Tyro Payments Ltd (ASX: TYR) is a business you may not have heard of but likely interact with on a daily basis.

Those funky terminals that make you tap on the side at your local coffee shop? That’s Tyro.

Let’s take a closer look at the business and why it might be worthy of a spot on your watchlist.

More than a terminal

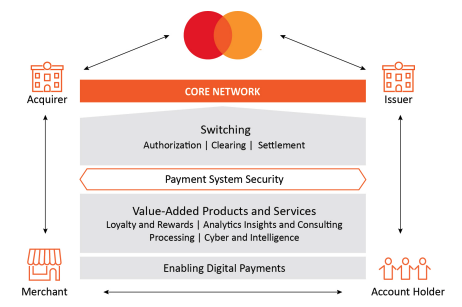

Tyro sits at the merchant Acquirer level in the payment process. The business provides a mission critical service for its merchants, typically small businesses.

Put simply, Tyro provides the terminal or online gateway for payments. It routes the transaction via a Scheme (such as Mastercard) and then settles the funds for the merchant.

It charges a clip of each transaction, typically around 81 basis points or 81 cents per $100.

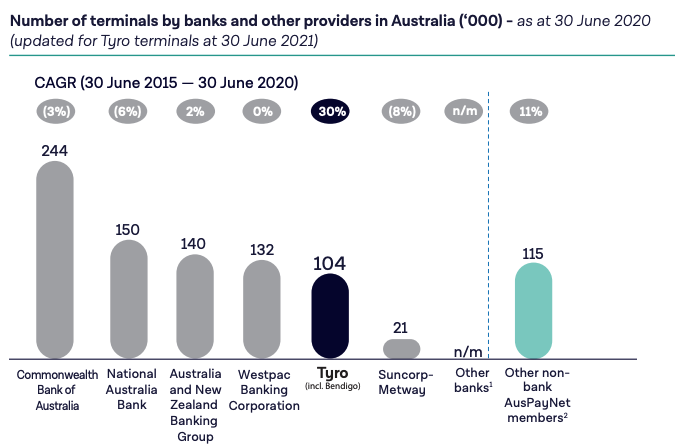

David vs. Goliath

With incumbents largely stagnant or going backwards, how has Tyro grown at 30% per annum over the past five years?

The business has lasered in on its technology and the customer experience for specific industry niches.

It was the first to enable real-time Medicare rebates and WeChat payments.

Furthermore, it offers a unique marketplace where merchants can integrate point of sale or patient software with payments. This saves time reconciling transactions and minimises manual mistakes.

The business has a track record of innovation, with over half its staff in technology roles.

The numbers

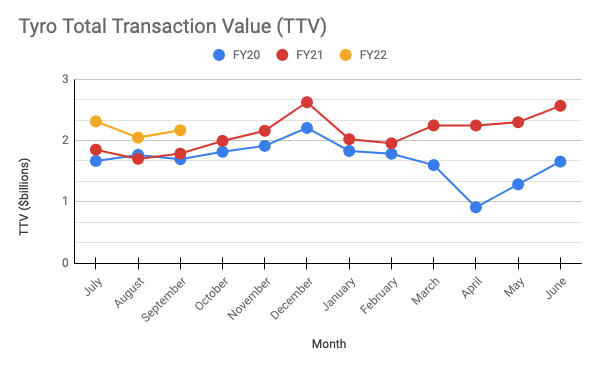

Since its IPO in 2019, Tyro has steadily increased its total transaction value (TTV) despite ongoing pandemic lockdowns.

The company will only benefit from easing restrictions in Sydney and Melbourne, its two biggest markets by TTV.

Tyro recorded its first earnings before interest, tax, depreciation and amortisation (EBITDA explained) profit in FY21 of $14.1 million.

The business is still making accounting losses, however, is narrowing the gap and approaching a critical inflection point.

Your margin is my opportunity

The biggest risk to payments is disruption. In the payment network above, the Acquirer, Scheme and Issuer all take a clip of the transaction.

As Amazon founder Jeff Bezos said, “Your margin is my opportunity”.

New technologies such as blockchain and peer-to-peer payments are cutting out these middlemen.

Tyro also incurred its first terminal outage in 18 years in January. At one point, 30% of merchants were impacted and is now facing a class action.

Subsequently, Tyro’s net promoter score has fallen from 43 to just 21.

My take

Tyro only has about 4% market share, therefore it has a long runway for growth ahead.

It has a big focus on its customers. Taking on slow-to-react competitors. And is reaching a scale where it now can start making decent profits.

The cherry on top is that it will likely experience strong growth in TTV as cities emerge from the pandemic.

As long as the business can continue to take market share, I think the Tyro share price will follow a similar trajectory.