Blue-chip ASX share Macquarie Group Ltd (ASX: MQG) remains in a trading halt this morning as the business raises $1.5 billion on the back of its first-half update.

Currently, the Macquarie share price is stuck at $197.83 while the business completes its bookbuild.

Firing on all cylinders

Key highlights for the first half ending 30 September include:

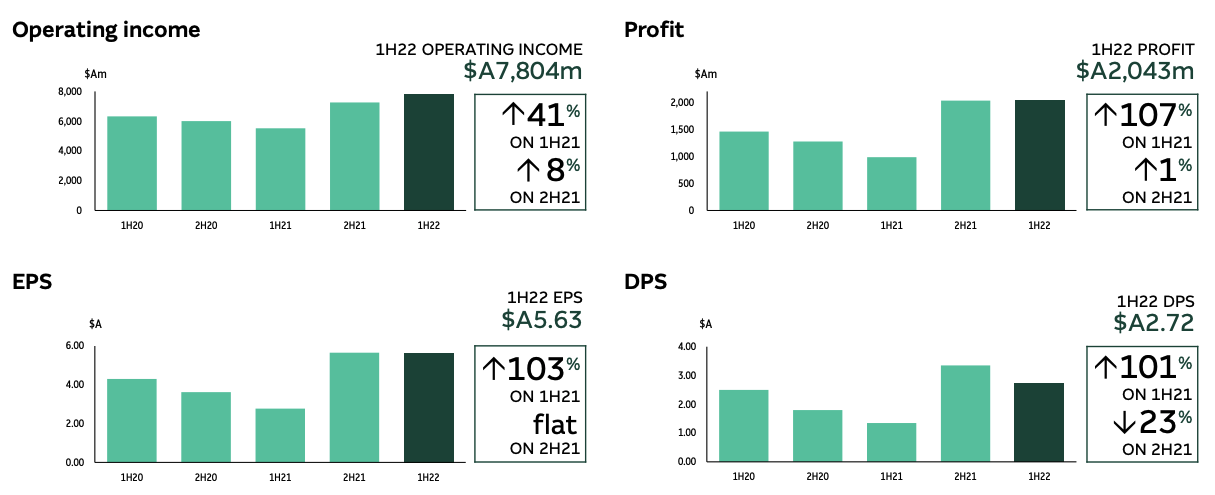

- Net operating income of $7,804 million, up 41% year-on-year (YoY) and 8% on the prior half

- Net profit of $2,043 million, up 107% YoY and flat on the prior half

- Assets under management of $737.0 billion, up 31% YoY

- Return on equity of 17.8%

- Interim dividend of $2.72 per share, 40% franked and representing a 50% payout ratio

Group income and subsequently profits resulted from strong performance across all four of Macquarie’s divisions.

Macquarie Asset Management (MAM) delivered a record half, with operating income up 37% and net profit contribution up 23% YoY.

Bank and Financial Services (BFS) increased profits by 52% YoY, primarily the result of unwinding credit provisions and a 14% jump in its home loan portfolio.

Commodities and Global Markets (CGM) achieved a 60% net profit jump as a result of strong gains in Gas and Power as energy prices spiked around the globe.

Macquarie Capital benefitted from increased mergers & acquisitions activity and higher fee income, with profits of $468 million against a prior-year loss of $189 million.

The nitty gritty

The Australian Prudential Regulation Authority (APRA) is currently reviewing capital requirements for all banks.

It may mean Macquarie needs to hold more cash to meet regulatory requirements. However, the company believes it will be able to accommodate any changes.

Additionally, Macquarie is bringing its Green Investment Group (GIG) under MAM.

The need for climate solutions as the world moves towards net-zero carbon is spurring demand for specialist investments and solutions.

Spoilt for choice

In a world with zero and in some cases negative interest rates, investors are struggling for return opportunities. Except for Macquarie.

Management deployed $5.5 billion of capital over the past year and is continuing to identify opportunities to generate superior returns.

Subsequently, the business will be raising $1.5 billion via an institutional placement, with the bookbuild beginning at $190.00.

Furthermore, a share purchase place for eligible shareholders will be offered.

“Raising new capital provides us with additional flexibility to invest in new opportunities where the expected risk-adjusted returns are attractive to our shareholders, while maintaining an appropriate capital surplus”.

My take

Macquarie is going from strength to strength, with its share price up 41% year-to-date.

Raising capital at record share price highs is a savvy move by management that will result in only a 2% dilution.

In my opinion, Macquarie is one of the best blue-chip ASX shares. If you have a long investment horizon, it’s hard to go past this money machine.

Looking for other share ideas? Check out two ASX shares I’d buy and hold for the next decade.