The Tabcorp Holdings Limited (ASX: TAH) share price is moving into the red today after the company announced a slow start to FY22 at its annual general meeting (AGM).

Currently, the Tabcorp share price is down 2.10% to $5.12.

Lockdowns impact across the group

It’s been a difficult start to FY22 for Tabcorp, with group revenue down 7.3% as lockdowns impact the business.

Lotteries revenue is down marginally by 0.2% due to Keno venue closures.

Similarly, closures at TAB and gambling venues has led to a 17.2% reduction across the wagering division and a 14.6% decline in gaming services.

Some of the declines have been offset by migration to digital channels. However, the pure-play online bookmakers have a big advantage in this respect and have been able to increase advertising to poach customers.

Demerger remains on track

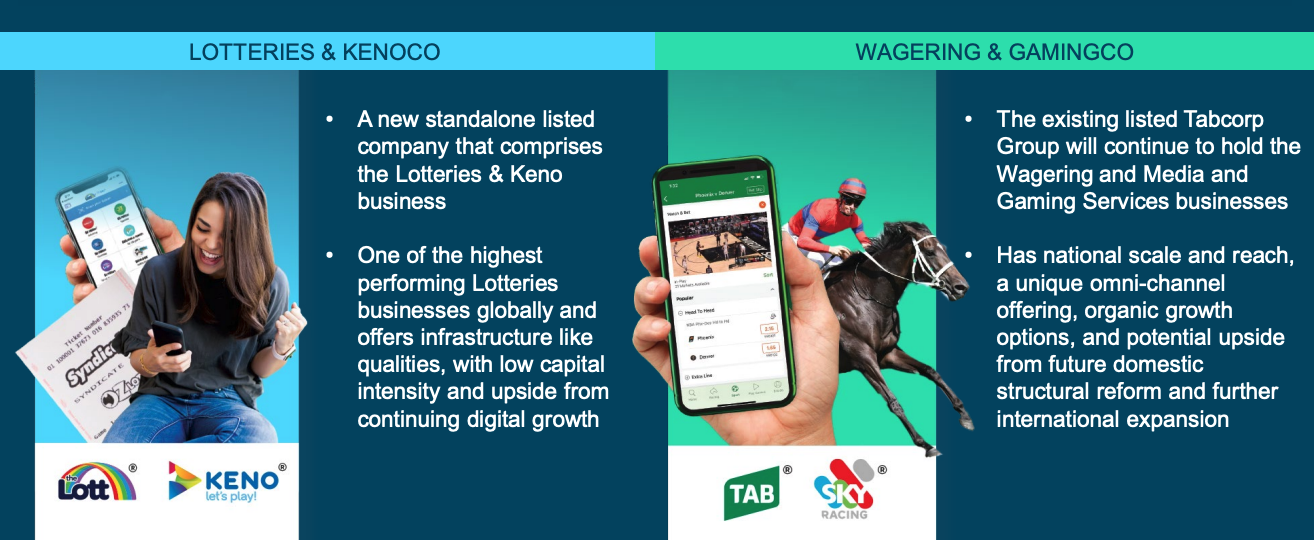

The planned demerger of the Lotteries business is on track to be completed by June 2022 subject to regulatory approvals.

A scheme booklet will be released in April and shareholders will be able to vote in May.

Several director and executive appointments were released today as the two businesses become stand-alone listed companies.

Management reiterated one-off cash costs of $225 to $275 million from the separation. Additionally, the two entities will incur $40 million in incremental annual costs.

Demerger summary. Source: TAH AGM presentation

The demerger comes just four years after the initial merger between Tatts Group and Tabcorp.

Something needs to change

Chair Steven Gregg spoke on the current regulatory climate of wagering in Australia.

“It is unsustainable for our wagering business to return 40% of its revenues to the racing industry while online bookmakers return roughly half of that and are subject to far less regulation”

A majority of online bookmakers such as Sportsbet and Pointsbet Holdings Ltd (ASX: PBH) are based out of the Northern Territory, which has more favourable regulation.

Subsequently, online bookies can reinvest the additional savings into advertising to steal clients from the likes of Tabcorp.

My take

The slow start to FY22 is disappointing but to be expected given gaming venues in New South Wales and Victoria have been largely shut.

However, I think once restrictions ease, people will be out in droves at pubs, clubs and sporting events. Tabcorp should be a beneficiary of this.

If you’re interested in learning more about the Tabcorp demerger, check out why I think it will be a positive for shareholders.