The Kathmandu Holdings Ltd (ASX: KMD) share price is largely unmoved today despite the business providing a first-quarter trading update.

Currently, the Kathmandu share price is down 0.2% to $1.50.

Kathmandu owns the Kathamndu outdoor retail brand in addition to Rip Curl and Oboz.

Lockdowns impact same-store sales

Same-store sales for the first 13 weeks of FY22 were significantly impacted by lockdowns across New Zealand, Victoria, ACT and New South Wales.

Kathmandu sales were down 17.6%. Meanwhile, Rip Curl revenue was down 9.4%.

The business also hasn’t recognised any government subsidies to offset the impact.

As a result, operating profit is expected to be $35 million lower than FY20.

Despite the impact on same-store sales, some purchases have moved online with e-commerce sales up 33.8% year-on-year.

On a positive note, adjusting for the impact of lockdowns, Kathmandu sales jumped 16.3% and Rip Curl sales are up 1.6%.

In more recent weeks, the reopening of Victoria and New South Wales has resulted in a 27% spike in same-store sales of Rip Curl.

“Rip Curl and Kathmandu are well prepared for the key Black Friday and Christmas trading period, and inventory remains sufficient to meet expected demand. Due to the uncertain COVID trading environment the Group will not provide forward guidance, however as markets reopen, trading is expected to improve with growth opportunity in the second half of FY22”.

Demand elevated due to pandemic bottlenecks

The business has a backlog of Rip Curl and Oboz wholesale orders due to supply chain issues. Kathmandu’s North American has been the hardest by the constraints.

For example, Oboz product deliveries in Q2 will be impacted due to the closure of footwear factories in Vietnam in Q1.

Rip Curl wetsuits are also in high demand.

Management noted heightened freight, logistics and raw materials costs.

These costs could be passed onto customers and potentially lead to margin pressure.

Investor day signals return to growth

In addition to releasing a trading update, Kathmandu hosted its annual investor day.

The business is looking to add $250 million in new sales across its Kathmandu brand over the next 3-5 years.

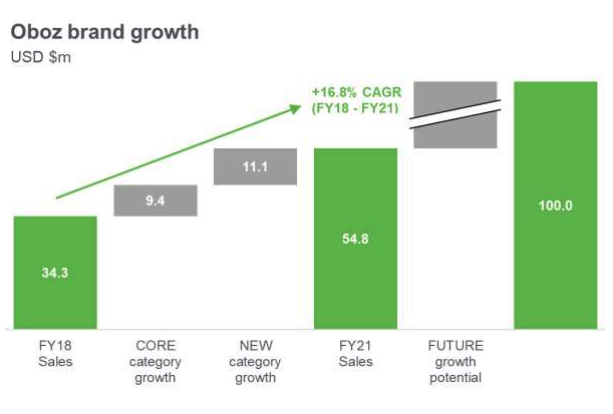

Similarly, Oboz is hoping to grow to US$100 million sales over the period, which would be an 85% jump.

My take

It’s difficult to get a read on Kathmandu.

The business says “inventory remains sufficient to meet expected demand” but then in the next paragraph says it’s experiencing supply chain disruption.

Subsequently, I’ll be waiting for conditions to normalise before evaluating the company.

To keep up to date on all the latest news regarding Kathmandu and the ASX, be sure to bookmark the Rask Media home page.