One small step for Commonwealth Bank of Australia (ASX: CBA). One big step for Little Birdie.

CBA is set to include retail platform Little Birdie in its CommBank app, suggesting deals directly to 6.4 million app users.

The move will solidify CBA’s goal to create a one-stop app for financial services, fending off competition from the likes of Afterpay Ltd (ASX: APT) owner Square, Pearler and neobanks.

Not so little

In May Little Birdie didn’t even have a product.

However, CBA backed the start-up led by Catch.com founders with $30 million.

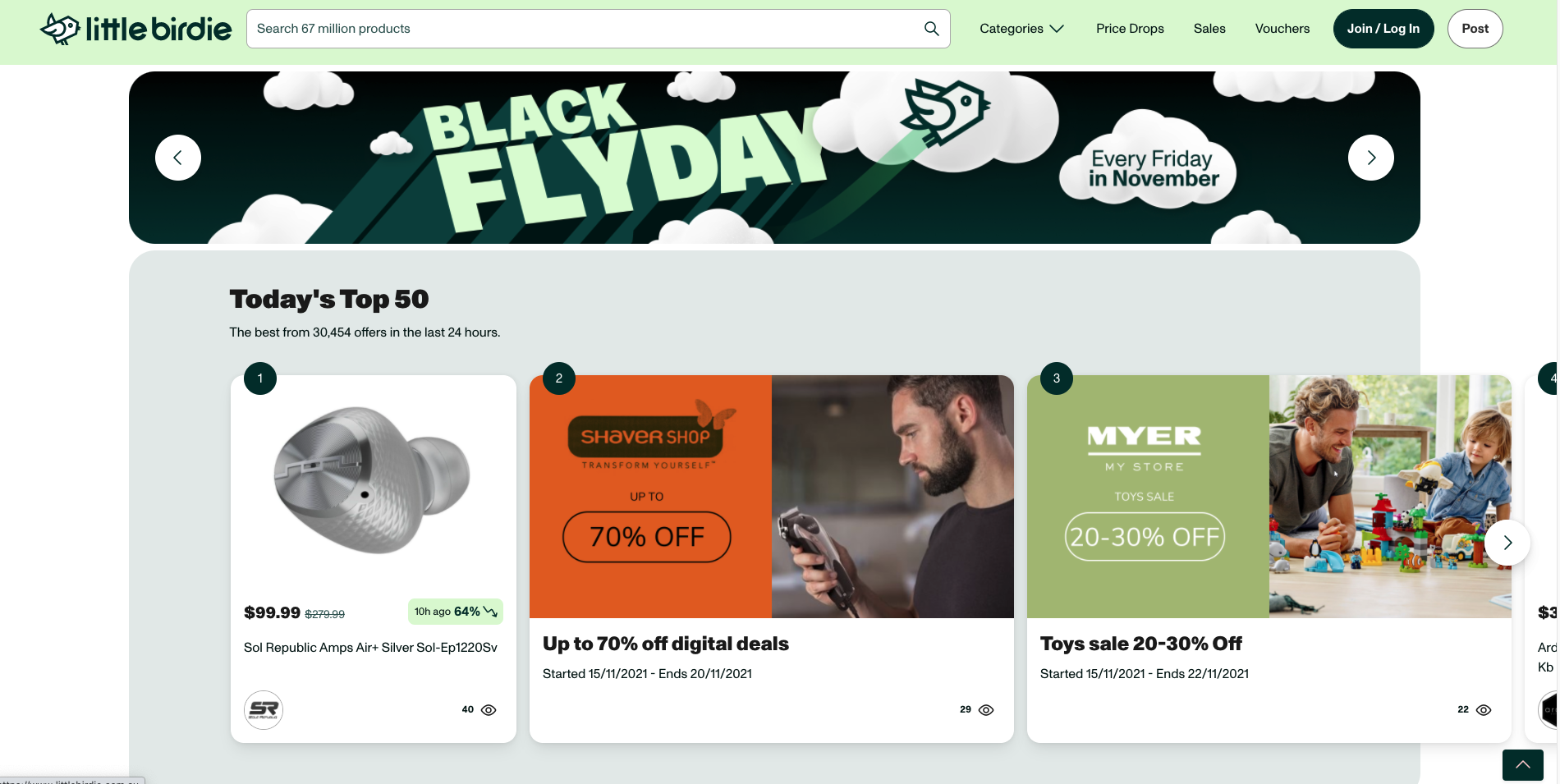

Think of Little Birdie as online classifieds for Australian retailers.

“…we provide a bird’s-eye view of all the best deals currently in-market as well as brokering exclusive deals just for our Little Birdie members”.

In many ways, it’s similar to Afterpay. Retailers compete for lead generation and customer share of wallets through one intermediary.

Except CBA can use its enormous database of customer shopping habits to provide relevant offers straight to a customer’s device.

Fending off competition

Over the past 12 months, Australia’s largest bank has accelerated its technology road map to counter the emergence of tech-driven disruptors.

It may be over 100 years old, but CBA has one key advantage. Customers.

As a result, if it can keep adding relevant offerings to its already sticky customer base, customers will be less likely to leave for newer offerings.

For example, CBA added a benefits finder, which has connected Australians with $481 million of unclaimed concessions and rebates.

Additionally, it partnered with Amber – an energy disruptor – to provide wholesale renewable power prices to customers for just $15 per month.

It’s even encroached on Telstra Corporation Ltd’s (ASX: TLS) turf, with the addition of retail internet plans from More Telecom.

And just when you think CBA can’t get any more progressive, it’s partnered with Gemini to provide bankers with the ability to buy and sell cryptocurrencies.

If you can’t beat them, join them

CBA and other traditional banking institutions have two choices.

One – milk existing market share in the short term and lose out to tech and customer-centric disruptors over time.

Two – acknowledge the banking landscape is changing. Subdue profits in the short term by investing in new tech. Protect and subsequently grow market share over time.

CBA has chosen number two. And is now lightyears ahead of the other three big banks in this respect.

If you enjoyed this analysis, consider signing up for a free Rask account and accessing our full stock reports.