The Aussie Broadband Ltd (ASX: ABB) share price is largely unmoved today despite the business providing a Q1 update.

Currently, the Aussie Broadband share price is down 0.39% to $5.06.

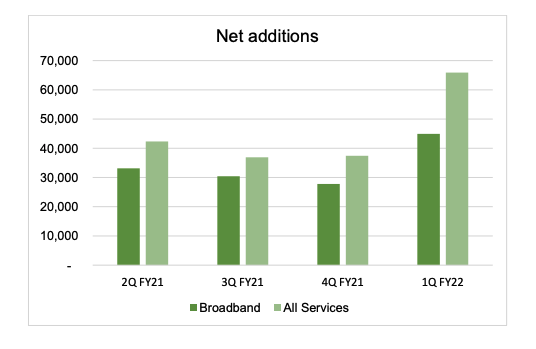

Growth across all services in Q1

Key highlights from the quarter ending 30 September (Q1) include:

- Broadband connections of 445,780, up 11% quarter-on-quarter (QoQ) and 44% year-on-year (YoY)

- Mobile connections of 29,447, up 15% QoQ and 112% YoY

- Revenue of $111.4 million, up 11.3% QoQ

- Onboarding of its first white-label customer

- VoIP and Fetch achieving double-digit QoQ growth

Residential broadband continued to be Aussie Broadband’s bread and butter, adding 32,978 new connections or a 9% increase on the prior quarter.

The majority of orders are now transfer orders. Households who already have a connection to NBN are choosing to switch to Aussie Broadband.

Business is also growing steadily at 13%, although off a much lower base.

During the quarter, the company launched a variety of first-month free and two months free promotions to encourage uptake of new broadband and mobile services.

“The company remains committed to strong customer and revenue growth and will continue to pursue growth opportunities, provided [customer acquisition cost] remains within its tolerances. This will result in intra-period EBITDA sacrifice to drive higher levels of subscriber growth”.

Management did note a decline in net mobile additions of 45% is primarily due to current customers moving away from Aussie Broadband due to a change of network.

The business recently transferred its mobile offering from Telstra Corporation Ltd (ASX: TLS) to Optus.

Positively, over 90% of migrated customers have retained their service with Aussie and are happy with the coverage by Optus.

All systems go

Aussie broadband is juggling several balls currently as it enhances its product offering.

The Fibre Project remains on track with 41 of the 107 sites now completed, up from 25 in the previous quarter. The project will be completed during FY22.

Aussie’s proprietary Carbon platform – an enterprise solution for businesses – is gaining traction with a 21% increase in additions on QoQ.

The business finalised its $134 million capital raising, and is actively pursuing its acquisition strategy.

Hey, can we get some help over here?

With lockdowns persisting across Victoria and New South Wales, Connectivity Virtual Circuit (CVC) charges were up 137% over the month as households worked from home.

CVC is basically the amount of internet each retailer buys from NBN. If demand spikes as it has with work-from-home, retail service providers (RSPs) acquire more CVC at a higher rate, impacting margins with little incremental revenue gain.

RSPs such as Aussie Broadband, Optus and Telstra have voiced the NBN needs to do more to assist.

“To be clear: Aussie Broadband believes NBN is earning additional CVC overage revenue as a direct result of the lockdowns, whilst incurring little to no incremental cost for providing this additional capacity”.

Outlook for FY22

The business expects 53,000 to 60,000 net broadband additions in the second quarter, led by the migration of 20,000 white label services.

It also expects CVC charges to remain elevated as lockdowns persist.

My take

Overall, a solid update for Aussie Broadband.

Growth remains strong across all services despite CVC headwinds. Hopefully, investors will get an announcement by year end on who the company plans to acquire.

Looking for new share ideas? Check out two ASX shares I’d buy and hold for the next decade.