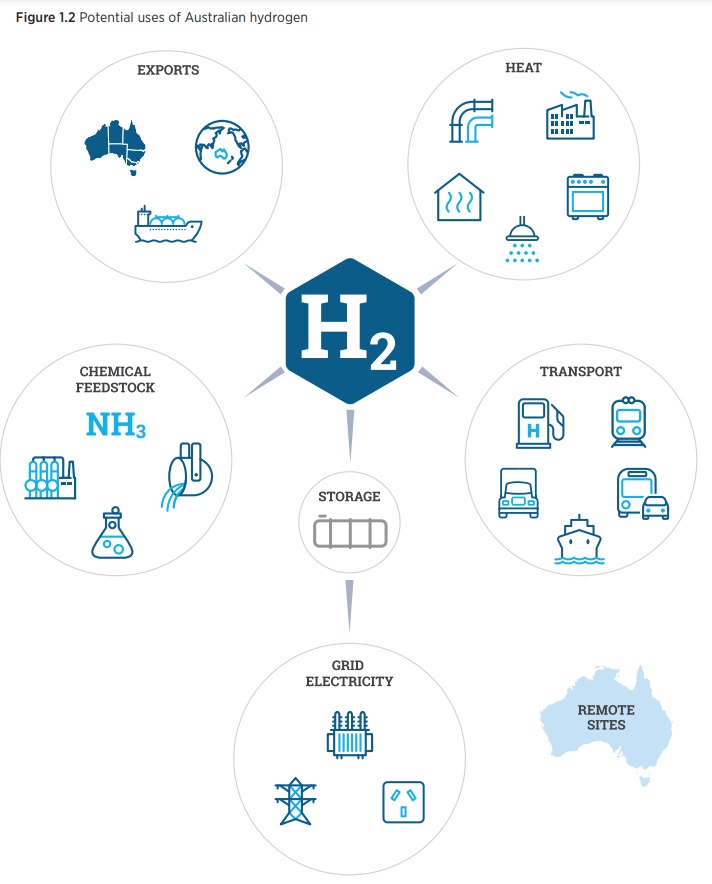

The success of hydrogen is highly sought after by our society for the fact it is so versatile (“the Swiss army knife of decarbonisation”). Hydrogen has an array of use cases, and in some cases like mass transit (think busses and trucks) is already being rolled out.

