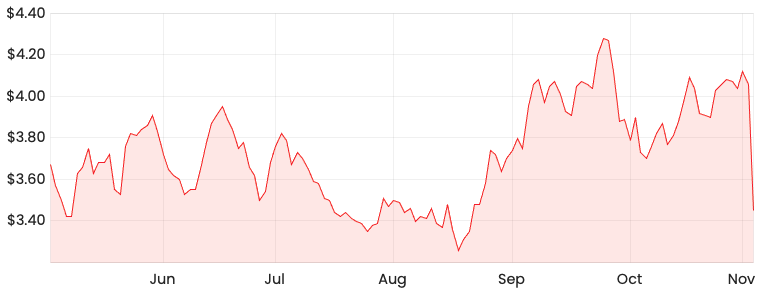

Tyro Payments Ltd (ASX: TYR) held its annual general meeting and experienced a seismic shock to its share price towards the end. What happened to the Tyro share price?

TYR share price

What happened?

As management went through the usual motions of providing an update on the FY21 results, it seemed like a stock standard annual meeting.

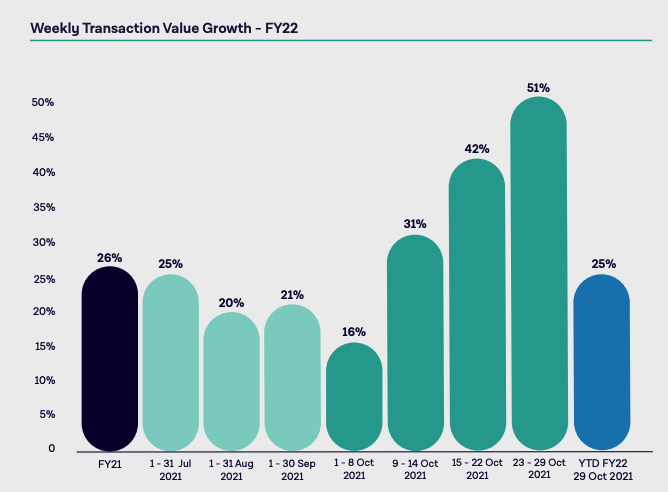

Management also went through a trading update since then, showing strong growth in transaction volume driven by the removal of lockdown restrictions in NSW and VIC.

You can see the ramp up in transaction volume below.

Transaction value essentially increased by 46% in the two weeks since NSW came out of lockdown.

The banking business also performed well with loan originations to 31 October 2021 at $20.6 million, representing a 1447% increase compared to the prior corresponding period (PCP). It should be noted this is off a low base.

Overall, group profit came in 14% higher at $38.5 million as of 31 October 2021.

After the usual presentation of the results, there were no questions raised from members at the meeting.

The sell-off

Despite there being no concerns or issues raised at the meeting, there was a sudden large sell-off.

Management discussed the situation amongst themselves on the call and appeared confused.

As a result, management released an announcement after hours. Tyro advised investors that gross profit has been reduced by the Bendigo Bank Alliance revenue share agreement.

This explains why there was a variance between the transaction value growth rate of 25% and the gross profit growth rate of 14%.

Management also noted reported gross profit will be $41.2 million, equating to a 22% increase in PCP profit of $33.8 million.

My take

It seems a sizeable group of investors may have overreacted to the impact of the Bendigo Bank revenue share arrangement.

I think it’s important to consider the long term opportunities that this agreement could provide rather than focus on the immediate impact.

One potential positive impact is Bendigo Bank’s potential to provide a deeper pool of merchants.

Another one would be the potential stickiness by locking down merchants through business banking.

On the flip side, I will be constantly asking myself, “Who has more bargaining power, Tyro or Bendigo Bank?”.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.