The A2 Milk Company Ltd (ASX: A2M) share price is continuing to sour after the business unveiled an updated strategy at its Investor Day.

Despite the 163-slide presentation, the market remains unimpressed with A2 Milk as the share price dropped 10% to $6.11.

China cash-cow running dry

The overarching theme from the presentation was that A2 Milk has been hammered by several external headwinds.

When the pandemic emerged in March last year and international travel subsequently closed, its cross-border and daigou channels came to a standstill.

Customers rushed to stockpile Infant Milk Formula (IMF), leading to inventory issues in future periods.

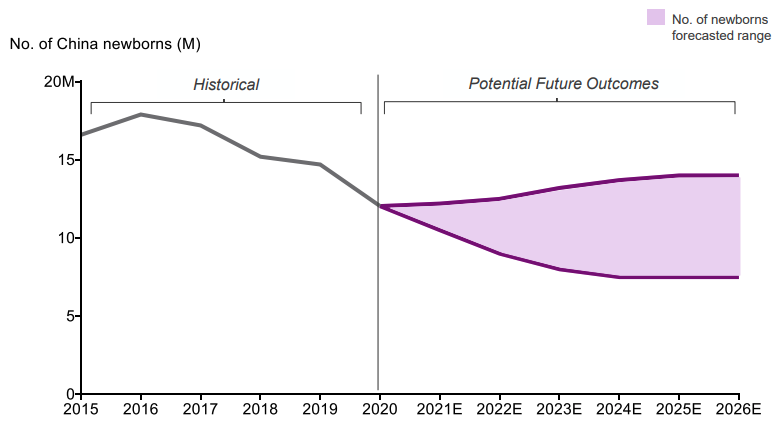

To compound matters, the adverse demographic trends in China – its largest market and highest margin market – began to accelerate. The number of newborn babies numbers continue to fall.

Furthermore, Chinese families are no longer prioritising international brands, rather opting for IMF that resonates with them. Local producers are winning this battle, outpacing their multinational peers.

Illustrating this shift, local IMF consumption has risen from 29% in FY19 to 45% in under three years.

A total reset

As a result of the above headwinds, A2 Milk has sought to rebase the expectations of the market.

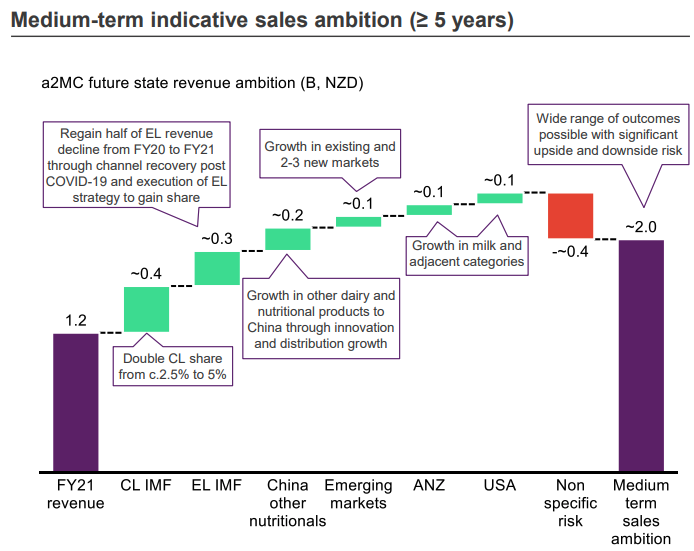

Its medium-term target is to reach $2.0 billion in revenue, led by doubling the market share from Chinese IMF and growth across all other segments.

New markets are on the cards including Vietnam, Indonesia, Malaysia and Singapore. South Korea has already been launched through a distribution agreement.

Additionally, the business will look to expand into adjacent products. An example of this is the partnership with chocolate maker Hershey’s to create a chocolate milk product.

Earnings before interest, tax, depreciation and amortisation (EBITDA explained) margins have been slashed to mid-teens in the immediate future. Management’s goal is to return margins to low-mid 20s over the medium term.

Prior to the pandemic, EBITDA margins hovered around 30%.

A rocky start to FY22

Despite the optimism conveyed by management about the future, trading remains volatile.

English IMF sales are down on FY21 but up on the previous quarter. For Chinese IMF, sales are down on both a quarterly and yearly basis due to reduced channel inventory.

Similarly, the United States faces headwinds with sales down compared to last year due to a reduction in demand from customers and distribution costs.

On a positive note, fresh milk volumes in Australia and New Zealand are on the rise.

My take

Today was a defining moment for A2 Milk.

The business rolled out its new executive team and structure. It’s rebased market expectations and attempted to communicate a sense of optimism about the future.

It’s been hit hard by the pandemic but will benefit as travel resumes.

For now, I’ll be watching from the sidelines to see if management can deliver on its medium strategy.