The Zip Co Ltd (ASX: Z1P) share price sunk 5.16% yesterday to $5.70.

On most days, a 5% dip wouldn’t be worthy of discussion.

However, the drop came on the back of big news for buy-now-pay-later (BNPL) competitor Affirm Holdings Inc (NASDAQ: AFRM).

Affirm conquers US market

Overnight at its first-quarter result, Affirm announced it would serve as Amazon’s (NASDAQ: AMZN) only third party, non-credit card, BNPL option in the United States.

The deal would cover the next fourteen months of sales up until January 2023. Crucially, it includes two holiday periods where annual sales peak.

In August, Affirm announced a non-exclusive pilot program with Amazon, where it competed with the likes of Zip Pay for customer financing at the checkout.

“…Amazon had their pick obviously and partners in the space. They tested, they tested us, we passed the test. We passed the test with flying colors and better. And so I think that that’s a very important qualitative matter here” – Founder & CEO Max Levchin

Now Affirm will have exclusive access to Amazon. It will also be embedded In Amazon Pay’s digital wallet and available to all customers.

In return, Amazon was issued two tranches of warrants in Affirm. The first is worth 7 million shares and the second 15 million. Both are subject to performance hurdles.

A warrant is effectively an option, which gives Amazon the right but not the obligation to purchase shares.

Coincidentally, Amazon also holds 14.6 million warrants in Zip as part of its 2019 deal.

Here’s why I’m concerned about Zip

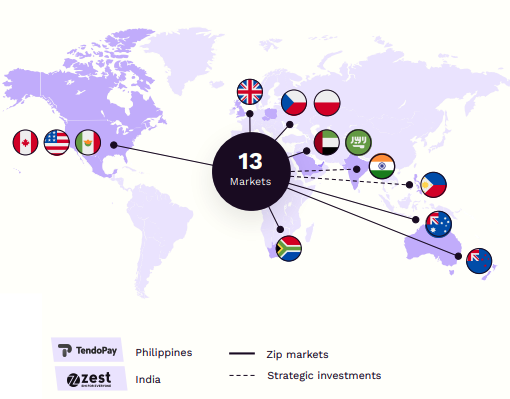

Arguably, Zip’s biggest advantage is its global footprint. It’s in 13 markets, and actively looking to move into new regions.

In contrast, Affirm only operates in the United States and Canada.

It would make more sense for Amazon to partner with Zip. It’s in the same markets as Amazon. The two businesses know each other well. Amazon even owns warrants in Zip.

“We’re in over 13 markets. And as commerce and retail becomes globalized, merchants can now integrate once, and we can give access to multiple regions. We’ve done all that heavy lifting ahead of the competition” – Zip Founder & CEO Larry Diamond

So why choose Affirm? Especially after just over a month of working together?

Maybe Affirm offered a rockstar deal. Or the company aligns better with Amazon’s customer base. It’s hard to know for sure.

Nonetheless. it’s a warning bell.

My take

Zip is the 7th most shorted stock on the ASX with over 9% of the register betting it will fall in value.

Before today’s deal, I was quietly bullish on the Zip share price. Its land and expand strategy is attractive to global merchants who want a one-stop solution for each market.

But now I’m left wondering if it’s the right plan. Subsequently, I’ll be watching Zip shares from the sideline for now.

If you’re looking for new share ideas, check out three ASX shares I’d purchase today.