The medical device business PolyNovo Ltd (ASX: PNV) share price has fallen sharply to end the week after announcing the resignation of its Managing Director.

Currently, the PolyNovo share price is down 5.66% for the day to $1.75.

PNV share price

A lasting legacy

Chief Executive Paul Brennan, who has been with PolyNovo for nearly 7 years, has announced his resignation from the company.

He will remain in the role for the next three months to assist with an orderly transfer.

In the meantime, former Director Max Johnston will take over the role on an interim basis.

Chairman David Williams said:

“I would like to thank Paul for his leadership over the last 7 years. During this time PNV has undergone a significant transformation, expanded geographically, and enjoyed extraordinary commercial success that has shaped the company into a global medical device business”.

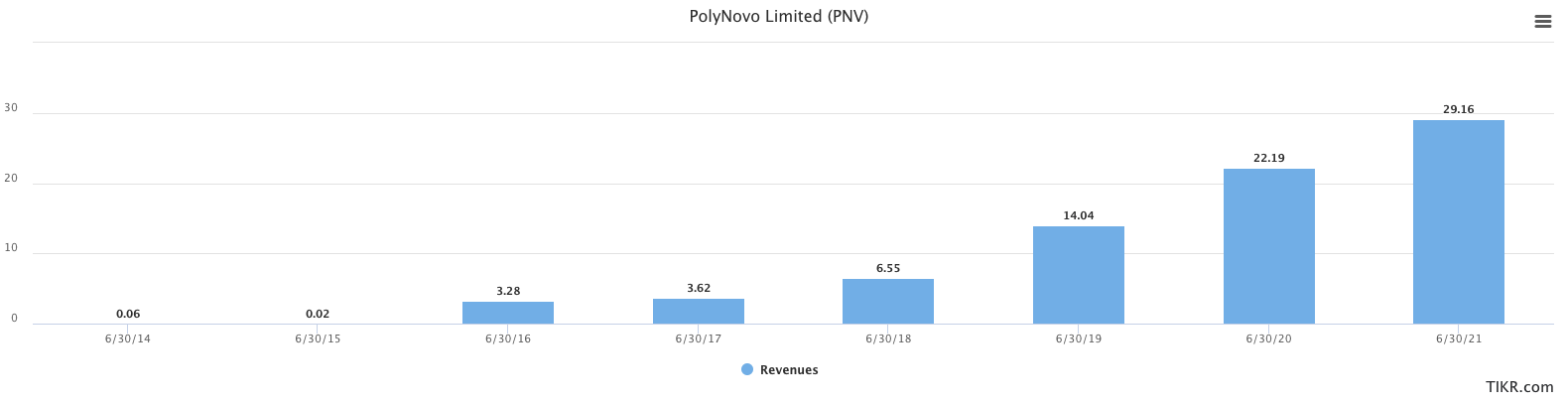

In his time as Managing Director, Mr Brennan has taken PolyNovo from effectively zero revenue to $29 million.

Impressively, the PolyNovo share price has increased 20-fold over the same period.

CEO falls on his sword

Despite building significant shareholder wealth, PolyNovo has disappointed the market in more recent times.

It’s been unable to grow international sales relative to expectations of its patented NovoSorb product, which aids in the healing and restoration of significant skin burns.

“…in more recent times there have been increasing differences with the Board in relation to Paul’s interaction with the company’s senior management team and his management style. Accordingly, the Board has accepted Paul’s resignation.”

Previously, the business had cited distribution issues related to the pandemic for the slower than expected sales growth.

However the announcement today revealed that the issues were not just external, but internal as well.

In somewhat of a dig at the departing CEO, the board noted his sales and marketing experience wasn’t up to scratch:

“The Board has started the search for a new outstanding candidate and leader with appropriate sales and marketing experience to spearhead growth in the US and the EU”.

A notable absentee

The writing was on the wall this morning when the company released an announcement inviting shareholders and followers to attend an online healthcare conference next week that Mr Brennan would not be attending.

Instead, Mr Williams and CFO Jan Gielan would present.

It’s disappointing to see Mr Brennan fall on his sword given the shareholder wealth creation he has led.

But recent sales growth has been underwhelming. Hopefully, the change in leadership will help propel PolyNovo from back to its share price highs last seen in 2020.

To keep up to date on all the latest news regarding PolyNovo and the ASX, be sure to bookmark the Rask Media home page.