The A2 Milk Company Ltd (ASX: A2M) share price has capitulated as pandemic induced border closures and subsequent supply chain issues set off a chain of multiple profit downgrades.

The introduction of a new leadership team and a couple of class actions haven’t helped matters either.

Subsequently, the A2 Milk share price has tanked 52% over the past year and nearly 70% from its all-time highs.

Looking at a price chart, the A2 milk share price now looks cheap compared to historical prices.

However, I’d be avoiding A2 Milk shares for now. Here are three reasons why.

A2M share price

1. Regulation uncertainty

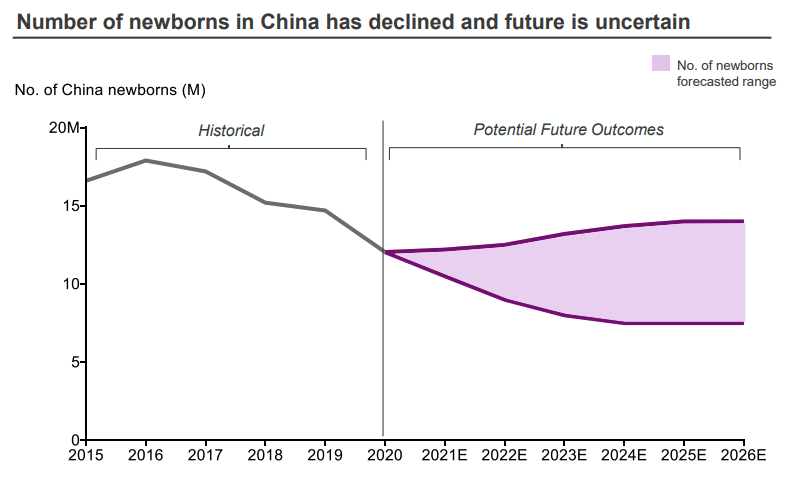

China has a population problem.

Chinese families are having fewer babies as a result of the cost of living pressures and education costs.

The country recently introduced a 3rd child policy to stimulate the birth rate. It even turned an entire industry – private tutoring – non-for-profit effectively overnight to reduce the cost pressures on families.

The Chinese government acts with a swiftness atypical of Western governments. As a result, it’s near impossible to forecast what the government will do next.

But I suspect premium infant milk formula (IMF) isn’t helping them achieve population objectives.

2. Swimming against the tide

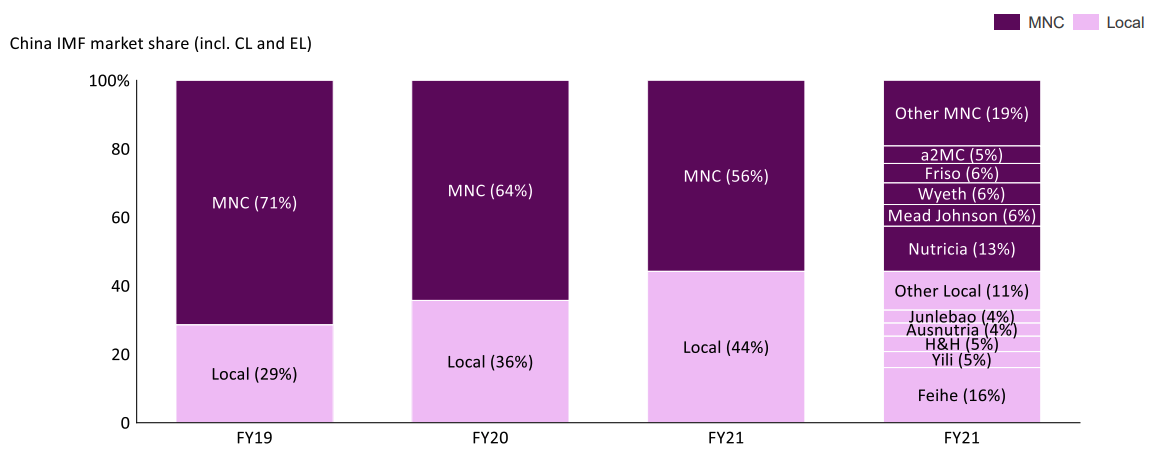

To compound problems for A2 Milk, Chinese families are moving away from multinational brands. Local producers are winning the battle and taking market share.

Illustrating this shift, local IMF consumption has risen from 29% in FY19 to 45% in three years.

The Chinese government has already stated publicly it wants 60% of the IMF market to be produced by local firms. A2 Milk is swimming against the tide as the size of the pie shrinks.

3. The worst may still be ahead

A2 Milk recently hosted its strategy day for investors.

It was a 163-page slide deck, outlining management’s plan to rebase growth expectations and reach $2 billion in sales by 2026.

However, slide 159 – FY22 trading update – suggested the worst may still be ahead.

Chinese IMF sales are expected to fall significantly compared to the prior year’s half. Similarly, English IMF will be below 2021 levels. Even the United States is suffering volume declines.

If you’re chasing a turnaround story, you need the business to actually turn around. I suspect the worst may still be ahead for A2 Milk.

I’m quite bearish on the A2 Milk share price. But greener pastures may be on the horizon. Check out why these analysts rate the A2 Milk share price a buy.

Alternatively, if you enjoyed this bear thesis, consider signing up for a free Rask account and accessing our full stock reports.