The National Australia Bank Ltd (ASX: NAB) share price is moving into the red today after releasing its FY21 results.

Currently, the NAB share price has fallen 2.63% to $28.34.

Unwinding provisions boost profits

Key highlights for the year ending 30 September 2021 include:

- Net operating income of $16.81 billion, down 2.2% year-on-year (YoY)

- Underlying profit of $8.99 billion, up 9.88% YoY

- Cash earnings of $6.56 billion, up 75.3% YoY

- Statutory net profit of $6.36 billion, a 248% jump YoY

- Tier 1 Capital ratio of 13.00%, up from 12.37%

- Final dividend of 67 cents per share, total FY21 dividend of 127 cents per share

Navigating the 88-page management discussion and 127-slide investor presentation is no small feat.

In summary, the big jumps in cash earnings and statutory profit are not the result of remarkable business performance but lower expected loan losses.

In FY20 when the pandemic hit, NAB – like all banks, expected losses and defaults to increase. Subsequently, the business put aside money, which is recorded as an expense, therefore, lowering profit.

The expected losses did not eventuate. As a result in FY21, NAB is now unwinding those losses, which flow through as profits.

If you strip out the loan provisions and a one-off software expense from FY20, the underlying profit detracted 6.4%.

Above system growth fails to translate

Despite the lower revenue YoY, NAB performed admirably across its divisions.

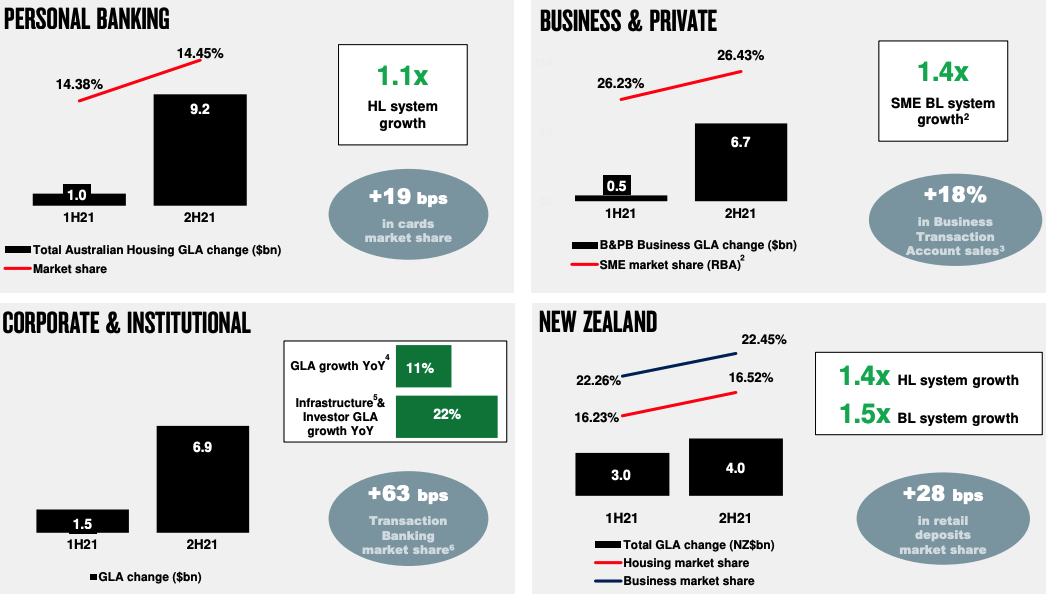

Business & Private banking was the standout with 1.4x system growth. New Zealand also performed strongly with 1.5x system growth.

Personal and Corporate & Institutional businesses achieved more subdued growth of 10% and 11% respectively above system.

The strong performance was the result of a significant improvement in NAB’s lending experience through digitising processes and employee training.

Its new credit decision engine simplifies approvals while analytics enables automated valuations.

Subsequently, the business has reduced the time for a banker to submit an application by 50%.

30% of loans are approved with an hour, 60% within a day and 80% within a business week.

Unfortunately, lending growth did not translate into meaningful profit growth due to higher expenses and net interest margin pressures.

Best of a bad bunch

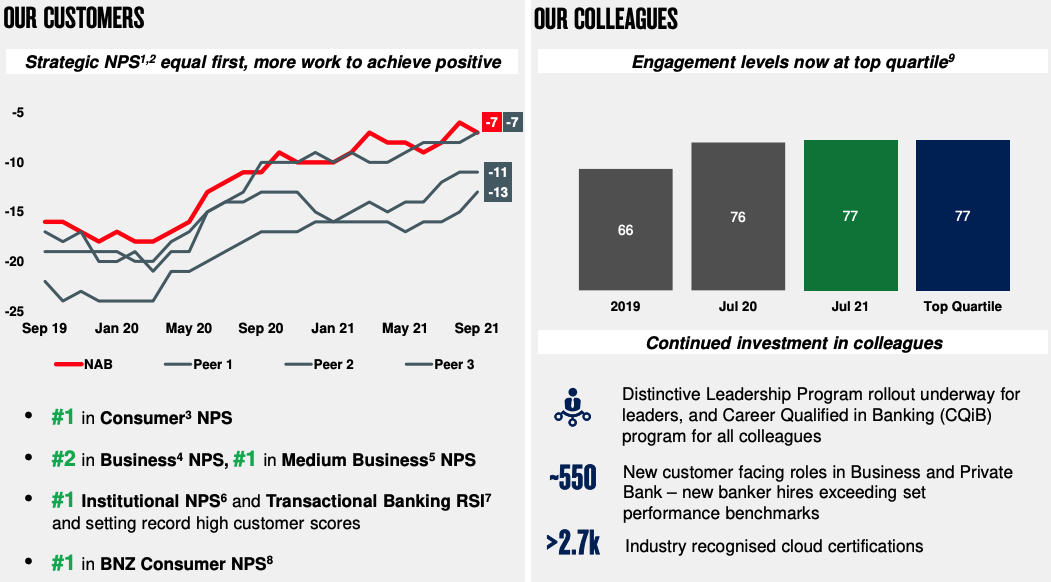

NAB’s net promoter score – a measure of customer satisfaction – remains equal first among its banking peers.

However the actual score remains negative, meaning on average, customers have a poor experience with the bank rather than a great one.

Positively, employee engagement levels are now in the top quartile at 77.

Simplification nearing end

NAB is close to simplifying its operations. It completed the divestment of MLC Wealth in May.

Meanwhile, NAB added neo banks UBank and 86 400 to its umbrella in addition to acquiring Citibank’s Australian consumer business.

My take

Despite the unremarkable financial result, it’s positive to see NAB moving in the right direction on an operational level.

Its streamlining of lending processes should flow through to revenue and profit growth over time if it can maintain this advantage.

On a fully franked dividend yield of 4.5%, I think the NAB share price could be a decent dividend play.

If you enjoyed this FY21 report, consider signing up for a free Rask account and accessing our full stock reports.