With the Magellan Financial Group Ltd (ASX: MFG) share price down 39% since its last annual general meeting (AGM), it’s fair to say shareholders had more than a few questions for management.

Founder, Chairman and Chief Investment Officer Hamish Douglass and Chief Executive Officer Brett Cairns fronted the music.

Both answered questions thoughtfully, acknowledging the concerns of investors while conveying a sense of confidence about the future.

Here are three notable takeaways from the AGM.

1. Don’t judge us on one year

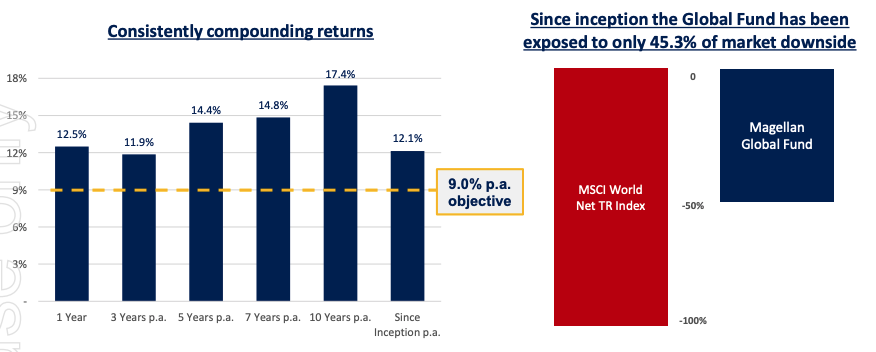

After a year of significant underperformance, Magellan reminded investors that its clients expect two things from the global equities strategy:

- A compound annual growth rate of 9% per annum after fees

- Downside protection and lower volatility than the market

Magellan has delivered on these two objectives with flying colours.

Institutional clients, which make up about 72% of funds under management (FUM), expect Magellan to produce good returns with lower volatility than the market. It’s not expected to shoot the lights out each year.

“I haven’t found any sort of institutional investors who actually find any sort of concern about what’s going on” – Hamish Douglass

The company acknowledges its one-year performance is below expectations and the benchmark index.

But you can’t fault the business for not doing what it said it would do.

2. More than a one-trick pony

Magellan made a deliberate effort at the AGM to demonstrate the business is much more than just a global equities fund manager.

The company is becoming increasingly diversified multiple investment products:

- Global listed infrastructure

- Three Core Series exchange-traded-funds (ETFs)

- FuturePay retirement product

- Australian equities via Airlie Funds Management

- Sustainable strategy

In addition to the five growth products, the business is expanding into private equity-like investments under Magellan Capital Partners.

Its three current investments – Finclear, Guzman y Gomez and Barrenjoey, are scaling fast.

Finclear’s recent capital raise implied Magellan has already tripled its money in a year.

Moreover, Barrenjoey – originally ridiculed by the market for its big loss of around $40 million in June and $156 million in upfront capital – was profitable over the first three months of FY22.

For context, most market analysts didn’t expect Barrenjoey becoming profitable until future years.

“…it’s like a snowball. These things start slow and then they can gain scale quickly. We’ve planted a number of seeds over many, many years. And now we’re starting to grow some trees and hopefully, those trees will grow into forests”.

3. Easy tiger

Magellan has largely outperformed over every time period from before 2020, therefore its relatively high management fee of 135 basis points was glossed over.

However, after significantly underperforming over the past year, rumours of fee pressure circulated.

Moreover, as net inflows started to slow, concern over potential outflows grew louder.

Douglass put those concerns to bed:

“On fees. On the institutional business, which is $80 billion in funds under management. We haven’t seen any questions or pressures on fees whatsoever. We are highly, highly competitive there”.

“But do we think our overall proposition is uncompetitive in the retail market? No, we don’t. We’re not about to slash fees. It’s not something that we’re hearing”.

That’s not to say either risk won’t eventuate in the future.

Management admits funds management is a low barrier to entry business. Clients can pull money very quickly.

But it’s not all doom and gloom. The feedback Magellan is currently getting from clients does not suggest either risk is imminent.

My take on the Magellan share price

It wasn’t quite Al Pacino’s inch by inch speech from Any Given Sunday, but Douglass and Cairns were certainly defiant.

The business knows it needs to improve performance across global equities.

However, management did a good job reminding investors (and the market) Magellan is much more than just global equities now.

I’m quietly bullish on the Magellan share price. But the company is not without risk and is still vulnerable to outflows or fee compression.

Looking for new share ideas? Check out two ASX shares I’d buy and hold for the next decade.