Wealth platforms Netwealth Group Ltd (ASX: NWL) and Hub24 Ltd (ASX: HUB) are considered to be largely the same business.

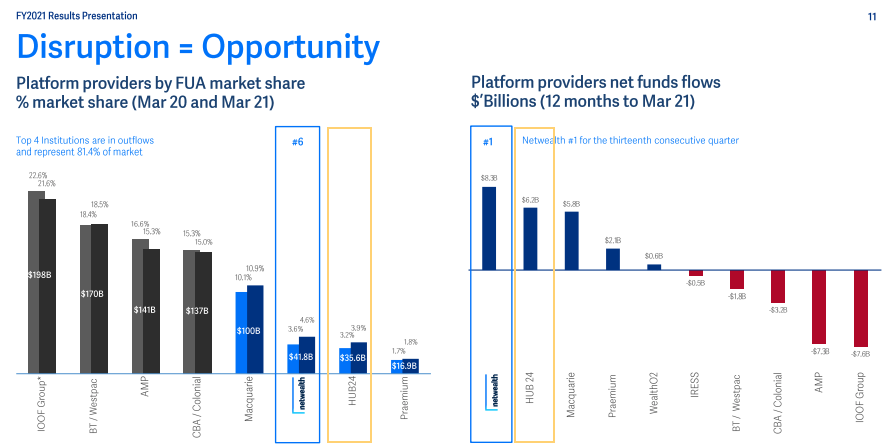

Technology-led disruptors. Number one and two for net inflows. Similar revenue margin and advisor numbers.

However, Netwealth is worth $4.2 billion compared to Hub’s $2.2 billion.

What’s caused the gap? And what’s better value at today’s prices?

Let’s take a closer look.

If you’re not familiar with either business, check out the 2-minute intros for Netwealth or HUB24.

Same, same but different

Both Netwealth and Hub built their reputations as leading wealth management platforms.

Commonly, you’ll find them battling it out for first and second place in the Wealth Insights and Investment Trends industry awards.

However, both have somewhat differing ambitions.

Netwealth is primarily focused on high net wealth (HNW) clients. This is illustrated by its average FUA of $16.6 million per intermediary, compared to $14.8 million for Hub.

“The affluent advice segment, high net-worth and private wealth groups represent a significant opportunity… we are well placed to support the unique and differentiated needs of this segment and provide a premium offering for sophisticated and high net-worth clients”.

In contrast, Hub has a focus on the broader wealth advice landscape, particularly it’s managed account offering, which is growing in popularity among advisors.

The business has nearly doubled managed account FUA compared to Netwealth.

In fact, Hub received the award for Best Platform Managed Accounts Functionality for the 5th year running by Investment Trends.

Moreover, Hub has intermediaries on varying fee plans, tailoring it to each client. Conversely, Netwealth recently aligned all clients to the same back-book pricing structure.

“HUB24 has remained focussed on developing innovative product solutions and delivering customer service excellence to empower licensees and advisers to deliver better financial futures for their client”.

Niche v diversified

As a result of differing ambitions, Netwealth has lasered in on organic growth. Until recently, its only outside investment was a 25% stake in fintech Xeppo.

However this week the business made a $785 million merger proposal to Praemium Ltd (ASX: PPS), which has since been declined.

Praemium is largely considered by the industry to have the best HNW non-custody solution.

By adding Praemium to its stable, Netwealth would entrench its market position as the best niche platform for HWL clients.

In contrast to Netwealth, Hub has been more active in its acquisition strategy. Last year, Hub acquired competitor Xplore and its $15 billion funds in administration (FUA).

Additionally, Hub branched out into non-custody wealth service offerings. It purchased Ord Minnett’s $10.5 billion non-custody Portfolio Administration and Reporting Services (PARS).

