The world’s leading hotel Software-as-a-Service (SaaS) platform SiteMinder Limited (ASX: SDR) is set to begin trading on Monday, 8th of November.

SiteMinder is raising $627 million in its initial public offering (IPO), valuing the business at $1.3 billion.

Let’s dive into the IPO and see why SiteMinder might be an attractive investment opportunity.

Bringing accommodation into the 21st century

Founded in 2006 by Mike Ford and Mike Rogers, SiteMinder aimed to open up every hotel and accommodation provider to online commerce.

SiteMinder’s typical clients – known as small and medium-sized businesses (SMBs) – include local bed and breakfasts, motels, lodges and vacation rentals.

No more pen and paper or spreadsheets to manage bookings, rates, availability and booking channels (Airbnb, Booking.com, Expedia, Agoda).

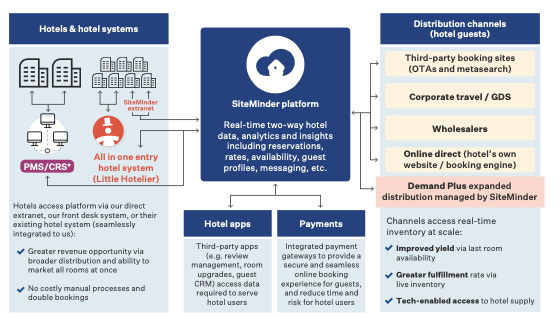

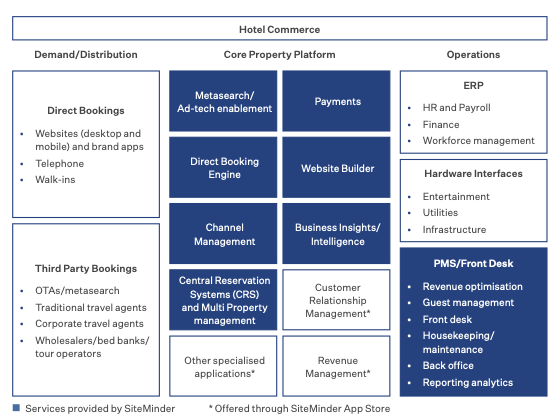

SiteMinder aggregates all the administration under its channel manager. The platform is cloud-based, enabling hoteliers to manage their business on the go.

“Our mission here at SiteMinder is to open up every accommodation provider’s access to online commerce”.

Since then, the company has expanded its product range to include website builders, booking engines and distribution with corporate agents.

SiteMinder connects over 425 hotel software systems with an equal number of distribution channels, providing genuine value for its customers.

The business operates 24/7 across 150 countries and with office locations in Sydney, Bangkok, Manila, London, Galway, Berlin and Dallas.

Both founders remain involved in the business. Ford as a non-executive director and Rogers as Chief Technology Officer.

Mission-critical software

When the pandemic hit, the travel industry literally came to a standstill. Global hotel bookings more than halved as travellers were restricted to domestic travel.

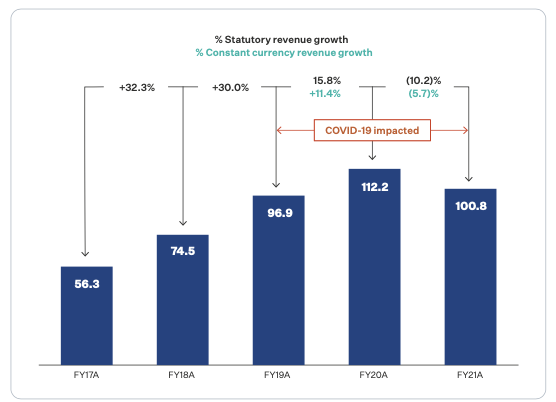

Despite this fall, SiteMinder’s revenue dropped only from $112 million in FY20 to $100 million in FY21.

In fact, in constant currency terms revenue fell only 5.7%.

Why would SiteMinder’s revenue only fall 6% when its industry came to a standstill?

SiteMinder is mission-critical to its clients.

It’s the last expense that gets switched off. Even if demand falls dramatically – as it did during the pandemic – customers still need to manage online bookings and guests.

Subsequently, the business was relatively less impacted than the overall sector illustrating resiliency and stickiness.

