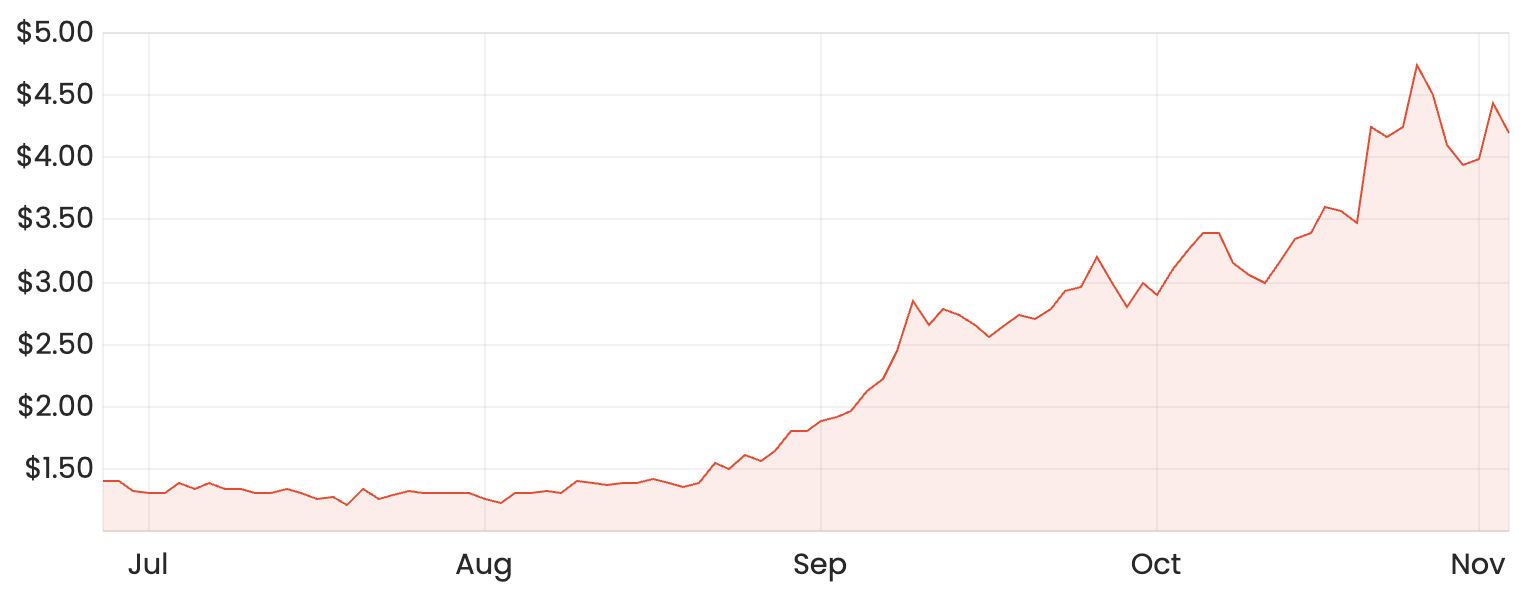

Today, I’m taking a brief look at Camplify Holdings Ltd (ASX: CHL) – a tiny ASX microcap that’s recently caught the eyes of investors. Shares have shot up over 200% since listing on the ASX a few months ago.

Let’s get into it.