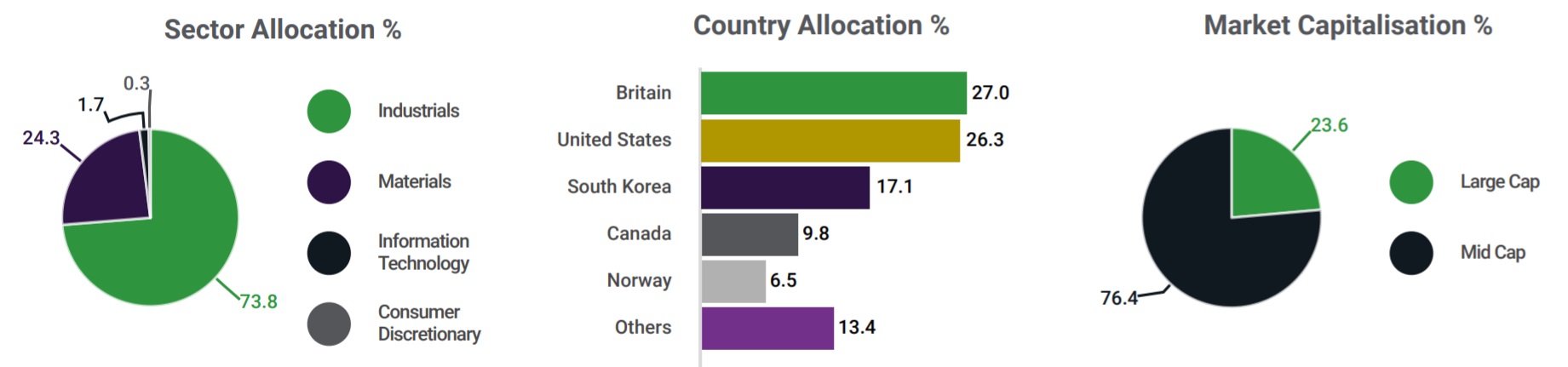

HGEN brings together the top 30 hydrogen-focused companies from around the world

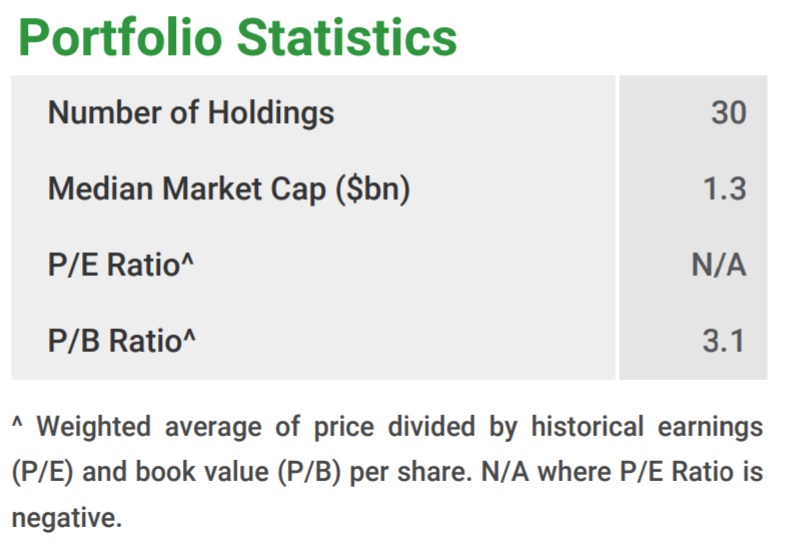

HGEN through the Solactive Global Hydrogen ESG Index brings together “30 companies from the developed world plus Korea and Taiwan”. This includes pure plays (max 10% allocations) and near-pure plays (max 4%). Pure plays include fuel cell equipment, technology providers, thermal and chemical processing machinery makers, while other sub-sectors are non-pure plays as defined by Solactive.

Valuation is difficult on most common metrics

The nascent hydrogen sector is pre-earnings, so metrics like ‘price to earnings’ don’t exist. Further, ‘book values’ are often based on the amount invested rather than the value of future earnings.