The opportunity

The global hotel market is estimated to encompass over 1 million properties. SMBs represent 85% of this market, with a large chunk still using manual processes.

Currently, SiteMinder services 32,000 properties globally inferring a market share of less than 4%.

As hoteliers digitise operations – which will be more important than ever post-pandemic – SiteMinder stands to benefit from this structural shift.

A-team

It’s worth pointing out the calibre of executives at SiteMinder.

Chief Executive Officer and Managing Director, Sankar Narayan was formerly the Xero Limited (ASX: XRO) Chief Financial and Chief Operating Officer.

Chief Product Officer Inga Latham ranked #7 in the 2021 Top Women Leaders in SaaS. Furthermore, Chief Marketing Officer made the top 50 list.

Chairman Pat O’Sullivan is currently on the board of Carsales.Com Ltd (ASX: CAR), Afterpay Ltd (ASX: APT) and TechnologyOne Ltd (ASX: TNE).

Past employers and industry accolades don’t correlate exactly with success. But it provides a solid foundation.

Unit economics

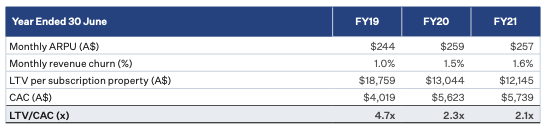

83% of SiteMinder’s revenue is recurring subscription fees to its online platform. The remaining 17% is from transaction fees from subscriber properties.

Its gross margin hovers around 75%. Cost of sales is largely attributed to global customer support, account management, hosting services and costs associated with transaction revenue.

Prior to the pandemic, SiteMinder’s Lifetime Value (LTV) to Customer Acquisition Cost (CAC) was in excess of 4.

However, churn picked up during the pandemic from 12% per year to 19%. Additionally, fewer customers were being onboarded due to a halving of demand.

Subsequently, LTV/CAC dropped to 2.1.

Despite the fall, management is confident it can return to historical levels once conditions normalise.

Valuation

The IPO values SiteMinder at a market capitalisation of about $1.3 billion. Its enterprise value/revenue multiple – a common valuation ratio for SaaS companies – is 12.5.

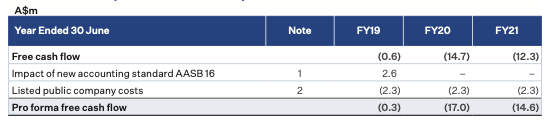

Despite collecting $100 million in revenue, SiteMinder is still not profitable on an EBITDA

or cash flow basis.

It lost $12.3 million in FY21 however almost reached breakeven in FY19 with a loss of $0.6 million.

Sales and marketing are its biggest expense, accounting for 35% of revenue in FY21.

The business will have $121 million in cash post IPO, which at the current loss rate should be sufficient for the company to reach profitability without raising further capital.

Why IPO now?

Of the $627 million equity raising, $537 million will go to selling shareholders and $90 million retained by SiteMinder for growth.

Venture firm TCV will exit completely, selling its 22.4% stake, while angel investor Les Szekely and Ford will sell down over half their holdings.

It looks to be net-positive. Existing shareholders get the chance to exit via a public market while the business gets better access to capital.

Competition

SiteMinder is not alone in the hotel software market.

Various competitors exist. Some choose to focus on just one vertical such as channel managers, with others providing several options.

Cloudbeds is arguably SiteMinder’s biggest competitor. Both SiteMinder and Cloudbeds battle it out for the top spots at the HotelTechAwards.

SiteMinder characterises itself as an open platform. Subsequently, many of its competitors are also its partners.

Customers can mix and match which software works best for them, and SiteMinder will be able to integrate seamlessly.

Trading update

The company did not provide forecasts for FY22.

However, it did announce Q1 FY22 revenue growth of 10% compared to the prior year and improvement in Q4 FY21.

My take

The SiteMinder IPO has certainly caught my eye.

The business provides a mission-critical service to its customers and based on industry awards, s a leader in its software niche.

Management is top quality. The company has long growth runway. And it will only benefit from the reopening of borders.

However, it’s not without risks, mainly competition and if the SiteMinder can translate its growth into profitability.

I’m looking forward to seeing how the business trades on Monday. For now, Siteminder remains at the top of my watchlist.