The Link Administration Holdings Ltd (ASX: LNK) share price is on the move this morning after the company received a takeover proposal.

Currently, the Link share price is up 11.78% to $4.84.

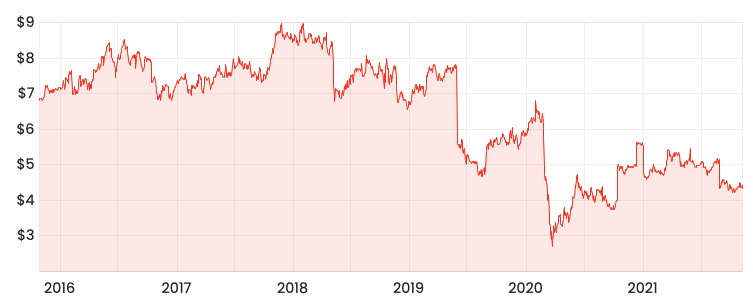

LNK share price

What was announced?

Private equity outfit The Carlyle Group has made a conditional non-binding offer to acquire 100% of the shares in Link.

The proposal includes two elements:

- Cash of $3.00 per share

- A pro-rata distribution of PEXA Group Ltd (ASX: PXA) shares, currently valued on a look-through basis of $2.38 per share

In total, Link shareholders would receive $5.38 in consideration, a 24.2% premium to Link’s last closing price.

The offer is subject to a number of conditions including due diligence, financing and regulatory approvals.

Link will consider the proposal before providing a decision on the offer. In the meantime, it will suspend the remaining $49 million of its $150 million buyback.

If you won’t monetise PEXA, we will

The pro-rata distribution of PEXA shares is a savvy move by Carlyle. It’s effectively using Link’s own balance sheet against them.

PEXA currently has a market capitalisation of $2.88 billion. Given Link owns 42.8% of PEXA, that shareholding is currently worth $1.23 billion.

By selling Link’s investment in PEXA, it reduces the cash Carlyle needs to provide.

Private equity strikes again

Over the past year, Link’s has been the subject of two separate private equity offers.

Carlyle and former owner Pacific Equity Partners (PEP) made a $5.20 per share offer in October last year, which was subsequently declined.

The offer was increased to $5.40, which was again rejected, however, Link allowed due diligence to develop a better offer. However, both bidders opted to walk away.

Next, SS&C Technology Holdings arrived at the party with a $5.65 per share offer. Similarly, the deal was declined but due diligence was granted. Again, private equity walked away.

PEXA now public

The key difference between today’s offer and the prior two is that PEXA is now a listed company. Previously it was private, therefore valuing the business was more difficult.

With a public market, the PEXA share price is readily available therefore private equity can sell the PEXA stake and retain the core Link administration business.

My take

Link’s initial public offering back in 2015 was at $6.37 per share by former private equity owner PEP.

Since then, the Link share price is 32% lower.

PEP used the public markets to sell out at a premium and is now coming back six years later when Link is at a discount.

It’s hard to say if it shows the genius of its private equity or the failure of management to deliver results.

Either way, shareholders should tread carefully. Private equity has visited twice bearing gifts, which subsequently had nothing inside.

Unless the offer becomes binding, I wouldn’t be surprised if it happens a third time.