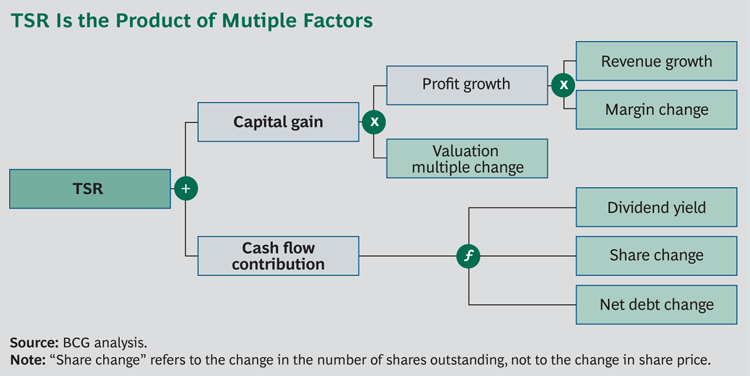

The three keys to long term value creation are no hidden secret: profit growth, changes in valuation multiples, and cash flow contributions. Boston Consulting Group use this framework for their analysis, and back in 2016 applied it to the ASX. Depending on your investment philosophy and timeframe, you may focus on some areas more or less than others.

Profit growth: revenues and margins

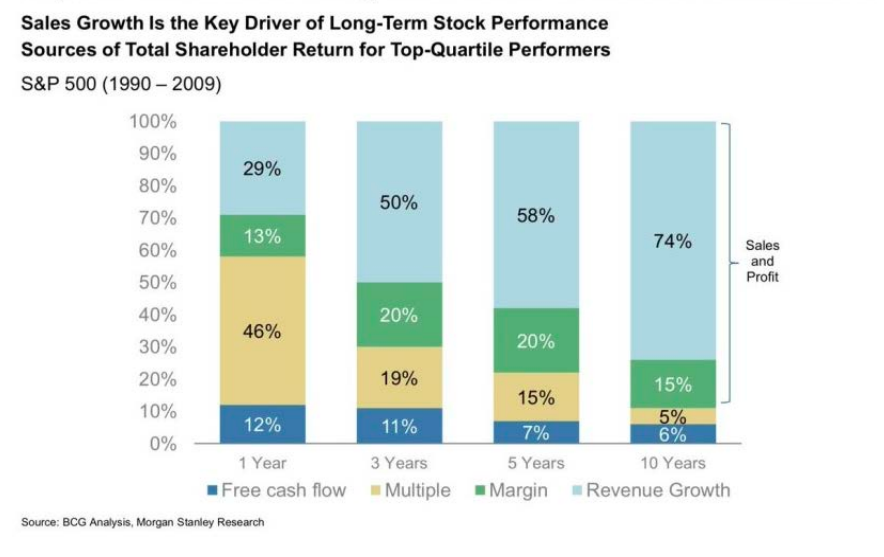

Owen recently tweeted about the sources of total shareholder returns, and no doubt many people would find it quite illuminating. Quickly, you will see that long term shareholder value has been driven by revenue and margin growth. Equally important, multiple expansion/contraction becomes less important over time. This may seem counterintuitive, though paying for quality has tended to be a winning approach historically.

