The electronics and appliance retailer JB Hi-Fi Limited (ASX: JBH) share price is rising today after the business provided a first quarter update at its annual general meeting (AGM).

Currently, the JB Hi-Fi share price is up 2.69% to $48.15.

Lockdowns slow sales momentum

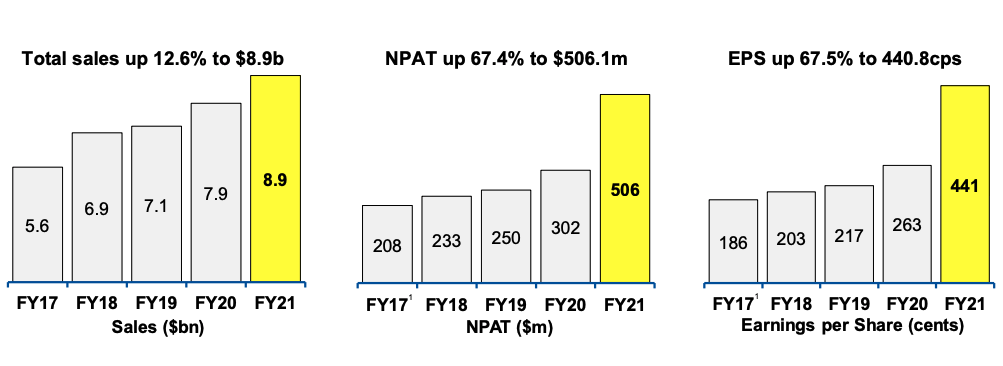

After a stellar FY21 where profits rocketed 67%, sales have slowed in the first quarter of FY22.

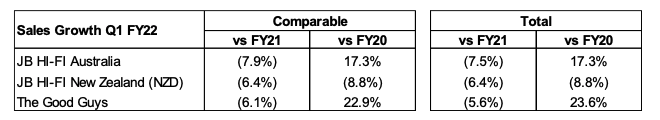

Comparable sales across JB Hi-Fi Australia decreased 7.9%. Similarly, JB Hi-Fi New Zealand (NZ) fell 6.4%.

The Good Guys also saw its sales drop 6.1%.

All three divisions were impacted by store closures across New South Wales, Victoria and Auckland as governments battled to contain the COVID-19 pandemic.

However, management noted customer demand remains high across the board.

Over a two-year horizon, both JB Hi-Fi Australia and Good Guys have achieved strong growth of 17.3% and 22.9% respectively.

By zooming out two years, JB Hi-Fi illustrates what sales looked like in a more normal trading environment pre-pandemic.

The business is cycling abnormally high sales figures from FY21, therefore a single-digit decrease given the pandemic restrictions is a great result.

“Important” Christmas period beckons

In October, sales momentum has continued as JB Hi-FI benefited from the reopening of New South Wales.

When asked at the AGM about supply chain concerns, Chief Executive Terry Smart said the company remains confident in the lead up to Christmas shopping.

“…we generally can switch suppliers as in different brands to try and fill those gaps. And that’s already been done… [supply chain issues are] very fluid and it can change from week to week, both in a positive sense and a negative sense. We feel like we’ve got it under control”.

My take

Today’s quarterly update may not look that flash. But it’s a tremendous result given the difficult trading conditions.

Sales should pick up leading into Christmas as customers are allowed to visit in-store again.

On a price-to-earnings ratio of just 11, the company looks extremely cheap.

I think JB Hi-Fi is a quality retailer. However, I’m waiting to see how the business trades in a more normalised environment post-pandemic.

Subsequently, JB Hi-Fi shares remain on my watchlist for now.

Looking for new share ideas? Check out two ASX shares I’d buy and hold for the next decade.