Both the Netwealth Group Ltd (ASX: NWL) and Praemium Ltd

(ASX: PPS) share prices will be on watch today after Netwealth proposed a merger of the two companies.

Currently, the Netwealth share price is largely unmoved at $17.20.

Conversely, the Praemium share price is racing upwards, increasing 15% to $1.43.

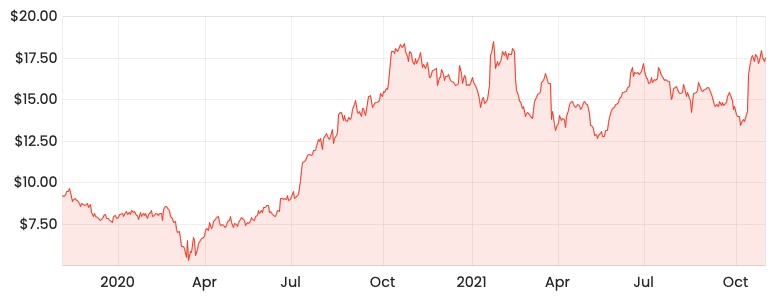

NWL share price

PPS share price

Netwealth eyes off Praemium

Netwealth submitted a non-binding proposal to Praemium intending to merge the two entities.

Praemium shareholders would receive 1.00 Netwealth share for every 11.96 Praemium shares held.

Additionally, Praemium shareholders would receive net proceeds from the sale process of Praemium’s international operations above $50 million.

The deal implies a valuation of $1.50 per share for Praemium and is a 29% premium to its closing share price.

From an enterprise value (EV) lens, the deal values Praemium at $775 million and on an EV/EBITDA multiple of 55 excluding international sale proceeds.

Strategic match

The acquisition would result in $72 billion funds under administration (FUA), solidifying Netwealth’s position as the largest independent platform.

The combined group would hold $22 billion in non-custody assets. Additionally, each would be able to leverage relationships with existing advisors and client bases.

The transaction will accelerate Netwealth’s strategy into non-custody services through Praemium’s industry-leading portfolio reporting and administration.

Praemium will benefit from Netwealth’s tech portal and scale.

“Netwealth believes that a merger with Praemium would build upon the respective strengths of both companies to enhance the position of the combined group as the fastest growing wealth management platform in the Australian market”.

Thanks but no thanks

In response to the proposed merger, the board “unanimously concluded that the proposal undervalues Praemium’s business and is not in the best interests of Praemium shareholders”.

Praemium noted the offer does not appropriately reflect its current performance, technology and growth momentum in addition to recent deal premiums in the sector.

The Praemium board remains open to engagement on a more appropriate valuation.

My take

Praemium has always been a logical target for Netwealth given the business wants to expand into non-custody assets.

Another logical suitor is Hub24 Ltd (ASX: HUB). Given its now known Praemium is up for grabs, Hub may make a competing bid.

It’s not surprising to see Praemium reject the first offer. It’s a fair deal but likely not enough of a takeover premium to warrant further engagement from the board.

I expect Netwealth to increase its offer in the near term to try and get this deal done.