The Morrison government pledged up to $1 billion in funds to develop low-emissions technologies. Here are two ASX electric vehicle (EV) shares that could benefit from this move.

Before we dive into these two ASX shares, let’s find out what Morrison revealed yesterday on what lies ahead in the EV landscape.

Morrison turns on the EV engine

The Australian government is finally catching up on the EV industry. It wants to create a fund focused on supporting businesses to develop low-emissions technology that is both affordable and scalable.

According to the Australian Financial Review, the fund will receive $21 billion over the next ten years to develop the technologies to reach net zero.

Novonix (ASX: NVX)

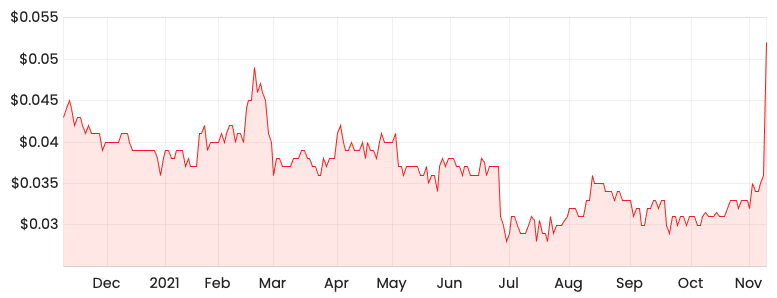

NVX share price

Novonix develops and supplies lithium-ion battery materials and testing equipment for the North American market. This company is essentially a pick and shovels play.

It creates the ingredients that are required to develop electric vehicles. Just like how carbohydrates provide us fuel to run.

What makes Novonix a potentially sound EV investment?

Novonix’s key competitive advantage lies in its method of producing the materials.

The lithium-ion manufacturer has developed a more affordable and environmentally sustainable way to create the materials.

Given Novonix’s advantage is reliant on an innovative production method, close attention should be paid to competitors.

Rectifier Technologies (ASX: RFT)

RFT share price

Rectifier is another pick and shovels play except it develops the power modules installed in EV chargers.

Why are these power modules called rectifiers?

These rectifiers convert alternating current (AC) into direct current (DC). The devices are known as such because they ‘straighten’ the currents to run in only one direction. As with a laptop or a phone, cars can’t be plugged into a socket without a DC conversion.

What makes Rectifier an attractive EV investment?

The big catalyst behind Rectifier actually lies in its relationship with Tritium. Tritium is a Brisbane based private company that manufactures EV chargers, which is fast becoming one of the global leaders in the EV charger industry.

This is a double-edged sword.

On one side, Rectifier can ride the coattails of Tritium as the EV charger continues to expand across the globe.

However, investors ought to be wary of Rectifier’s dependence on Tritium in the EV segment. Tritium is its key customer, representing a majority of EV revenue.