Enterprise value to revenues

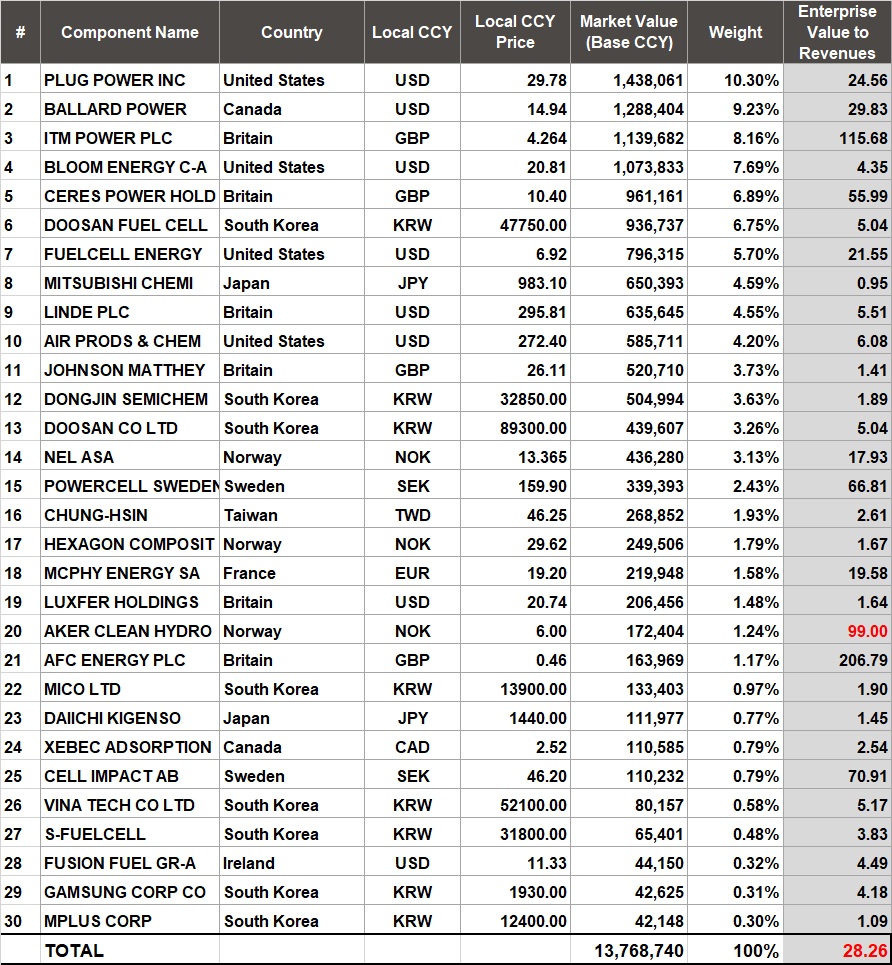

Those familiar with tech investing would be comfortable looking at ‘enterprise value to revenues‘. EV enables us to consider the market cap, as well as net assets – I am using this because the cost capital will be really important as companies issue equity/debt to fund their growth. And I’ll be comparing this to revenues as 29 of 30 companies that comprise HGEN have some today, but few have any earnings. Here’s a breakdown of their holdings:

Overall, HGEN has an EV/Revenue of ~28.26. So for every $1 an investor puts into HGEN, you’re buying less than 4c of sales. That seems expensive, but it’s all relative to the industry’s growth prospects.

HGEN is in good company with 28x EV/Revenue

Taking a screen for multi-billion comparisons on the ASX, you’ll see the likes of Pro Medicus Limited (ASX: PME) on 102x, Afterpay Ltd (ASX: APT) on 80x, Atlassian (NASDAQ: TEAM) on 62x, Wisetech Global Ltd (ASX: WTC) on 42x, etc. Notably, they typically are scalable tech companies rather than industrials.

