The Westfield shopping centre owner, Scentre Group (ASX: SCG) share price will be on watch today after the business provided an operational update for the 10-month period to October 31.

For context, the company reports on a calendar year basis.

Currently, the Scentre Group share price is unmoved at $3.15.

Is now the time for investors to dip their toes in the shopping centre landlord?

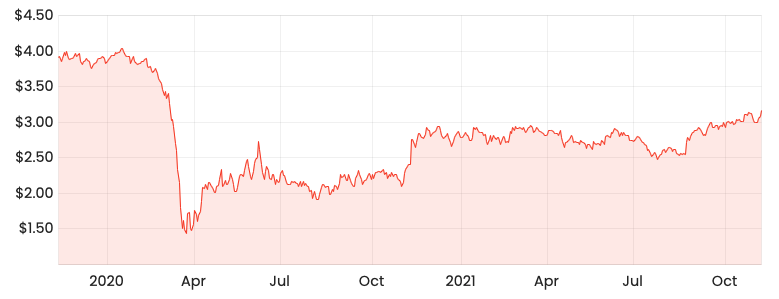

SCG share price

Resilient performance despite ongoing lockdowns

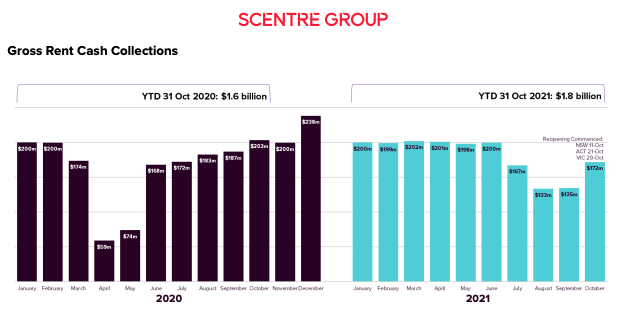

The company announced it has collected $1.8 billion in gross rent since the beginning of the year.

Gross receipts have exceeded the same period across 2020 by $187 million.

The last four months have been difficult for Scentre Group after lockdowns reemerged across parts of Australia.

Subsequently, it has only collected $607 million in receipts over this period compared to $828 million in 2020.

Over the first nine months of 2021, the business completed over 2,000 new lease deals including 868 new merchants and 191 brands.

Overall, portfolio occupancy remains high at 98.5%.

Subject to no material change in conditions, the business expects to distribute 14 cents per share in 2021.

This equates to a dividend yield of around 4.4%.

A state by state basis

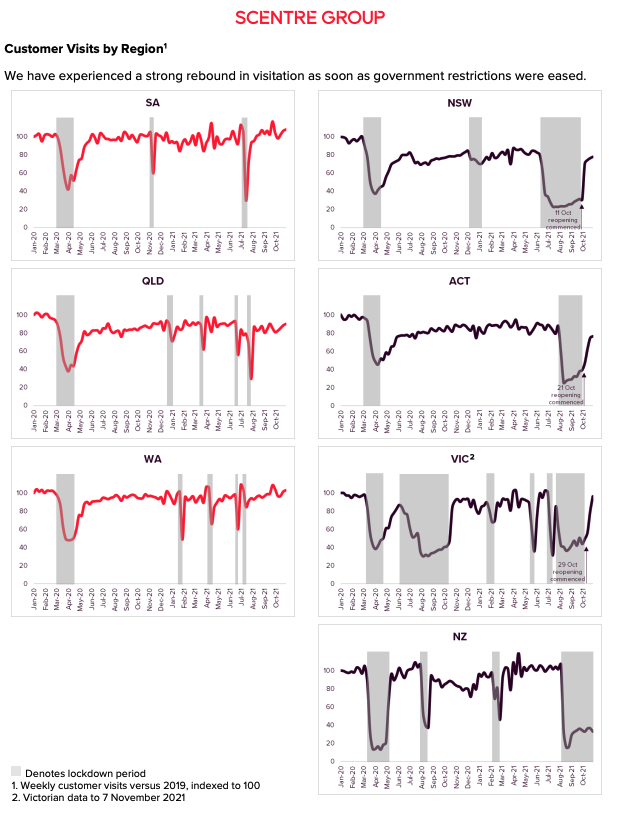

Operations at Westfield Centres in Queensland, Western Australia and South Australia continue to trade above 2020 levels.

Conversely, operations in New South Wales, Victoria, New Zealand and the ACT have been impacted by pandemic outbreaks.

Positively, customers have returned rapidly once restrictions have eased.

Overall, in-store sales were 7.2% lower for the year compared to 2019 levels.

Down but not out

It’s been a turbulent 18 months for shopping centre owners.

Pandemic restrictions resulted in a big shift towards e-commerce brands such as Temple & Webster Group Ltd (ASX: TPW) and Kogan.com Ltd (ASX: KGN).

As a result, some investors have asked if this is the end of the shopping centre?

While consumer dynamics may have changed, Scentre Group believes its in-store offering can add value for retailers.

The business is undertaking a $355 million redevelopment of Westfield Knox to replace the exit of Myer.

A new library will be added in addition to supermarket chains and a fresh food market.

At Westfield Mt Druitt, the company is spending $55 million to create a new rooftop entertainment and dining precinct.

My take

I’m not averse to holding Scentre Group as a dividend stock in a diversified portfolio with a yield of 4.4%.

But keep in mind, the business will likely need to spend more to refurbish centres over the coming years to adapt to changing consumer preferences.