Despite limited news out of the company, shares in enterprise software provider TechnologyOne Limited (ASX: TNE) have had a strong run recently – up around 40% since June.

Tech One is a brilliant ASX success story and has many of the typical features of a great investment. Here are just a few I look for.

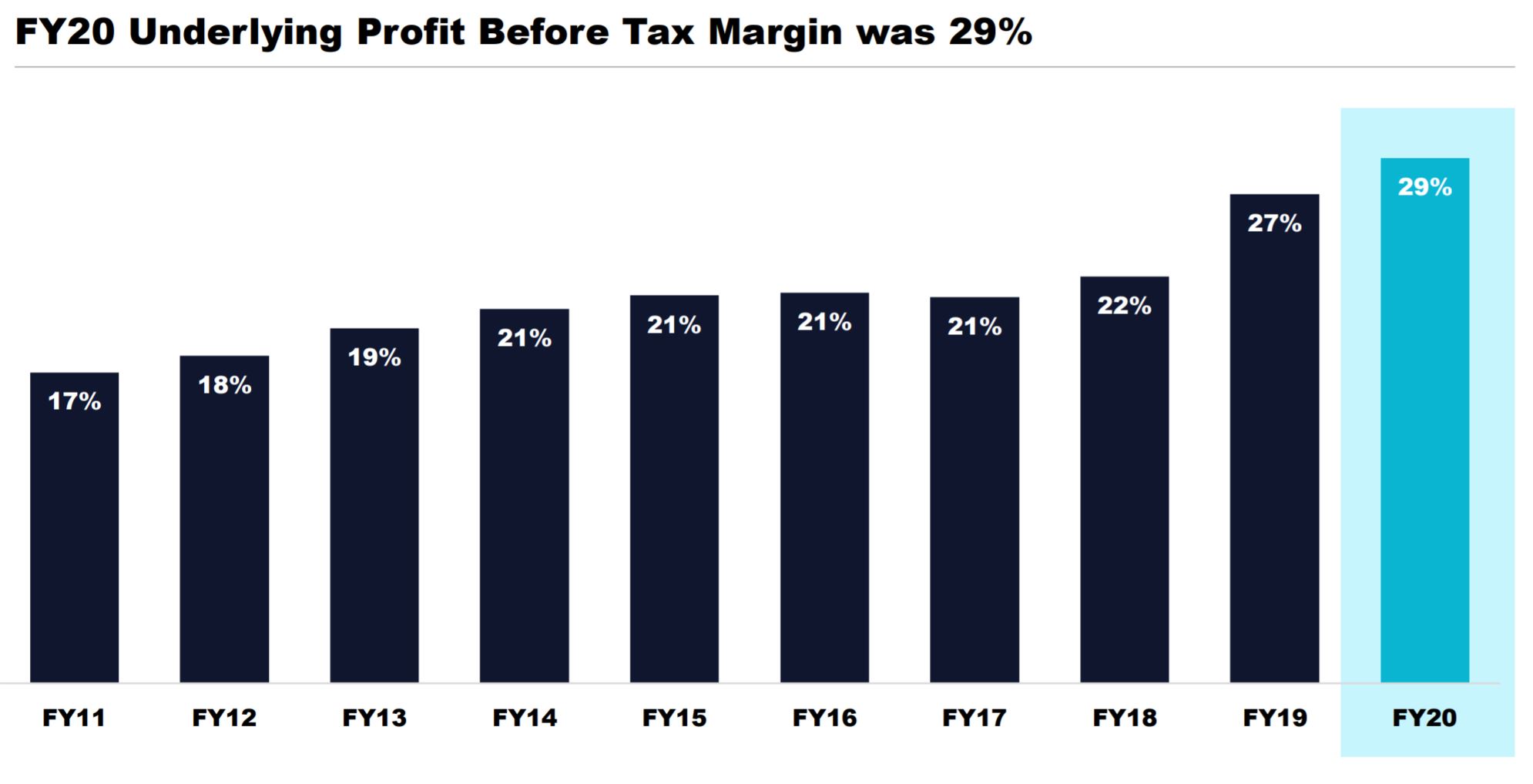

Got margins?

A useful metric to assess the profitability of a business is its net profit margin. Meaning, for every dollar in sales (revenue) the business makes, how much is leftover in the form of profit (earnings) after all expenses are paid for.

Software companies can often boast really high margins because the additional cost to bring on another customer is next to nothing. Apart from some fixed costs like cloud-hosting and subscriber support, additional subscriber revenue can pretty much all fall to the bottom line as profit.

Tech One is currently on a net profit margin of 29% for FY20, a number which has trended upwards consistently over the past several years. In the next few years, management expects this will grow to 35% due to more cost reductions from the continual transition towards Software-as-a-Service (SaaS).

Switching costs

Once a business gets set up with enterprise software, changing can be costly, time-consuming and a headache to retrain your entire workforce on how to use it. It’s no surprise then that Tech One can boast a customer retention rate of over 99%.

With such low levels of customer churn, the business doesn’t have to invest a whole lot to acquire new customers, which often works wonders on the unit economics, such as the lifetime value (LTV) of a customer.

To say that Tech One’s customers are sticky would be an understatement. At the moment, over 85% of revenue is recurring, but management is targeting 95% by FY27.

Cloud tailwinds

Tech One is currently investing in R&D to extend its solution into a Local Government Digital Experience Platform (DXP). This will be targeted towards customer-facing applications rather than back-office support functions.

While many universities and local governments are still spending millions to create their own in-house software, there’s a large growth runway as these organisations look for a cheaper and better-integrated solution.

To read more about Tech One, check out this article here: TechnologyOne (ASX:TNE) share price pops after first international acquistion.