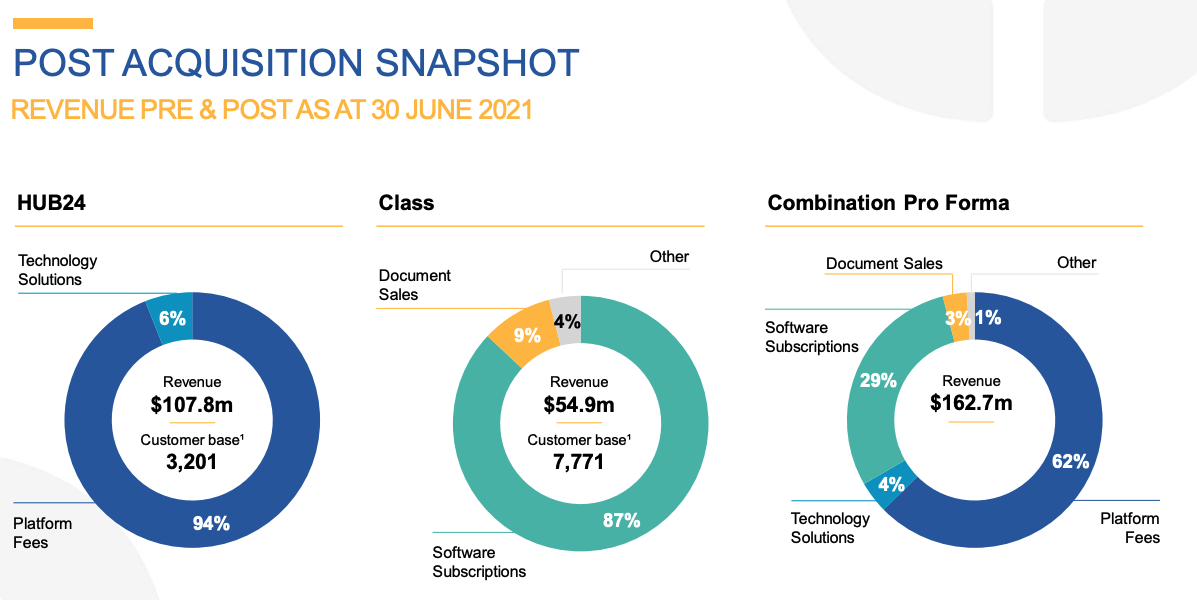

More recently, Hub launched a $386 million takeover of self-managed super fund (SMSF) administration provider Class Ltd (ASX: CL1).

The deal for Class was also presented to Netwealth, however, management did not believe it aligned with its strategy.

All these acquisitions form part of Hub’s plan to simplify the Australian wealth landscape through diversified advisor products.

It has a custody option. A non-custody product. And soon to be an SMSF product.

Recently, Hub has acquired businesses in the wealth industry, which provide something different to its current products.

Conversely, Netwealth is largely focused on organic growth with bolt-on acquisitions to support the core business.

We run a tight ship

Despite Netwealth having only 15% more platform FUA than Hub24, the company is noticeably more profitable than Hub24.

In fact, if you include non-platform FUA such as that from PARS, Hub has more FUA than Netwealth.

Netwealth recorded a net profit after tax (NPAT) of $54.1 million, 360% higher than Hub in FY21.

Similarly, Netwealth achieved an EBITDA of $79.3 million compared to $36.2 million for Hub.

The major contributor to the profit difference is cost.

Hub24 had cash expenses of $88 million compared to just $65 million for Netwealth in FY21.

Part of the reason is that Hub outsources trustee services for its superannuation FUA, which Netwealth does not. Subsequently, Hub incurs Platform and custody fees of $10.5 million.

Additionally, Hub has also incurred one-off acquisition and divestment costs of $7.5 million.

Finally, Hub’s wage bill is $7 million higher than Netwealth.

Netwealth Co-Manging Director Michael Heine chooses not to receive long-term incentives and takes a modest $250,000 cash salary, compared to Andrew Alcock who took home $1.8 million in FY21.

Credit where credit is due. Netwealth runs a tighter ship than Hub.

As result, more revenue drops to the profit line and the market values the business accordingly.

A closer look at valuation

Neither Netwealth nor Hub24 are cheap businesses.

Netwealth trades on a price-to-earnings multiple of 77. Hub’s is even richer at 222.

On a price-to-EBITDA multiple, Netwealth’s 53 whereas Hub’s is on 59.

An argument could be made that as Hub scales, it will achieve greater relative operating leverage growth than Netwealth. Subsequently, profits would rise faster and the valuation multiple will contract.

But given PARS derived revenue is per account rather than a clip of FUA, this business won’t scale as well as platform.

Similarly, Class has seen its profit margin shrink over recent years.

Netwealth has a proven strategy, and while it looks expensive, the multiple doesn’t look as scary in one or two years.

My take

Despite Netwealth being nearly double the market capitalisation of Hub24, I believe it offers better value.

The business will keep spinning off profits as inflows increase. It’s lasered focus on HNW and private wealth clients. And has demonstrated sound cost control.

For Hub, I’m yet to be convinced of the diversified wealth company strategy.

Management deserves the benefit of the doubt given its success with the platform, but integrating Class and Xplore will be no light task.

If you enjoyed this comparison, consider signing up for a free Rask account and accessing our full stock reports.