The Telstra Corporation Ltd (ASX: TLS) share price will be on watch today after the business announced its US$1.6 billion acquisition of Digicel Pacific.

Currently, the Telstra share price is up 2.41% to $3.82.

Telstra teams up with Australian Government

In a partnership with the Australian Government through Export Finance Australia (EPA), Telstra will contribute US$270 million of equity to purchase Digicel.

The remaining US$1.33 billion will be provided by EPA.

An additional US$250 million is payable over the next three years subject to Digicel’s performance. Telstra would be liable for $50 million of the earnout payment.

Who is Digicel?

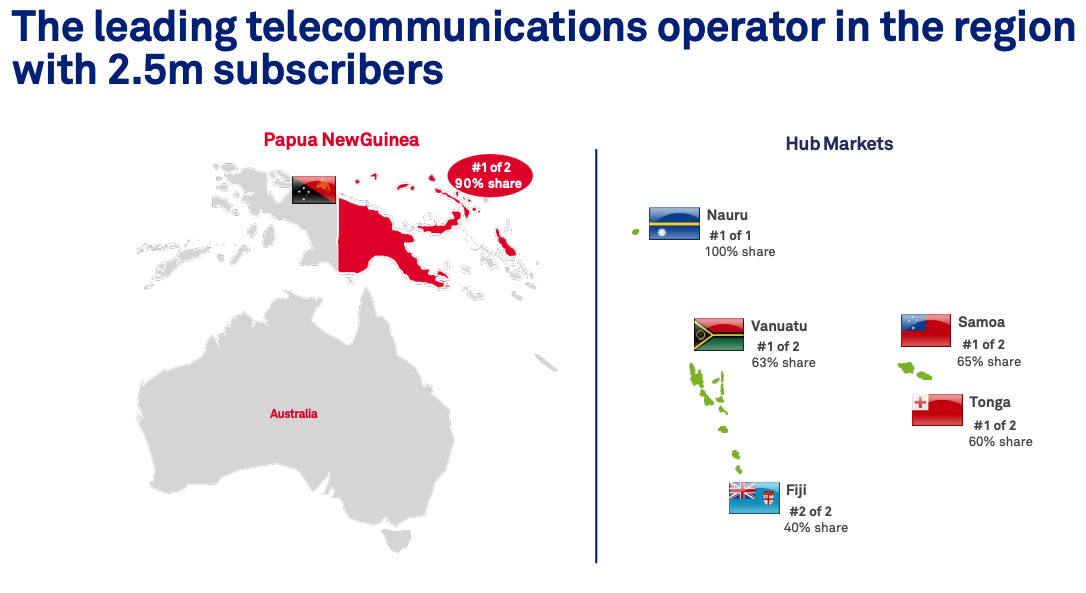

Digicel Pacific owns and operates predominantly mobile infrastructure across select Pacific nations.

About 76% of revenue is derived from Papua New Guinea, with the remainder across Hub Markets.

The business has 2.5 million subscribers, 1700 employees and over $400 million in revenue.

Digicel achieved US$233 million in earnings before interest, tax, depreciation and amortisation (EBITDA explained) in FY21.

However, growth is largely stagnant or declining across subscribers and revenue.

Why would Telstra acquire Digicel?

The company will receive a preferred return of US$45 million per annum for the first six years. Given the US$270 million upfront contribution, Telstra is set to recoup its investment in year six.

Moreover, the terms of the deal are very favourable. Telstra is providing relatively little capital to own 100% of the Digicel business.

The EPA is effectively subsidising the acquisition to gain a strategic foothold in Pacific infrastructure. Or looked at another way, the Australian Government is preventing another nation from snapping up potentially crucial infrastructure.

Meanwhile, Telstra ensures it achieves its financial hurdles.

“The transaction is expected to deliver an attractive IRR and exceeds all Telstra M&A criteria – EPS accretive, ROIC above WACC and more accretive than a share buyback”

My take

The deal is a savvy move by Telstra.

It didn’t need to make the Digicel purchase. But it knew the Australian Government wanted to buy the assets and therefore was able to leverage terms with a great risk-return payoff.

The market has reacted positively to the deal, with the Telstra share price climbing higher today.

I’m not rushing out to buy Telstra shares, but it looks the company is making all the right moves.

Looking for new share ideas? Check out two ASX shares I’d buy and hold for the next decade.