Shares in furniture retailer Nick Scali Limited (ASX: NCK) are trading around all-time highs since announcing its $103 million Plush acquisition.

But is it the best pick amongst the other ASX retailers? Its share price chart might say so.

Not only has its shares returned more than a 10-bagger since listing, but they’ve also paid a fully franked dividend at around 6% over the past several years.

NCK 2-year share price chart

Plush acquisition recap

Nick Scali will be buying the Plush business in a $103 million deal through existing cash reserves and new debt facilities.

Plush is a specialist sofa retailer that operates on a similar make-to-order business model as Nick Scali. Given the similarities between the two businesses, Nick Scali is anticipating material synergies after a two-year integration period.

Deal valuation

With $7 million of cash within the Plush business, this gives an enterprise value of $110 million.

Plush brought in underlying EBITDA of $10 million in FY20 and $27 million in FY21, which gives a trailing EV/EBITDA multiple of 11 and 4.1, respectively.

But was the deal cheap?

With the limited amount of financial data provided, it’s certainly hard to say.

To explain why, we need to take a look at the somewhat messy corporate history.

Plush has been a subsidiary of by Greenlit Brands, which also owns Fantastic, Snooze and a couple of others. But Greenlit Brands is owned by Steinhoff International which has been selling off assets to reduce debt for over two years now.

As Steinhoff doesn’t report Plush as a single business, we can’t see its recent history to get a clearer picture of the business.

More to the story

However, Plush used to be a subsidiary of ASX-listed Fantastic Holdings until it was purchased by Steinhoff in 2016.

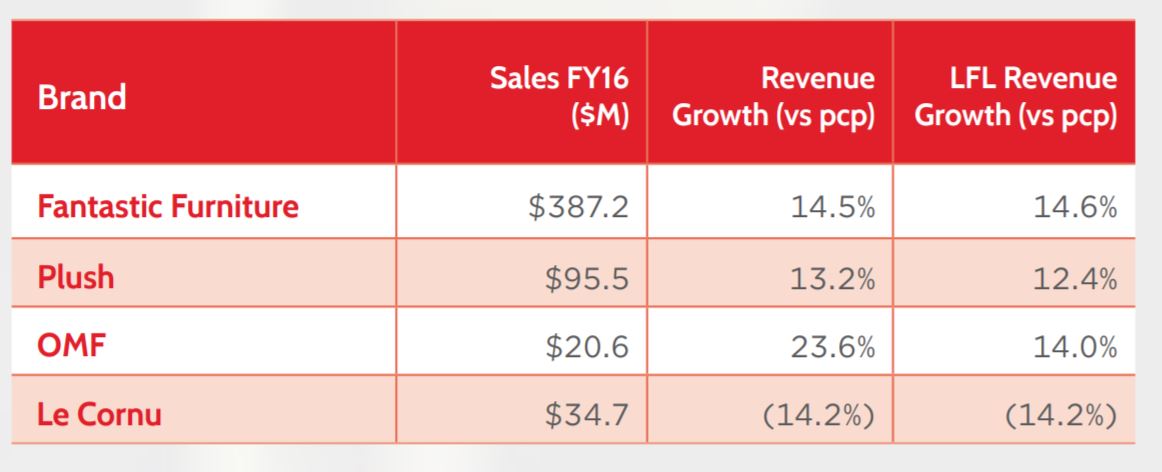

We can see from Fantastic’s last annual report in 2016 that the Plush business had a store network of 35 and annual revenue of $95.5 million.

I infer that since that time, Plush has added 11 (currently has 46) showrooms and grew its top line to $111 million in the four years until FY20 and then a huge $160 million in FY21.

If you take the view that the Plush business will continue to benefit from increased discretionary spending in this sector, the deal doesn’t seem too bad.

If you take a more bearish view, it could seem like Nick Scali has paid a fairly high multiple for a low growth business (pre-COVID) where there’s more perceived opportunity from synergy benefits. Nick Scali wants to open 54 new Plush stores, which could work fine as long as the expansion returns significantly more than its cost to do so.

Summary

There’s both a bull and a bear case to be made for this deal depending on your view of Plush’s outlook over the coming years.

Time will tell if this acquisition has been an efficient allocation of capital. I’ll be on the sidelines for now, however.

For more share ideas, click here to read: 2 fast-growing ASX software shares for your watchlist.