Camplify background

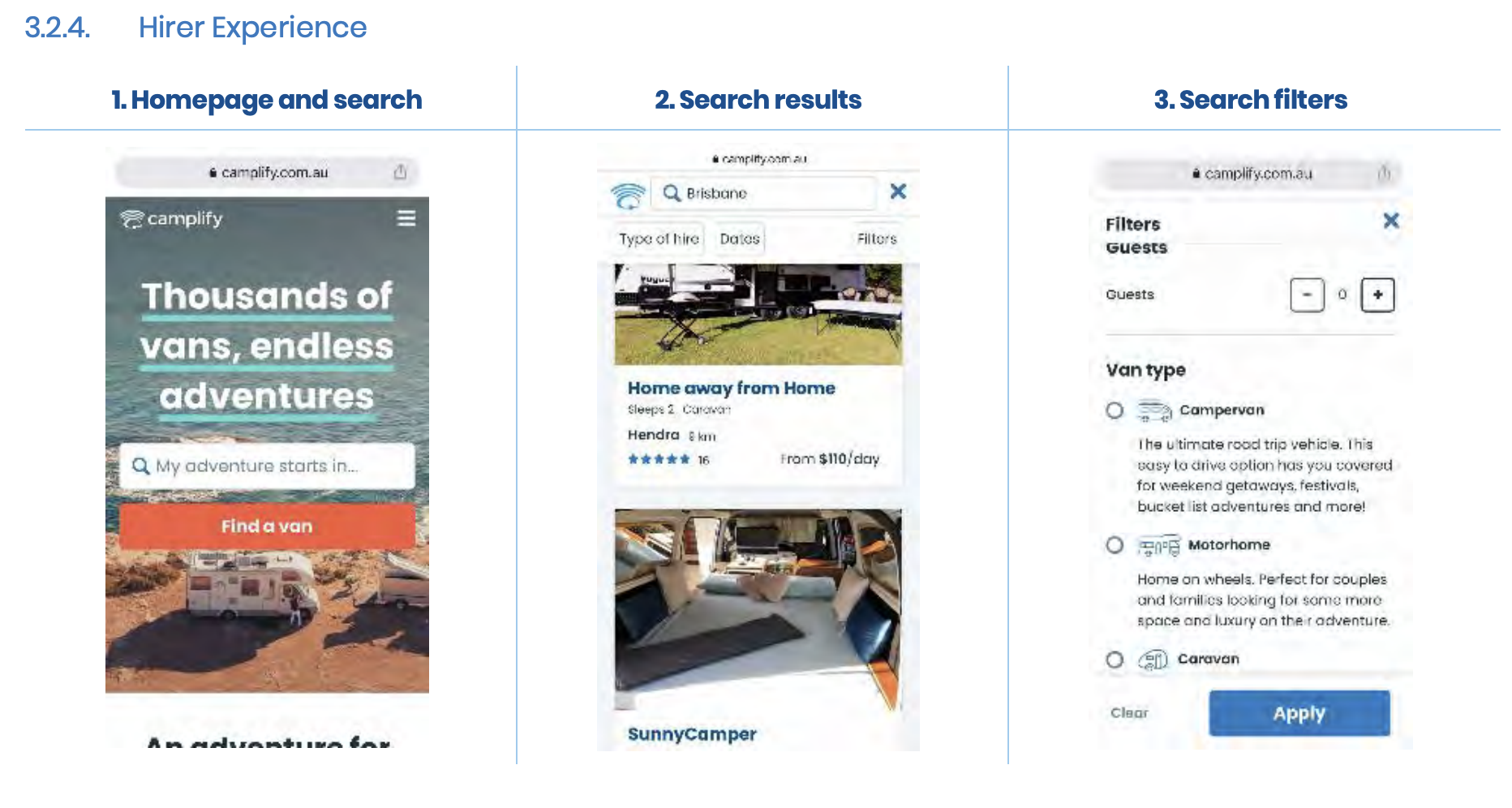

Often described as the Airbnb for recreational vehicles (RVs), recently listed Camplify operates a two-sided marketplace connecting RV owners to those wanting to potentially hire one.

Instead of going through a typical RV rental company, hirers can browse the thousands of caravans and campervans on Camplify’s platform, read reviews, communicate with the owner and organise the pickup/drop-off.

Camplify does not hold any its own inventory. It’s just the intermediary that facilitates the transaction and earns the majority of its revenue through a clip of the ticket based on the transaction value (usually around 25%)