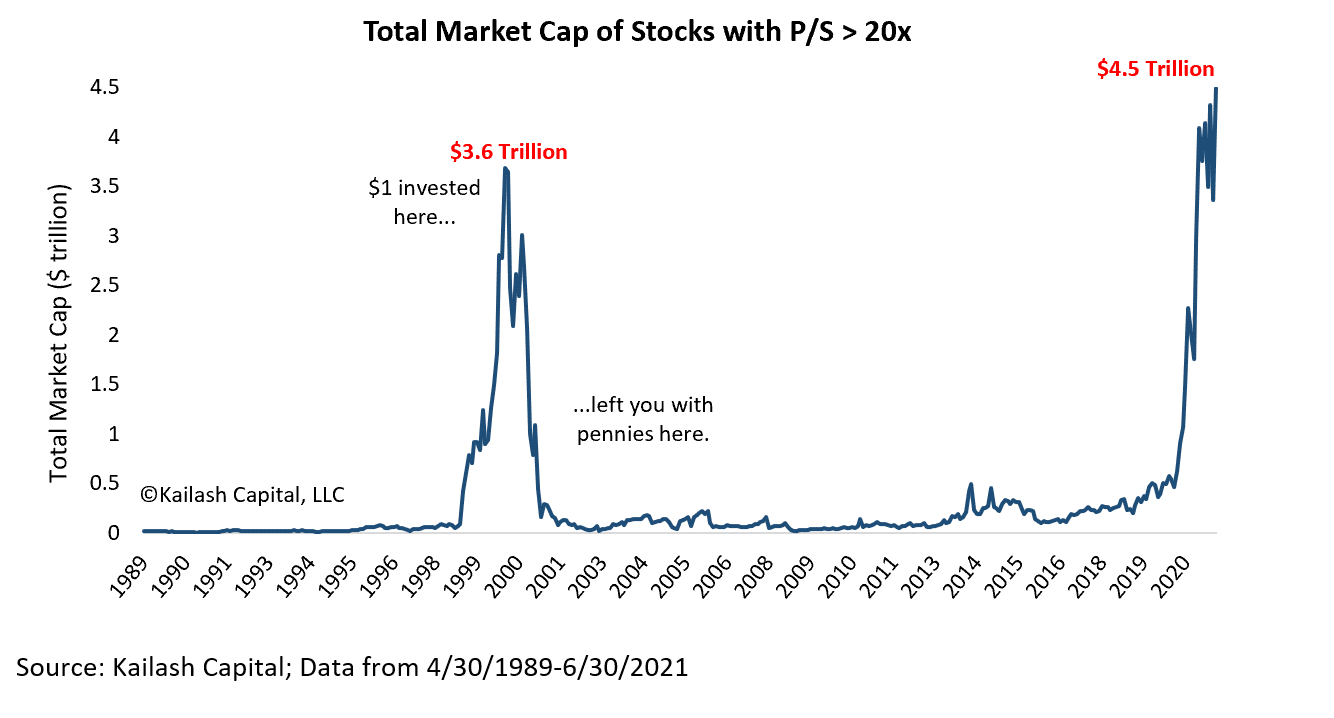

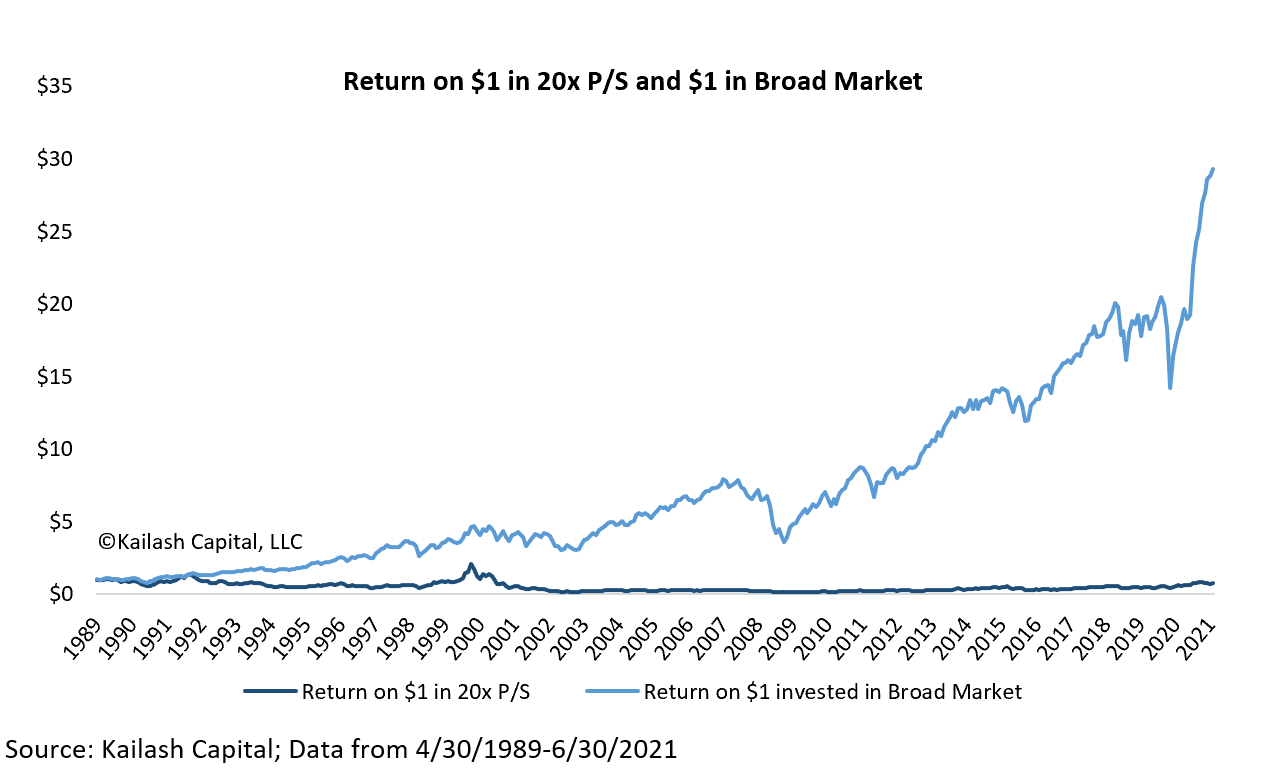

While the market is really hot for stocks with huge sales multiples, history demonstrates that returns have been anemic for these high flyers.

What growth rates would be required to underwrite a 10% rate of return

In a bullish scenario (25% profit margins, 6% discount rate, terminal of 20x), the underlying companies would need to grow 22% per annum to achieve a 10% return for investors. Using industry peers (12.5% profit margins), that number quickly goes up to 32%.

Using Tesla’s margins of 8%, growth would need to be 40% — that’s slightly below Tesla’s 3-year revenue compound annual growth rate of 43.8%.

Watering the weeds, pruning the flowers

HGEN rebalances every six months with limits of 10% / 4% allocations for pure / non-pure plays. So if a company like PlugPower starts selling their fuel cells, while Aker Clean Hydro’s ammonia fertilizer is stuck in the development pipeline, PlugPower will be trimmed. This is the opposite of how a venture capitalist would operate, who would add to their winners while the losers shrink in their portfolio.

Final thoughts

It’s hard to invest in something that requires 30 Tesla’s in one ETF for a 10% return. Thematic ETFs often have a role in a portfolio, though it’s important to look under the hood and think about the valuation.