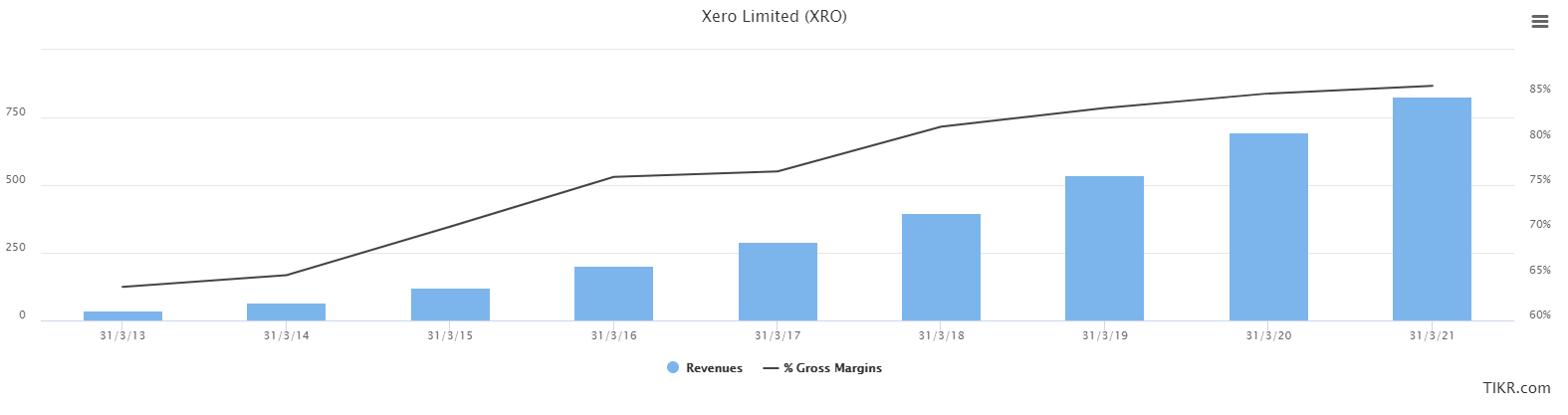

For example, Xero Limited (ASX: XRO) has compounded returns at around 40% CAGR based on revenue and margin growth for over a decade.

Changes in valuations are a double-edged sword

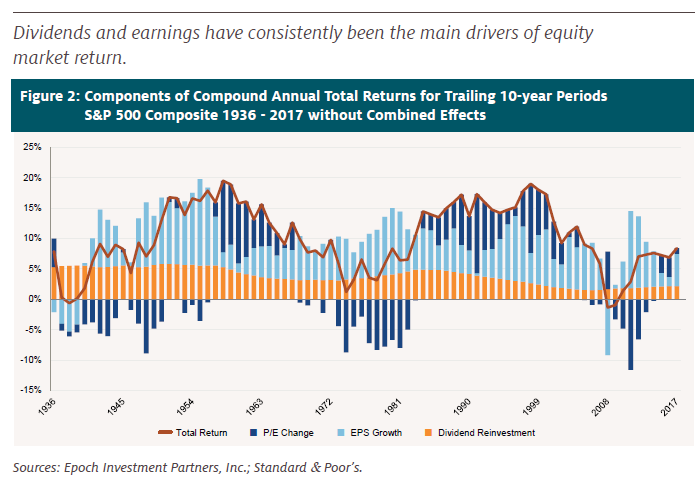

Owen was right to highlight that in the long term, multiple expansion (or changes in multiple valuation) is not a driver of growth. While there have been periods of multiple expansion that have driven the market (notably between the Black Monday 1987 crash and the dot.com bubble of 2000), there have also been periods of significant multiple contraction (notably the stagflation of the 1970s and more recently the Global Financial Crisis).

Although the Australian stock market is ~25% above the long term average Cyclically adjusted Price To Earnings (CAPE), some individual stocks are at nosebleed valuations while others still offer reasonable prices.

Why we shouldn’t ignore cash flows

Cash flows do matter when it comes to long term value creation, though it depends on what style of investing you prefer. In Australia where 54% of the ASX is mining and financials, cash flows drive around 30% of long term value creation. So for your fast-growing components of your portfolio, it’s probably only ~6% of your returns, for a balanced ASX portfolio this actually increases to ~24%.

Return on invested capital

The key to understanding cash flow is thinking about the return on invested capital (ROIC): how much can a business reinvest in itself, and what returns will it provide to shareholders?

Companies that pay very high dividend rates typically have limited opportunities to reinvest. For example, Coles (ASX: COL) pays 80-90% of earnings as dividends (yield of ~3.3%), and with the remaining 10-20% of retained earnings, they reinvest it at a relatively low rate of ~10% ROIC. Buying Coles today, you can expect long term returns of around 5% (=3.3% dividends + [15% retained earnings * 10% ROIC]).

