Florida based active global equities manager GQG Partners Inc. (ASX: GQG) is set to start trading on Tuesday after the business completed the biggest initial public offering (IPO) of 2021.

The business raised just shy of $1.2 billion valuing GQG at $5.9 billion.

Let’s dive into the business and why it could be an interesting investment.

The newest fundie in town

GQG was founded in 2016 by Chairman Rajiv Jain and CEO Tim Carver.

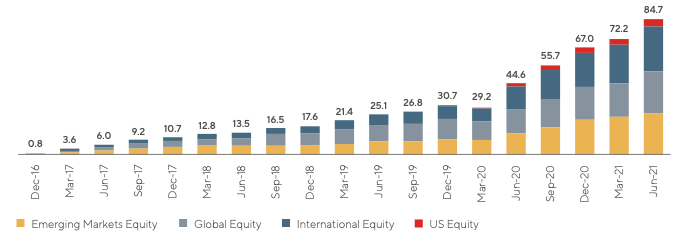

The business currently has US$85.8 billion in funds under management (FUM) across four strategies.

It also recently launched three dividend-focused products.

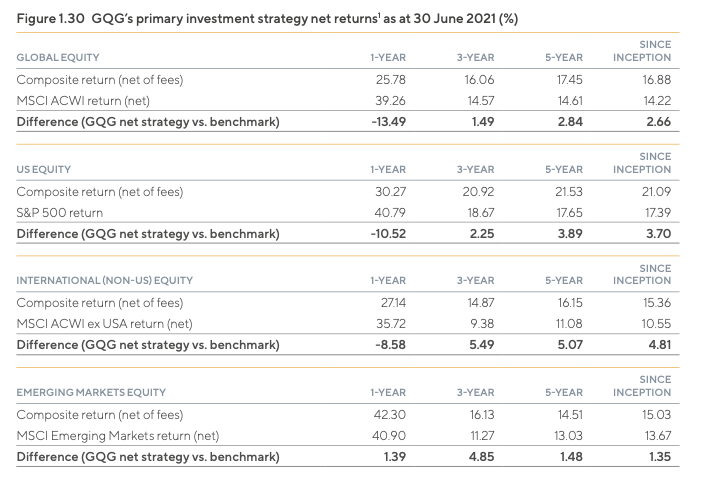

All strategies have outperformed since inception. However, the underperformance has crept in over the past year.

The business is unique as it has one investing team covering all of the funds. It takes an umbrella approach to its investable universe and builds portfolios accordingly.

Analysts are from non-traditional backgrounds, including ex-investigative journalists.

GQG focuses on large-cap businesses. The average market capitalisation of its investments is US$366 billion. For context, no business on the ASX is valued this highly.

Notable holdings across its funds include Alphabet Inc (NASDAQ: GOOGL) and Microsoft Corporation (NASDAQ: MSFT). Its biggest sector weighting is information technology.

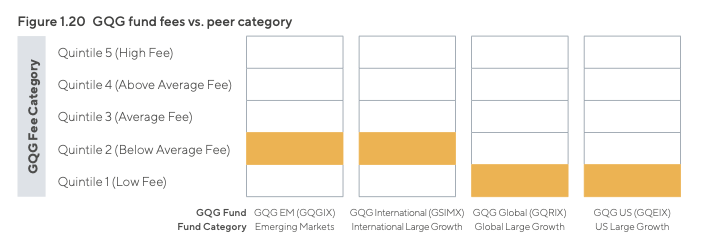

On costs, the business is highly competitive with an average management fee of 49.6 basis points

The business also factors environmental, social and governance (ESG) into its process.

Under the Principles of Responsible Investment, the business ranks A for Strategy & Governance, Incorporation and Active Ownership.

Why IPO?

All proceeds from the $1.175 billion capital raising will go to selling shareholders.

Jain will be the firm’s largest shareholder post IPO, owning 68.8% of the business.

Carver will own 5.6% while new shareholders will own 20.1% of the business.

Shares in GQG will trade as CHESS Depositary Interests (CDIs) because of its United States incorporation.

Effectively, this gives shareholders all benefits of owning the business without holding the legal title.

Why Australia?

Carver previously headed boutique fund manager Pacific Current Group Ltd (ASX: PAC) for ten years. Therefore, he has knowledge of public life as an ASX listed company.

However, it’s odd the business still choose to list in Australia and not the US where it is based.

The business currently has 6% of its clients based out of Australia and New Zealand compared to 76% for the US and Canada.

Runway for growth

GQG is expecting its strong FUM momentum to continue growing to US$92.5 billion by the end of FY22.

The business will look to grow FUM through its existing strategies, launching new products and entering new distribution geographies.

My take

GQG looks like it has the hallmarks of a good dividend stock.

The IPO values the business on FY22 16.5x distributable earnings per share or around a 5% dividend yield.

It’s growing at a decent clip, which should help protect the dividend going forward.

However, it’s worth remembering any distributions would likely be unfranked given its US base.

I’ll be adding the business to my watchlist, for now, to track it going forward.

Looking for new share ideas? Check out two ASX shares I’d buy and hold for the next decade.