The share price of fund manager Pendal Group Ltd (ASX: PDL) will be on watch today after the business provided its FY21 results.

Most Australian public companies report on a financial year basis from July 1 to June 30.

However, Pendal’s financial year is from October 1 to September 30 and therefore reports its results in November.

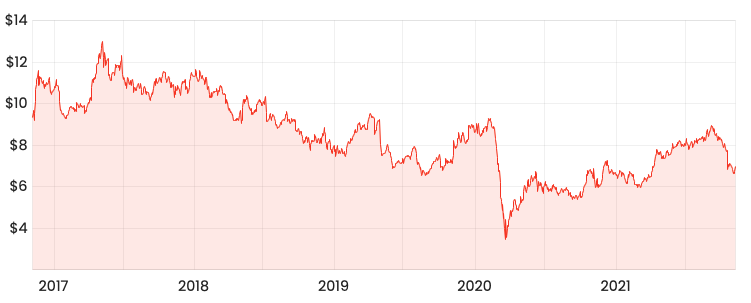

Currently, the Pendal share price is up 0.72% to $7.00.

PDL share price

TSW acquisition flatters growth

Key results from FY21 include:

- Closing funds under management (FUM) of $139.2 billion, up 51% year-on-year (YoY)

- Fee revenue of $581.9m, up 23% YoY

- Underlying profit after tax of $165.3 million, up 25% YoY

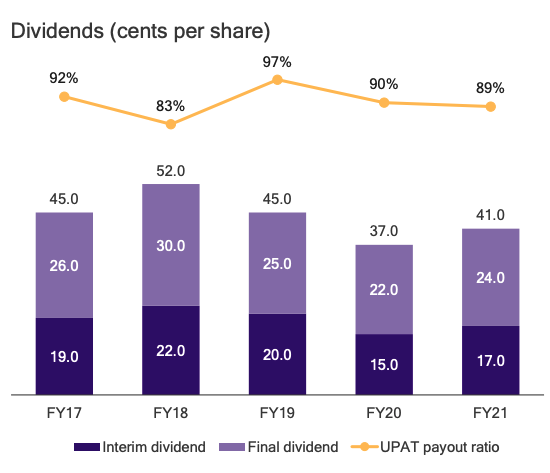

- Final dividend of 24.0 cents per share, a total dividend of 41 cents per share up 11% YoY

Revenue and underlying profit increased primarily as a result of growth in base fee revenue from its funds.

At face value, the result looks like Pendal achieved solid growth across the business.

However, the result is flattered by the acquisition of Thompson, Siegel & Walmsley (TSW), a US-based value-oriented investment management company.

Stripping out the effect of TSW, FUM only increased 15%. In fact, Australia and Europe experienced net outflows over the year.

The reason FUM increased is largely the result of growth in the underlying value of investments of $16.0 billion.

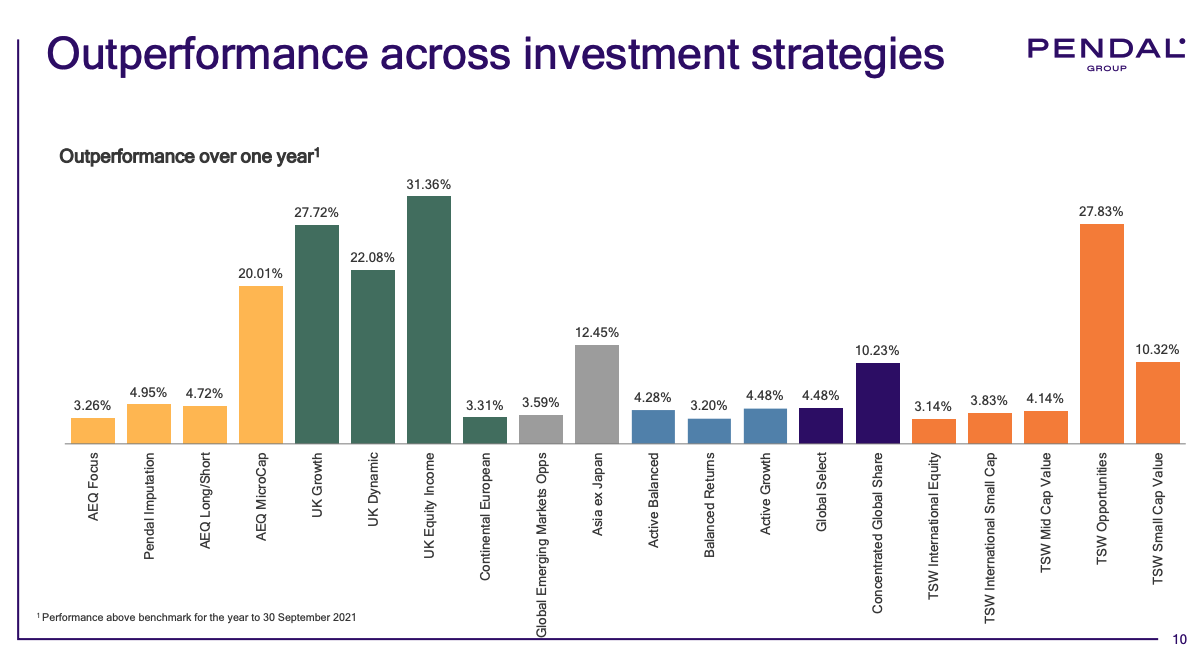

On a positive note, performance fees increased 4-fold due to 1-year outperformance across several funds.

Net inflows is Pendal’s Achilles Heel

Pendal’s net outflows were masked this year by equity markets setting all-time highs.

However, management conceded that clients are placing pressure on the company:

“…we see pressure on flows, particularly in the institutional channel. While this may have short-term effects, we are confident that changes made to our sales leadership during the year and ongoing development of our US and European distribution strategy, will support future growth.

Is Pendal a good dividend investment?

Pendal’s FY21 dividend of 41 cents per share values the company on a dividend yield of 5.8%.

That may look better than leaving money to accumulate in a bank account earning next to zero.

But Pendal’s dividend has been slowly declining for the past 5 years. Moreover, its payout ratio (represented in yellow) remains at the upper end of its range.

Subsequently, if FUM were to decrease the business would have little wiggle room to defend its distribution.

I’m cautious of investing in fund managers that have net outflows. It means its clients are actively taking money away and allocating it elsewhere.

As a result, I’d be staying away from Pendal for now until net inflows return.