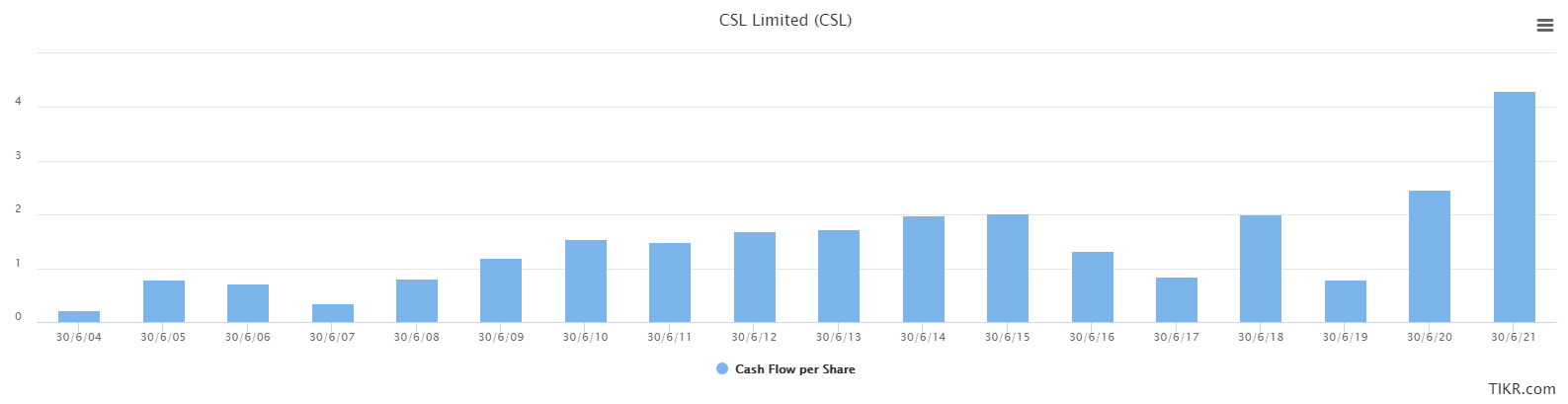

In contrast, companies that pay lower dividends with higher ROIC are using retained earnings to fund growth. For example, CSL (ASX: CSL) pays ~40% of earnings as dividends (yield of ~1%), and their five year ROIC has been consistently above 20%. Long term returns can be expected to be around 13% (=1% dividends + [60% retained earnings * 20% ROIC]).

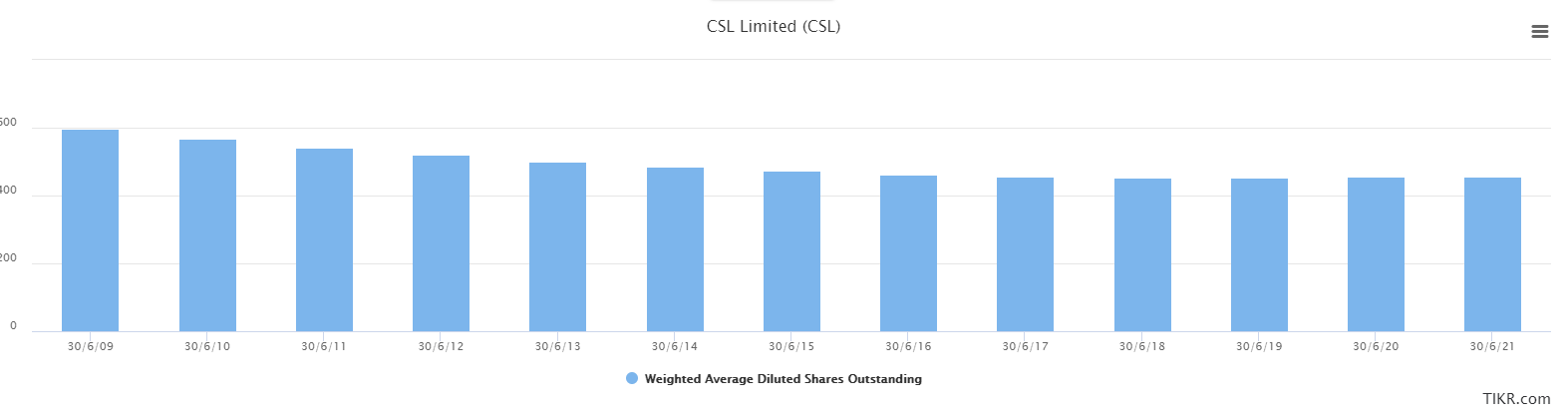

Shareholder dilution and share buy backs

I tend to look at most statistics on a per share basis to account for shareholder dilution and buy backs. While dilution can be good if the capital raise is to fund high-return acquisitions, it can also shrink the size of your part of the pie.

Conversely, share buy backs can increase your size of the pie, but the value is when these buy backs are made at below fair price. Again, CSL has provided a masterclass in shareholder buy backs, adding 2% CAGR to returns over the past decade.

Why don’t more companies highlight their shareholder value creation?

