The Kogan.com Ltd (ASX: KGN) share price is moving into the green today after the business provided a first-quarter update.

Currently, the Kogan share price is up 9.97% to $12.02.

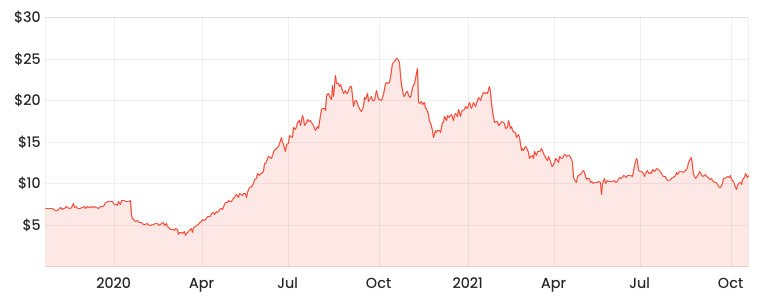

KGN share price

Mighty Ape flatters growth

Key highlights for the three months ending 30 September include:

- Gross sales of $330.5 million, up 21.1% year-on-year (YoY) and 23.2% quarter-on-quarter (QoQ)

- Gross profit of $52.5 million, down 1.7% YoY but up 31.6% QoQ

- Adjusted earnings before interest, tax, depreciation and amortisation (EBITDA explained) of $10.8 million

- Kogan First members of 197,000, up 171.1% YoY and 64.4% QoQ

Kogan’s acquisition of Mighty Ape – a New Zealand based e-commerce retailer – is the primary driver of growth for the business.

Stripping out the impact of Mighty Ape, Kogan.com gross sales increased only 8% and gross profit fell 9.3% YoY.

Adjusted EBITDA increased 240.7% QoQ. However, the improvement is off a very small base and is a result of unwinding inventory issues.

Compared to the prior year, EBITDA actually dropped 57.0%.

Customer numbers tracking upwards

During the quarter, the business continued its marketing of the Kogan First membership program.

Kogan First is similar to Amazon Prime, offering exclusive deals and free shipping to members.

As a result, active customers have increased 30.7% over the past year to 3.35 million.

“During 1QFY22, the Company focused on further scaling Kogan Marketplace and Kogan First, improving logistics and customer service, while also driving synergies through the successful integration of Mighty Ape”.

Inventory issues resolved

Kogan has resolved previous inventory issues flagged earlier in 2021.

Subsequently, the business has been able to close temporary overflow warehouses, which added $7.7 million in extra logistic costs.

Inventory now sits at $194.3 million, compared to $227.9 million on June 30.

My take

The result is a little underwhelming. Might Ape flatters the underlying Kogan.com site growth.

For comparison, online furniture retailer Temple & Webster Group Ltd (ASX: TPW) announced growth of 56% for the first three and a half months of FY22.

Furthermore, the announcement excluded comparables QoQ and YoY numbers for adjusted EBITDA from the main dot points.

With travel to resume by year-end, discretionary online spending will likely fall, which is a short-term headwind for the business.

As a result, I’ll be watching Kogan share price from the sidelines for now.

Looking for new share ideas? Check out two ASX shares I’d buy and hold for the next decade

.