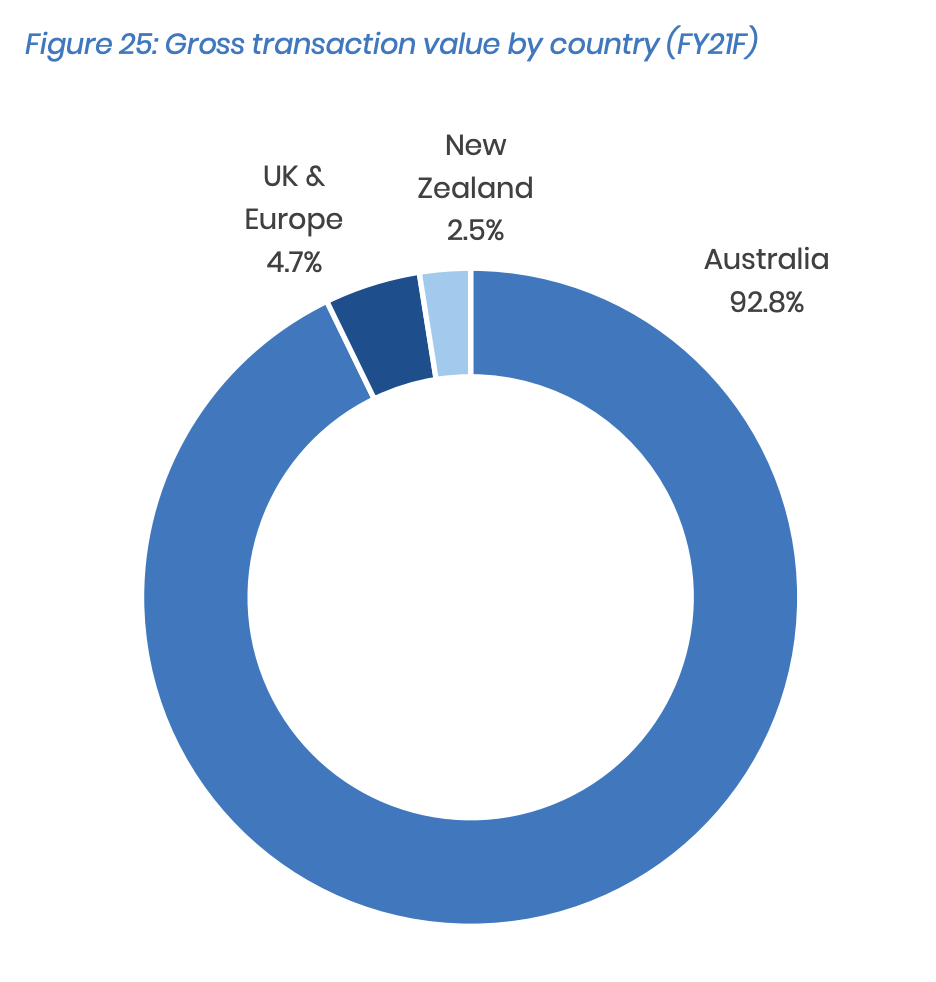

Since being founded in 2014, Camplify has grown its fleet size to 5,400 RVs across its platform and 150,000 total members (hirers and owners) across its markets in Australia, New Zealand, Spain and the UK.

As you can see from the image below, the company makes the vast majority of its revenue here in Australia.

Recent financial performance

During FY21, Camplify brought in revenue of $8.4 million based on total transaction value of $32.9 million. These figures were significantly better than the prospectus forecast which could partly explain why its shares have shot up so quickly.

Thanks to the capital light business model, Camplify can generate a high gross margin of around 70%. At the moment the business is unprofitable, but as a result of the recent IPO, has around $17.7 million of cash in the bank.

Based on the most recent Q1 FY22 results, the business is burning through approximately $2.7 million of cash every quarter. During the quarter, management said the majority of the growth had come from the UK and Spain on the back of easing restrictions and more movement.

Camplify is likely to continue to benefit from a reopening trade as hiring an RV is a cost-effective option for travellers. But despite the lack of international travellers in Australia since the onset of COVID, it was also able to benefit from a large amount domestic tourism. Either way, it looks like the demand for RV rentals will remain buoyant as buying one outright is too costly for many people.

With such a huge amount of unutilised RVs on the road, Camplify is hoping it can grow its fleet and develop its product to attract more hirers to the platform and continue growing its top line.

My take on Camplify shares

While the narrative is positive, keep in mind that those who got in on the IPO bought shares for $1.42 each. Today, they’re changing hands at $4.19, which is why I’m more cautious around the valuation rather than the quality of the business.

If Camplify can replicate the success of its Australian business into its new markets overseas, even today’s valuation doesn’t look too stretched. However, if the market is betting on the success of its international expansion, the downside risk could also be significant if the execution doesn’t go as planned.

Personally, I’ll be sitting on the sidelines for now as I’d like to see some more track record of execution. Nonetheless, Camplify is a fast growing business that I’ll be keeping an eye on.