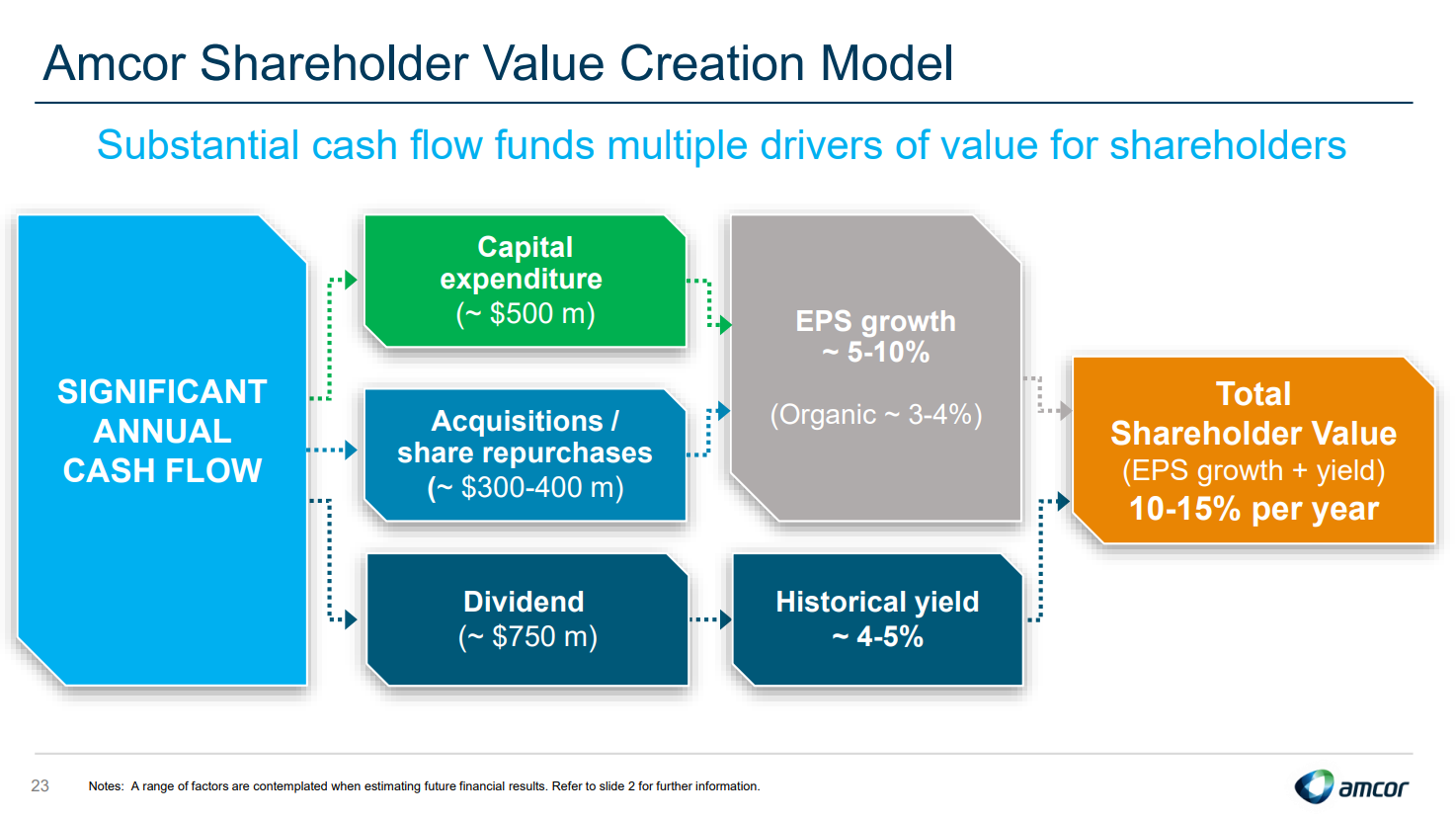

A bugbear for me has always been that ASX companies tend to focus on one part of the puzzle, but don’t present investors with the whole picture. One of my favourite investor presentations comes from Amcor (ASX: AMC). They don’t worry about short term share price fluctuations that are outside of their control. Rather, the emphasis is on long term value creation through dividends, share buy-backs, acquisitions, and capital expenditure.

Final thoughts

In the long term, returns will be driven by good quality investments made at fair prices. I believe you can get the best of both worlds by looking for earnings per share growth and sound capital allocation while avoiding high-valuation traps. Next week I’ll be screening for some of the best opportunities on the ASX.