The Domino’s Pizza Enterprises Ltd. (ASX: DMP) share price is falling today after the company provided a trading update at its annual general meeting (AGM).

Currently, Domino’s share price is down 12.47% to $124.56.

DMP share price

Growth decelerates in FY22

The start to FY22 has been uneven across regions due to local pandemic restrictions.

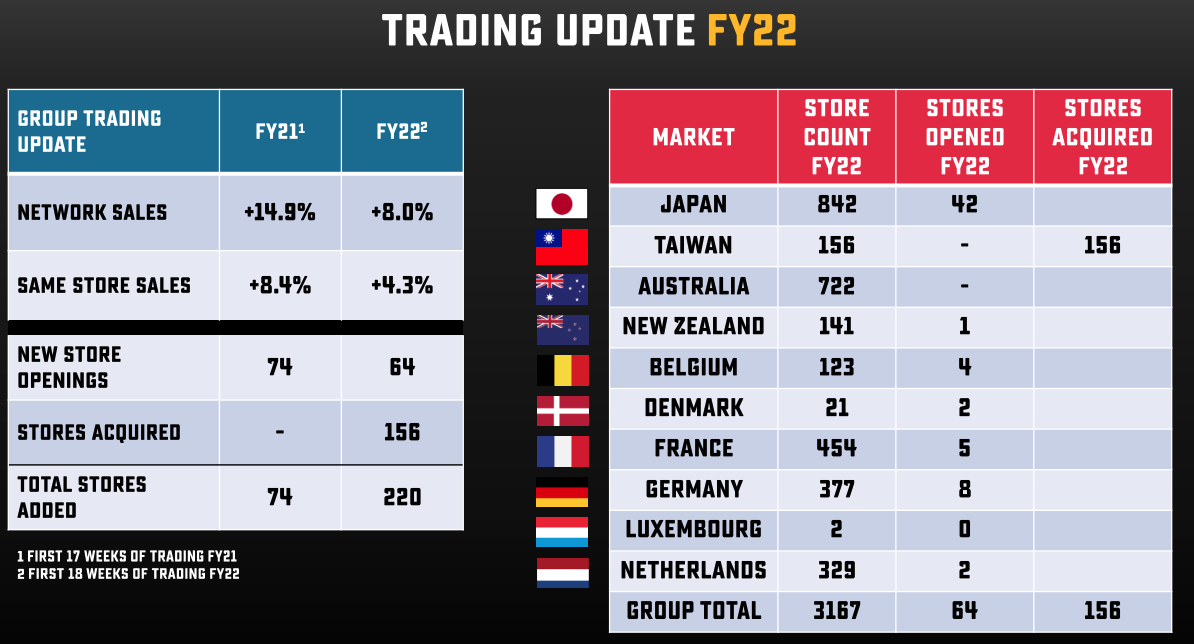

For the first 17 weeks of FY22, total sales have grown 8.0%, but only 4.3% on a same-store sales basis.

In comparison, the first 18 weeks of FY21 resulted in a 14.9% jump in total sales and an 8.4% increase in same-store revenue.

Domino’s group network has increased 7% as a result of opening 64 new stores and the onboarding of 156 stores from the acquisition of Domino’s Taiwan.

“Unable to forecast”

The company noted difficult trading conditions across Australia and New Zealand (ANZ) due to pandemic restrictions.

Subsequently, Domino’s expects lower earnings in the first half before boosting store openings and growth over the medium term.

Japan achieved an initial strong three months of trading, but has slowed since its state of emergency has been lifted.

On a one-year basis, sales are now negative and management remains unable to forecast if FY22 sales and earnings will surpass FY21.

In Europe, delivery customers acquired over the past 18 months have largely been retained.

“There’s no question the next 6-12 months will be challenging. That should not be surprising – the past 18 months have been just as challenging”.

Forest from the trees

At the AGM, management acknowledged the difficulty in forecasting short term results.

However, reminded shareholders of its confidence in reaching its long-term goals.

Domino’s ambition is to grow same-store sales 3-6% over the next 3-5 years, in addition to adding 9-12% to its network through organic growth.

The company will also look to pursue additional market opportunities.

“Our expectations for the future are unwavering – we will more than double our business over the decade ahead, with continued growth beyond”.

Priced for growth

In FY21, Domino’s achieved a net profit after tax (NPAT) of $188.2 million

The company currently has a market capitalisation of $10.8 billion, therefore is trading on a price-to-earnings ratio of 57.

Domino’s is priced for growth. But if it’s unable to increase profits in FY22, then the business looks expensive on traditional valuation metrics.

Hence why the share price fell considerably today.

Domino’s is a quality company, but at the moment its valuation looks too rich given the uncertain outlook.

Looking for share ideas? Check out two ASX shares I’d buy and hold for the next decade.