The Australia and New Zealand Banking Grp Ltd (ASX: ANZ) share price will be on watch today after the business provided its FY21 results.

Unlike most public companies that operate on a financial year basis, ANZ reports from 1 October to 30 September.

Currently, the ANZ share price is up 1.9% to $28.93.

Credit impairment reversals mask stagnant growth

Key highlights for FY21 include:

- Statutory Profit After Tax of $6.16 billion, up 72% year-on-year (YoY)

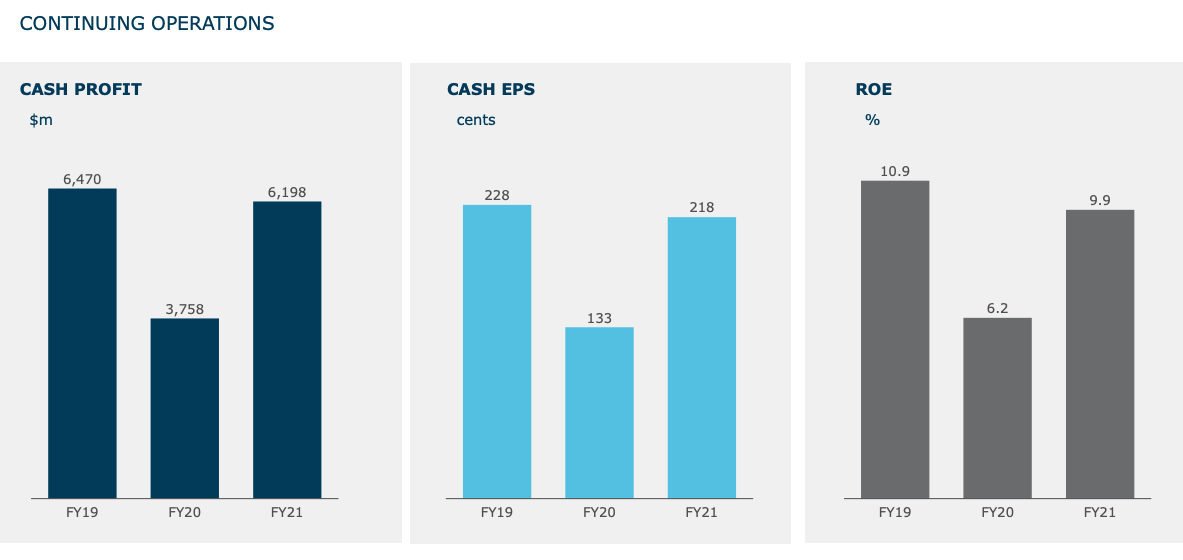

- Cash Profit of $6.19 billion, up 65% YoY

- Profit before credit impairments and tax of $8.39 billion, unmoved YoY

- Common Equity Tier 1 Ratio (CET1) of 12.3%, up from 11.3%

- Final dividend of 72 cents per share, fully franked

The 72% growth in statutory profit and 65% growth in cash profit is largely the result of unwinding credit impairments.

In FY20, banks including ANZ put money aside as provisions in the event customers were unable to pay their loans. Remember at this time, the pandemic had only just hit and no vaccines existed.

The provisions are recorded as credit impairments, which flow through the company’s profit and loss, subsequently reducing earnings.

However now ANZ is unwinding the provisions as the expected hit on customers never eventuated.

As result, the unwinding credit impairment is a positive for cash profits, therefore increasing earnings.

However compared to FY19, profits, earnings per share and return on equity have all fallen.

The final dividend of 72 cents per share brings total FY21 dividends to 142 cents per share.

As a result, ANZ is trading on a fully franked yield of 4.9%.

Steady divisional performance, NZ the standout

Performance across ANZ’s four divisions remained largely even.

Gains in Australian Retail were offset by similar falls in Australian Commercial.

Similarly, Australian housing loan balances increased marginally despite adding 179,000 new home accounts. Positively, 49% of all sales are now through digital channels, up from 40% in FY20.

Institutional income fell 16%, primarily due to lower market activity during the year.

New Zealand grew home loans by 11%. Furthermore, ANZ remains the largest KiwiSaver (equivalent of superannuation) provider, growing 16% to NZ$19 billion funds under management.

My take

A sound result by ANZ.

The business is essentially back to where it was in FY19, with a healthy dividend yield and solid divisional performance.

My concern with ANZ, and other big banks, is if they can continue to grow their business over the longer term?

The company has cut costs of running the bank for the third consecutive year, but there is only so much you can eliminate or digitise.

As a result, the dividend yield may come under pressure if the company can’t find other ways to grow profits.

Looking for new share ideas? Check out two ASX shares I’d buy and hold for the next decade.