Hoping to bolster its number one position, the Commonwealth Bank of Australia (ASX: CBA) has launched a new terminal solution for merchants.

The device, dubbed ‘Smart‘, is the next evolution in payments for CBA’s merchants.

Introducing Smart

The new terminal is packed with updated technology for merchants.

Customers will be able to customise the interface to business needs through CBA’s App Marketplace.

Developers (after approval) can build solutions that directly integrate with the terminal, in addition to proprietary applications owned by CBA.

In many ways it’s similar to the Xero Limited (ASX: XRO) app store.

The device will also feature dual SIM-card functionality, Wi-Fi, 4G/3G connection and broadband connections to keep businesses going independent of location.

Speaking of the internet, CBA plans to add an e-commerce capability that allows its terminal hardware to integrate with online payments.

CBA will release later this year a smaller Secure Card Reader, that can pair to a device such as a tablet or a phone. It’s similar to the Square Inc (NYSE: SQ) white dongle.

From defence to offence

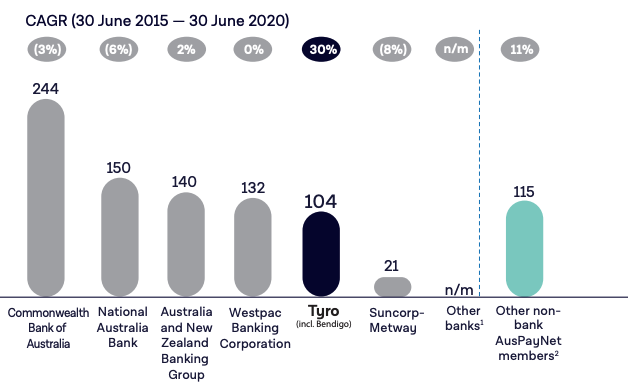

The likes of Tyro Payments Ltd (ASX: TYR) and Square have been nibbling away at CBA’s and the remainder of the Big 4’s market share for some time now.

CBA has lost 3% market share each year since 2015. In comparison, Tyro has grown 30% per year over the same period.

However, CBA has struck back in an attempt to level the playing field and protect its market share.

Notably, the business is going after Tyro’s three core verticals – hospitality, retail and healthcare.

“The new, smarter features will be particulary useful for hospitality, retail, and healthcare businesses…” – Group Executive, Business Banking, Mike Vacy-Lyle

Both Tyro and Square already offer marketplace solutions. The benefit of a marketplace is that it allows external developers to build products on top of the terminal software, enabling a greater variety of options for merchants.

CBA’s main advantage over its competitors is its 11 million retail customers. The business may choose to leverage this customer base to drive sales for its merchants, similar to how Afterpay Ltd

(ASX: APT) provides a two-sided marketplace.

For example, CBA could offer incentives such as waiving account fees for accounts that spend at merchants with CBA terminals.

My take

It’s certainly no Apple event, but the new terminal is a welcome upgrade.

It shows CBA is serious about merchant banking, which has previously been an underserved customer base.

The move will only intensify competition, particularly among tech-driven disruptors like Tyro and Square.

Overall, it’s great for merchants and consumers. More competition should yield better products and more competitive pricing.

Looking for new share ideas? Check out two ASX shares I’d buy and hold for the next decade.