I love dividend growth investing. There, I’ve said it. It is potentially the least sexy part of the investing world, filled with wo/man-child like myself, who are far from ‘OK Boomer’ yet invest like we’re well into retirement.

What is dividend growth investing?

Dividend growth investing (DGI) is really a subculture of growth at a reasonable price (GARP) that was popularised by Peter Lynch. To my mind, the DGI community have essentially adopted Lynch’s perspective of ‘stalwarts’: large, well-established companies that still provides growth, typically earning 10-12% per year.

DGI combines three key components:

- Returns to shareholders (dividends)

- Margin of safety (dividend yields as a proxy for reasonable prices), and

- Moderate growth (increasing dividend yields)

The Chowder Rule: dividend yield and growth

Last week I discussed 3 keys to unlocking long term value creation, outlining that yield and growth are both important – while avoiding high prices and multiple compression. DGI builds on this in a simple to use method for anchoring your portfolio with stalwarts.

The Chowder Number – popularised by a contributor Chowder on SeekingAlpha – is the sum of the current Dividend Yield Plus 5-year Dividend Growth Rate. There are three rules that essentially set a floor of 12% returns, though this can be down to 8% for more stable investments such as utilities. The Chowder Rules may not be the sole criteria for decision making, though some DGI investors such as European DGI have used it to good effect to review their portfolio.

Looking through the rear-view mirror

One criticism of the Chowder Rule is that, by using 5-year historical dividend growth figures, you are essentially looking through the rear-view mirror. It’s great for historical results but doesn’t tell you where the company is heading.

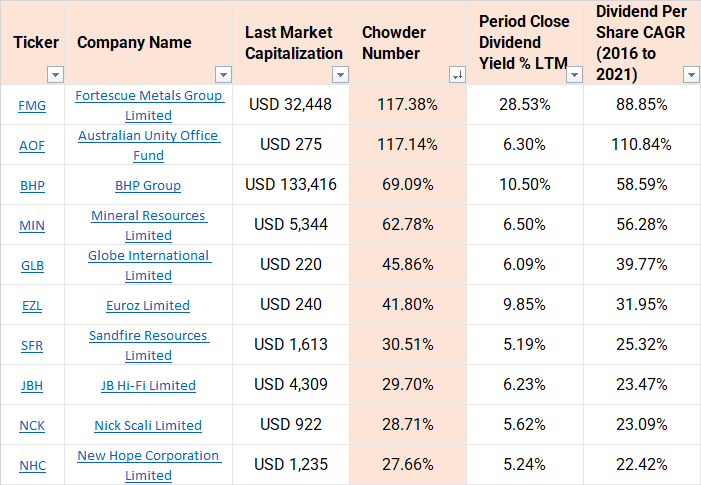

Below are the top 10 ranked Chowder companies based on Dividend Yield plus Dividend 5-Year CAGR growth. You’d be forgiven for thinking this is a list of cyclicals likely at their peaks or value traps.

Looking through the front windscreen

To accommodate this criticism, I have screened the ASX based on Dividend Yield plus Consensus EPS Growth. The EPS growth is a proxy for future dividend growth.

I use ‘consensus’ loosely and have typically taken the most conservative set of estimates over 1, 2 and 5 year forecasts from analysts. Furthermore, while dividend yield can provide some margin of safety, it moves much slower than share prices. Therefore, I also use the forward PE whereby I am typically looking for less than 20 depending on the sector.

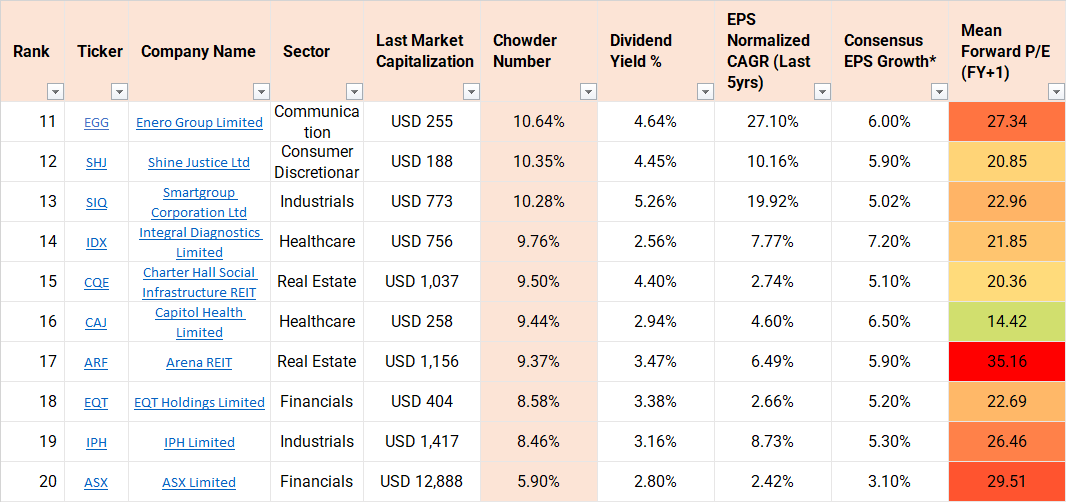

While the calculations are imperfect, at least it allows for the investor to look through the front windscreen of what may be coming for these stalwarts. The screen below are the companies ranked 20 to 11.

* The consensus EPS growth is based on 1yr, 2yr or 5yr analyst forecasts, and has been purposefully conservative. Even then, data shows that analysts typically are +25% bullish relative to actual figures, and so it’s likely these figures may also prove to be insufficiently conservative. This is a guide, and not a forecast.

Final thoughts

Dividend growth investing may not be the sexiest part of the investing orbit. However, even some of the best super-investors have put allocations to stalwarts, particularly at this time of the market cycle.

Next, I’ll be counting down from #10 to #1 DGI companies on the ASX, including in depth analysis on consensus forecasts and risks.