The Westpac Banking Corp (ASX: WBC) share price is sinking today after the business provided its FY21 result.

Currently, the Westpac share price is down 5.84% to $24.17.

Headline figures flatter result

Key highlights from the year ending 30 September 2021 include:

- Statutory net profit of $5.4 billion, up 138% year-on-year (YoY)

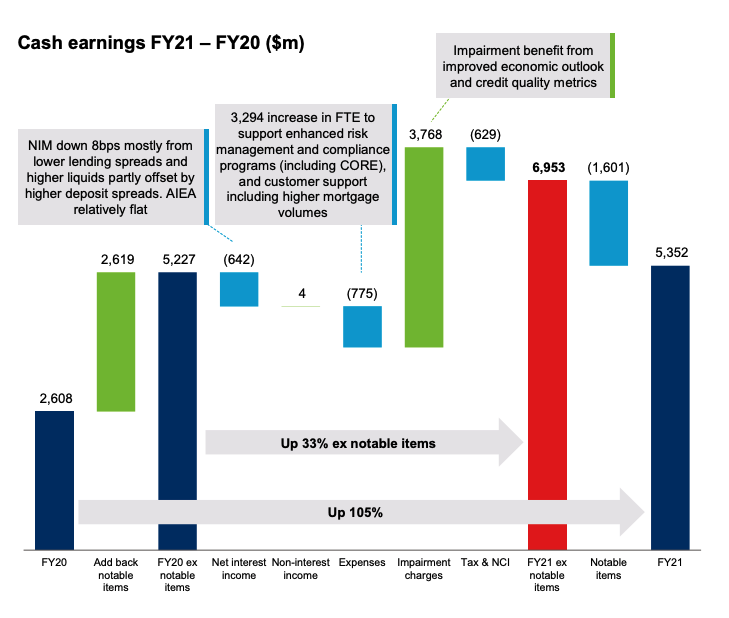

- Cash earnings of $5.3 billion, up 105% YoY

- Net interest margin (NIM) of 2.04%, down 4bps YoY

- Return on equity of 7.60%, up 372 basis points YoY

- CET1 capital ratio 12.32%, up 119 basis points YoY

- Fully franked final dividend of 60 cents per share, total FY21 dividends of 118 cents per share

Despite impressive growth results, the headline figures flatter the underlying performance of Westpac.

The bank benefitted from relatively lower notable items including lower remediation costs and the completion of AUSTRAC proceedings, offset by a writedown of goodwill.

Additionally, Westpac cash earnings profited from a $3.1 billion unwinding of credit provisions compared to a $590 million charge in FY20.

When the pandemic hit, the bank put aside money in the event customers were unable to pay loans. However the expected losses never eventuated, and now Westpac benefits from the unwinding of these provisions through the profit line item.

A better measurement of performance – core earnings – actually fell 2% compared to FY20.

“A turnaround in impairment charges and lower notable items were the main drivers of our improved earnings, while we also restored growth in mortgages and have begun to see better momentum in our institutional and business portfolios. While notable items were lower, they remain elevated as we continue to work on fixing our issues and simplifying our business”.

Modest growth throughout FY21

Australia’s second-largest bank reported modest growth across its divisions.

Mortgage lending increased 3% to $14.7 billion, and business lending grew 4% in the second half.

New Zealand performed admirably with profits up 56%. Again though, a large chunk of the earnings was a result of impairment reversals.

However, gains were offset by a $670 million loss in Institutional due to intangible asset writedowns in its Asia business.

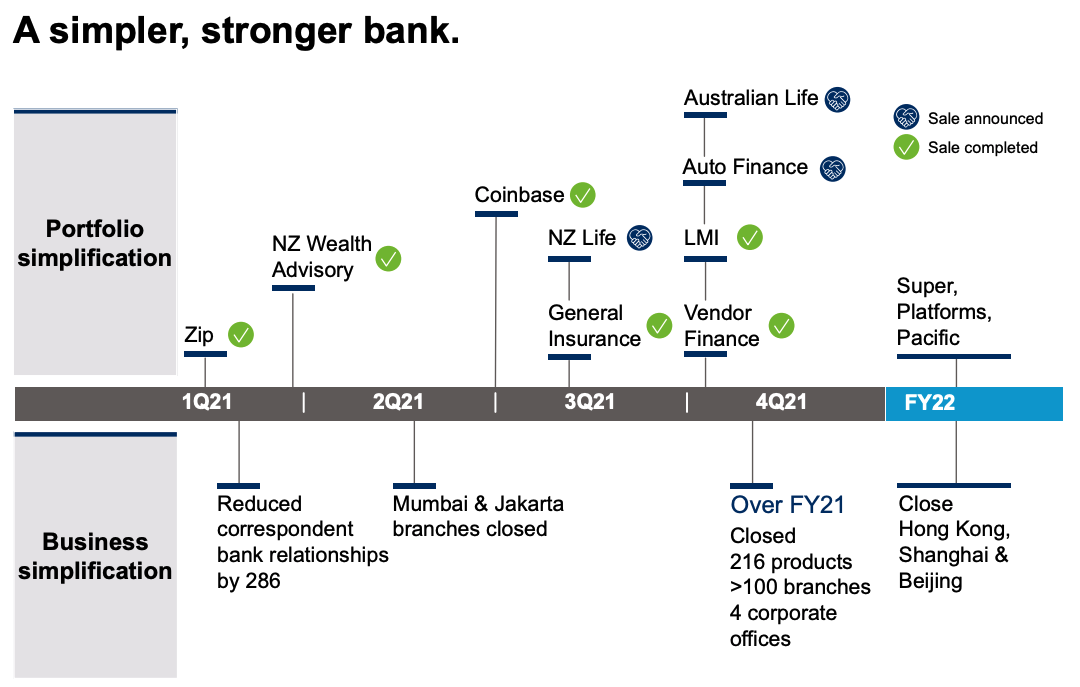

In order to simplify the business, Westpac divested several non-core assets.

Insurance arms were sold, gains on investments in Zip Co Ltd (ASX: Z1P) and Coinbase were realised and offices in India and China were closed.

$3.5 billion buyback announced

Westpac has announced a $3.5 billion buyback at an 8% to 14% discount to its market price.

The purchase would reduce the share count by about 3% depending on the level of demand and discount to market price.

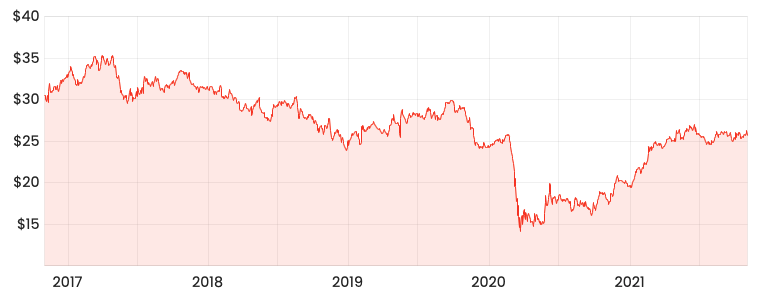

The Westpac share price is down 13.6% over the past five years.

Management is effectively investing in its own shares because it believes the share price is undervalued.

My take

Chief Executive Peter King summarised the result well:

“Our underlying results are not where we want them to be, and we recognise we have more to do to become the highperforming company we aspire to be”.

Headline numbers are flattering the underlying performance.

However, buying back shares should relay confidence to the market management believes it can execute and subsequently lift the Westpac share price.

Personally, I’d be looking elsewhere for share ideas. Check out two ASX shares I’d buy and hold for the next decade.