Shares in specialty retailer Dusk Group Limited (ASX: DSK) finished 3% lower yesterday after releasing a trading update for the 19 weeks ending 7 November 2021.

Dusk is a vertically integrated retailer with a range of home fragrance products including candles, diffusers and essential oils. If you need a refresher on the company, you can read more about it here: Why I think Dusk (ASX: DSK) could be one ASX share to look out for in 2021.

Trading update

Lockdowns in VIC, NSW and ACT have been a headwind on sales for the first part of 1H22, which resulted in 33% less trading days over the period.

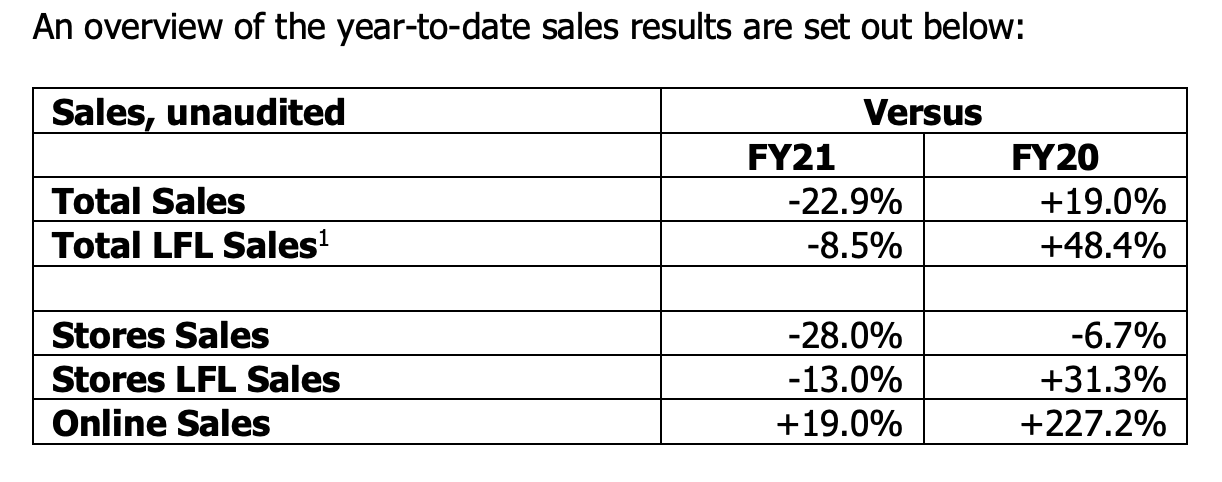

Management provided this handy, albeit slightly confusing table of how the business has been tracking lately.

For the first 19 weeks of the half of the year, total sales were down 22.9% on the same time last year. If you look at LFL sales which exclude the COVID closures, sales were still down 8.5% on FY21.

Pleasingly, online sales were up 19% on the year.

Keep in mind that sales jumped 48% over FY21, with most of this growth coming in the first half. These current figures are therefore cycling some lofty growth from the prior year. Considering the amount of trading days lost, the drop of sales doesn’t as bad some may think.

Here’s what CEO Peter King said on the update: “We anticipate that customers will be encouraged to shop in stores in the lead up to Christmas due to pent-up demand, combined with delays in deliveries for online purchases. Having opened 6 new stores so far in FY22, we now have 128 stores (including online).

With all stores now open and stock levels as planned, we are ready to capitalise upon the key Christmas trading period. We expect our customers will gift strongly this year and will enjoy inviting their family and friends back into their homes”.

The good news here is that all stores are now open. Management noted that since all stores had been open, stores in NSW, VIC and ACT had delivered positive LFL sales growth.

Like many other retailers, freight costs have been higher than expected. Rather than absorbing the costs, this was passed onto customers from an increase in retail prices which came into effect in June this year. Gross margins are higher than last year also due to some favourable FX movements.

Summary

Given that the holiday period is the busiest time of year for Dusk, it’s well positioned now that all stores are back up and running with plenty of inventory ready to go. Yesterday’s update might not have seemed too great at first glance, but overall I thought it was positive.

For more ASX share ideas, click here to read: 3 ASX shares I’d buy with $10,000.